2002 Chrysler Sebring Gtc Convertible 2-door 2.7l on 2040-cars

Perkasie, Pennsylvania, United States

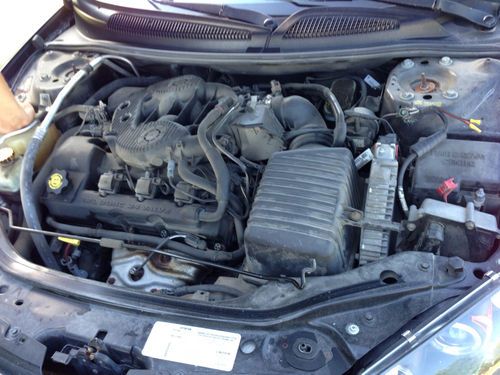

Engine:2.7L 2700CC 167Cu. In. V6 GAS DOHC Naturally Aspirated

For Sale By:Private Seller

Body Type:Convertible

Vehicle Title:Clear

Options: Cassette Player, CD Player, Convertible

Make: Chrysler

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Model: Sebring

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Trim: GTC Convertible 2-Door

Drive Type: FWD

Number of Doors: 2

Number of Cylinders: 6

Mileage: 102,000

Chrysler Sebring for Sale

2002 chrysler sebring convertible limited lxi(US $4,500.00)

2002 chrysler sebring convertible limited lxi(US $4,500.00) Lxi convertible 2.7l cd front wheel drive tires - front all-season fog lamps a/c

Lxi convertible 2.7l cd front wheel drive tires - front all-season fog lamps a/c 2004 chrysler sebring lx sedan 4-door 2.4l(US $1,000.00)

2004 chrysler sebring lx sedan 4-door 2.4l(US $1,000.00) 2007 chrysler sebring touring sedan 4-door 2.4l(US $8,900.00)

2007 chrysler sebring touring sedan 4-door 2.4l(US $8,900.00) 2004 chrysler sebring limited convertible 2-door 2.7l

2004 chrysler sebring limited convertible 2-door 2.7l 2005 chrysler sebring limited convertible 2-door 2.7l(US $9,500.00)

2005 chrysler sebring limited convertible 2-door 2.7l(US $9,500.00)

Auto Services in Pennsylvania

West Penn Collision ★★★★★

Wallace Towing & Repair ★★★★★

Truck Accessories by TruckAmmo ★★★★★

Town Service Center ★★★★★

Tom`s Automotive Repair ★★★★★

Stottsville Automotive ★★★★★

Auto blog

NHTSA investigating power modules on Chrysler Group SUVs and minivans

Mon, 29 Sep 2014The Center for Auto Safety is officially petitioning the National Highway Traffic Safety Administration to begin scrutinizing alleged problems with the totally integrated power module (TIPM) on about 24 Chrysler Group SUVs and minivans. The advocacy group claims that the part's failure can cause affected vehicles to stall or not start at all. NHTSA is still looking into the accusations and deciding whether a full investigation is actually warranted.

The CAS petition claims at least 70 TIPM failures, but according to NHTSA, six of the complaints are for models that don't have the modules. In 34 of the reported cases, the vehicles refused to start, and in 17 of them the engine stalled. There were also two allegations of smoke and one of a fire. However, none of these affected airbag deployment or resulted in a crash.

This petition isn't the first TIPM-related problem for Chrysler Group. A recent report in the New York Times alleged that it found 240 complaints potentially related to the issue on NHTSA's website alone. In September, the automaker also recalled 230,760 examples worldwide (188,723 in the US) of the 2011 Jeep Grand Cherokee and Dodge Durango replace the fuel pump relay circuit inside of the TIPM-7 with one external to the unit. The original part could allegedly cause the models to stall without warning. Even earlier, the company also recalled about 80,000 examples of the Jeep Wrangler and Dodge Nitro in 2007 to have the module reprogrammed.

