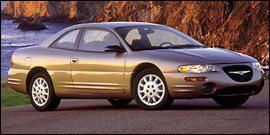

2001 Chrysler Sebring Lxi on 2040-cars

1017 S Main St, Wildwood, Florida, United States

Engine:2.7L V6 24V MPFI DOHC

Transmission:4-Speed Automatic

VIN (Vehicle Identification Number): 1C3EL55U31N675453

Stock Num: 675453

Make: Chrysler

Model: Sebring LXi

Year: 2001

Exterior Color: Gold

Options: Drive Type: FWD

Number of Doors: 2 Doors

Mileage: 68446

Guarantee Financing Good CreditNo CreditWill find a program for you.First time Buyers Program Available.This Vehicle is Approved for Lease to Own Program which is a Smart Alternative to Car Financing for those with Bad or Less than perfect credit !Approval is NOT base on your Credit Score* Bad Credit is OK* No Credit is OK* Bankruptcies is OK* Previous Repo is OKNo Long term Commitment ! Thank you for your recent Internet inquiry. Our staff is here to make sure that you get all the information you need to make an informed buying decision. We strive to achieve that goal, while making your purchase simple and pleasurable at the same time.

Chrysler Sebring for Sale

2007 chrysler sebring base

2007 chrysler sebring base 2000 chrysler sebring jxi

2000 chrysler sebring jxi 2010 chrysler sebring touring(US $11,995.00)

2010 chrysler sebring touring(US $11,995.00) 2003 chrysler sebring gtc(US $4,964.00)

2003 chrysler sebring gtc(US $4,964.00) 2006 chrysler sebring touring(US $5,900.00)

2006 chrysler sebring touring(US $5,900.00) 2006 chrysler sebring limited(US $5,995.00)

2006 chrysler sebring limited(US $5,995.00)

Auto Services in Florida

Zych Certified Auto Repair ★★★★★

Xtreme Automotive Repairs Inc ★★★★★

World Auto Spot Inc ★★★★★

Winter Haven Honda ★★★★★

Wing Motors Inc ★★★★★

Walton`s Auto Repair Inc ★★★★★

Auto blog

Dodge offering novel 1-year lease on '14 Challenger and Charger models

Mon, 14 Apr 2014Dodge is just days away from unveiling refreshed versions of the Charger and Challenger at the 2014 New York Auto Show, models promising updated styling and new powertrain options. Depending on how you look at it, the company is either so confident in its forthcoming 2015 models that it's offering an interesting Double-Up lease deal on the current vehicles, or it's so eager to clear out existing stock that it's resorting to novel lease deals. In any case, what they present is an interesting scenario, one which allows buyers to get the existing model right now, and then trade up to the facelifted 2015 models in one year.

Starting April 17, when the refreshed cars debut through the end of August, buyers can lease a 2014 Charger or Challenger for one year and exchange it for a three-year lease on a 2015 model next year, with no additional money down and the same monthly payment. Customers can even switch vehicles when the new lease starts. If drivers want to buy the '15, they get $1,000 off the purchase price. To be eligible, both leases must use the same dealership and be financed through Chrysler Capital. The Double-Up deal excludes the SRT versions of both cars and Charger SE models.

To offset the flood of one-year-old models coming back to dealerships, Dodge has struck a deal with rental car agency Enterprise, which has agreed to buy them all. "One-year leases are highly unusual in the industry," said company spokesperson Ralph Kisiel, and the fleet sale deal is what makes it possible.

Chrysler celebrates 30 years of minivans with special editions

Tue, 03 Sep 2013It's been known by many names: the Chrysler Town & Country, Dodge Caravan, Plymouth Voyager, Chrysler Voyager, Lancia Voyager, Volkswagen Routan, Ram Cargo Van... but the bottom line is that Chrysler's minivans have defined the segment for 30 years now. In fact, Chrysler says it has sold 13 million of them since 1983, helped along by the Chrysler Town & Country and Dodge Grand Caravan that accounted for nearly half of all minivans sold in the United States just last year. So to celebrate this three-decade milestone, the Auburn Hills auto has announced a pair of new special editions.

The 2014 Chrysler Town & Country 30th Anniversary Edition starts the Touring-L trim and includes such special touches as 17-inch wheels, unique badging, available Granite Crystal Pearl paint and an interior decked out in black Alcantara and Nappa leather, piano black trim and all the optional bells and whistles bundled in.

The 2014 Dodge Grand Caravan 30th Anniversary Edition, meanwhile, starts off with either the SE or SXT trims and also upgrades with 17-inch alloys as well as color-keyed mirrors and an interior with silver stitching, piano black trim, power everything, and of course, those special badges.

Chrysler launches new Ram ads and gears up for Super Bowl XLV [w/videos]

Tue, 09 Oct 2012Perhaps no car company has made bigger splashes in the last two years at the Super Bowl than Chrysler, and the automaker's marketing chief, Olivier Francois, said today that he plans to be all over the big game again in February.

Last year, the company made an ad featuring Hollywood icon Clint Eastwood. The spot achieved viral status quickly when pundits charged that Eastwood's lines were politically motivated; meant to appeal to progressive voters/viewers favoring a second term for President Obama. In 2011, agency Wieden & Kennedy burst into the game with a now famous commercial featuring Eminem. Both ads have supported Chrysler's "Imported from Detroit" marketing platform.

Francois briefed reporters Monday at the Detroit Opera House while he also debuted a new series of ads for the Ram brand.