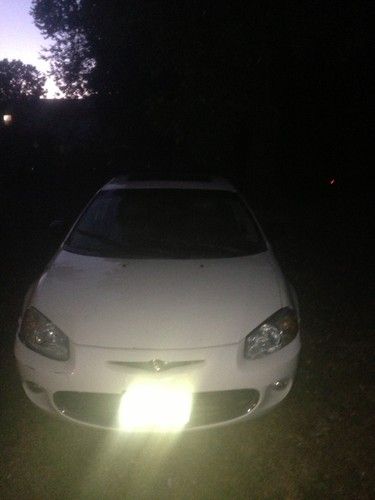

1997 Chrysler Sebring Convertible - Jx Runs Good on 2040-cars

Audubon, New Jersey, United States

Body Type:Convertible

Engine:2.5L 2497CC 152Cu. In. V6 GAS SOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 6

Make: Chrysler

Model: Sebring

Trim: JX Convertible 2-Door

Warranty: Vehicle does NOT have an existing warranty

Drive Type: AUTOMATIC

Options: Leather Seats, CD Player, Convertible

Mileage: 142,691

Power Options: Power Locks, Power Windows, Power Seats

Sub Model: JX

Exterior Color: Light Iris Metallic

Interior Color: Gray

Disability Equipped: No

Chrysler Sebring for Sale

2001 chrysler sebring lx sedan 4-door 2.7l

2001 chrysler sebring lx sedan 4-door 2.7l 2006 chrysler sebring convertible !! priced to sell !!

2006 chrysler sebring convertible !! priced to sell !! 1997 chrysler sebring jx convertible 2-door 2.5l(US $800.00)

1997 chrysler sebring jx convertible 2-door 2.5l(US $800.00) 2004 chrysler sebring limited coupe 2-door 3.0l(US $5,500.00)

2004 chrysler sebring limited coupe 2-door 3.0l(US $5,500.00) 2006 chrysler sebring touring convertible only 40k miles xtra clean and serviced(US $9,990.00)

2006 chrysler sebring touring convertible only 40k miles xtra clean and serviced(US $9,990.00) 2007 chrysler sebring limited sedan 4-door 3.5l(US $4,800.00)

2007 chrysler sebring limited sedan 4-door 3.5l(US $4,800.00)

Auto Services in New Jersey

XO Autobody ★★★★★

Wizard Auto Repairs Inc ★★★★★

Trilenium Auto Recyclers ★★★★★

Towne Kia ★★★★★

Total Eclipse Master of Auto Detailing, Inc. ★★★★★

Tony`s Garage ★★★★★

Auto blog

Jeep sets all-time sales record in 2012

Wed, 09 Jan 2013Last year was good to Jeep. Chrysler has announced its trail-rated brand set an all-time global sales record in 2012 by moving 701,626 units. That number easily surpasses the previous record set in 1999 when Jeep sold 675,494 models. All told, the brand saw a 19-percent sales increase worldwide over 2011, and much of that swell can be traced directly to the Wrangler. While the Grand Cherokee led Jeep sales, the Wrangler posted record numbers both globally and within the US, moving 194,142 and 141,669 units in each market, respectively.

Meanwhile, the Compass beat its previous global sales record with 103,321 units rolling off of dealer lots. In the US, Jeep sold 62,010 Patriot units, breaking that model's previous record as well. Jeep's impressive performance in 2012 marks the second year in a row the brand has seen double-digit percentage sales increases. Check out the full press release below.

SRT Viper plant idled over slow sales [UPDATE]

Wed, Mar 19 2014The SRT Viper is taking an extended production break later this spring while the factory copes with low demand and gears up for the 2015 model year. Chrysler will idle the Conner Avenue Assembly Plant from April 14 to June 23, and 91 employees there will be laid off during that time. Sales have been slow so far this year, with just 91 Vipers sold in the first two months of 2014 (591 were sold all last year), according to The Detroit News. According to Chrysler, this is all part of the plan for the Viper. The automaker says that the Connor Avenue factory was meant to fluctuate in this way because it only builds one vehicle, and the sports coupe was never meant to be a mass-production vehicle. The company claims that idling the plant will allow it to manage showroom inventories. "Customer and dealer demand for the SRT Viper continues at expected levels," said Chrysler spokesperson Dianna Gutierrez to The Detroit News. SRT hasn't revealed what changes are planned for the 2015 model. This isn't the first time we've heard of the Viper's weak demand. As of October 2013, SRT had hoped to build around 2,000 examples, but only about 1,000 had been made. At that point, officials then revealed production would likely be scaled back. We've contacted the Chrysler for further information, and we'll update this post if and when we hear back. UPDATE: Chrysler has passed along this official statement regarding the plant idling: Chrysler Group confirms that its Conner Avenue Assembly Plant will be down, beginning the week of April 14. Production will resume the week of June 23. Ninety-one UAW-represented employees will be laid off during this time. The SRT Viper is a hand-crafted American exotic car that is designed for a specific consumer that values performance, style and exclusivity. It has never been intended to be a mass-production vehicle as less than 29,000 vehicles have been produced in the past 20 years. The ability to increase and decrease production at the Conner Avenue Assembly Plant allows the company to continue to meet our customers' desire to keep these special cars exclusive. We will be able to take advantage of this transition to manage dealer inventories.

Sergio: Two-tier wage structure eliminated in FCA deal with UAW [w/video]

Wed, Sep 16 2015The two-tiered wage structure that governs the way domestic car companies pay their unionized employees – and rankles many of them in the process – could soon be a thing of the past. In a tentative deal seen as a bellwether for other ongoing negotiations, the United Auto Works and Fiat Chrysler Automobiles reached a tentative agreement on a four-year contract that would disband the two-tier structure, in which some workers earn higher hourly wages for performing the same job, over time. Officials who announced the tentative agreement late Tuesday in Detroit were short on details of its contents and union members still must ratify it. But FCA CEO Sergio Marchionne said the two-tiered structure will disband by the end of the contract. "The team has crafted together a very thoughtful process, where the issue will go away, go away over time," he said. Further details weren't divulged. Union negotiations with Ford and General Motors are ongoing, so hammering together a deal that sheds the two-tier structure with Chrysler first could set a precedent followed by the other members of Detroit's Big Three automakers. Other key issues that emerged in negotiations with FCA included escalating health-care costs and rewarding workers for the health of the auto industry. But dealing with the two-tier structure, born as GM and Chrysler circled bankruptcy during the Great Recession, was something the UAW wanted to confront. "The UAW has a philosophy about the economic balance of this country and the inequality, and our mission is to bridge the gap in this country," UAW president Dennis Williams said. "It's gotten out of whack. ... We don't want to share anything, and I truly believe that corporations that have that set of mind have lost their way." The UAW's executive board was expected to review the tentative agreement this morning before a union membership vote is scheduled. For Marchionne, who skipped the Frankfurt Motor Show to shepherd the negotiations during their final hours, the tentative agreement means he can shift his concern back toward pushing an FCA merger with General Motors or another company and touting the idea of industry consolidation in general. "The other side of this is capital usage in this business, which is something that remains unsolved," he said. "It makes the labor side sort of pale in comparison, given the magnitude of the potential synergies and benefits we'd be deriving from an intelligent approach.