Values snowball for legendary Tucker Sno-Cats, latest toys of the super rich

Fri, Jan 5 2018Here's a fun-sounding vehicle perfect for the cold and snow that's currently gripping much of North America. Tucker — no, not that Tucker — just marked its 75th anniversary making the Sno-Cat, its orange-painted, four-tread snow vehicles that have inspired backcountry skiers, collectors — and increasingly, the super rich. Bloomberg in a recent story writes that demand for the Medford, Ore.-based company's products is soaring on demand from the wealthy, who need a way to get to their backcountry mountain retreats. They're also in demand from collectors and gearheads who also love snow, like two anonymous collectors who are believed to have amassed more than 200 vintage Sno-Cats. The value of vintage models has reportedly tripled in the past five years to well over $100,000 for a fully restored rig. Tucker Sno-Cat Corp. claims to be the world's oldest surviving snow vehicle manufacturer, launched by E.M. Tucker in 1942 out of a desire to design a vehicle for traveling over the kind of deep, soft snow found in the Rogue River Valley of his childhood. It was four Tucker Sno-Cat machines that helped English explorer Vivian Fuchs and his 12-man party make the first 2,158-mile overland crossing of Antarctica in 1957-58. While many of the company's competitors either shuttered or adapted to serving ski resorts with wider, heavier treads, Tucker has stuck to its formula of making lightweight vehicles to travel over deep snow. Many Tuckers use Chrysler's flat six-cylinder engine, or its Dodge Hemi V8 for larger Sno-Cats, mounted rear or centrally, with basic, no-frills aluminum cabins. Sno-Cats all have four articulating tracks that are independently sprung, powered and pivoted at the drive axle. Track options come in three different types: conventional steel grouser belt track, rubber-coated aluminum grouser belt track, and one-piece all-rubber track. Steering is hydraulically controlled by pivoting the front and rear axles for smooth movement over undulating terrain with minimal disturbance of the ground cover. The company today makes 75 to 100 Sno-Cats a year for customers including the U.S. military, oil-drilling crews in cold places like Alaska and North Dakota, and utilities. But demand is so high that it's launched a profitable service reselling and refurbishing old machines. E.M. Tucker's grandson, Jeff McNeil, now head of this division, scours Google Earth for abandoned Sno-Cats rusting in backyards that he might be able to acquire and fix up.

Merged PSA and Fiat would retain all brands, Tavares says

Sat, Nov 9 2019By Elisa Anzolin and Gilles Guillaume PARIS/TURIN, Italy (Reuters) - Peugeot maker PSA Group and Fiat Chrysler would retain all of their car brands if their planned $50 billion merger goes ahead, the would-be chief executive of the combined group said on Friday. PSA CEO Carlos Tavares, seen as the architect of PSA's turnaround and in line to take the operational helm in the Fiat tie-up, said in a TV interview that the companies complemented each other well geographically and in terms of technology and brands. FCA derives 66% of its revenue from North America compared with only 5.7% for PSA, Refinitiv Eikon data shows. Europe remains the main revenue driver for PSA. "There's no doubt it's a very good deal for both parties. It's a win-win," Tavares told France's BFM Business, in his first interview since the French and Italian companies announced plans to create the world's fourth-largest auto maker last week. Fiat Chrysler (FCA) Chairman John Elkann, who would chair the combined group, said on Friday at an event in Turin that the 50-50 share merger would help the Italian carmaker "seize great opportunities." The deal, which would help the firms pool resources to meet tough new emissions rules and investments in electric and self-driving vehicles, as well as counter a broader downturn in car markers, is still at an early stage. PSA and Fiat have said they aim to reach a binding outline in the coming weeks, but still face questions over potential job losses, as well as scrutiny over whether the transaction favors one party more than the other. Tavares said the brands that would come under the combined group's umbrella — PSA's five passenger car nameplates include Citroen, Vauxhall and Opel, while FCA has nine, including Fiat, Alfa Romeo, Maserati, Chrysler, Dodge and Jeep — were all likely to survive. "As of today, I don't see any need to scrap any of the brands if the deal came to pass. They all have their history and their strengths," Tavares said. Few carmakers have as large a portfolio, with German rival Volkswagen Group counting 10 passenger brands, if newer Chinese ones such as electric vehicle label Sihao are included. The merger will also require approval from anti-trust authorities. Tavares said he did not expect the companies to have to make major concessions to meet competition rules, but added they were ready to do so, without giving details.