Vehicle Title:Clear

Engine:2.7 Litre fuel efficient

Fuel Type:Gasoline

For Sale By:Private Seller

Transmission:Automatic

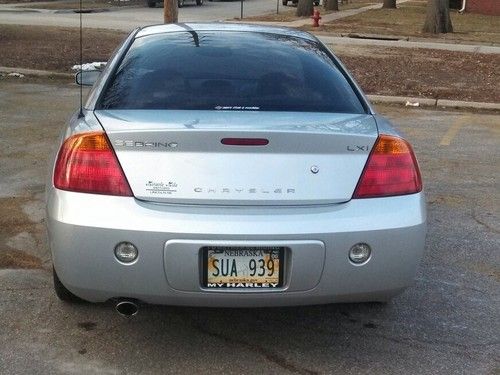

Make: Chrysler

Model: Sebring

Options: Keyless entry, Large trunk, Satellite radio, Aluminum wheels, Summer and Winter floor mats, Steering wheel radio controls, Rear Defroster, e85 Flex Fuel, Temerature gauge, Steering wheel radio control, Metric dash installed, Leather Seats, CD Player

Trim: Touring

Safety Features: Traction control, Stability Control, Fog Lights, Tilt Wheel, Summer & Winter tires, Automatic oil change sensor, Daytime running lights, Spare tire & Jack, Aluminum rims, Pannic button, Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Power Heated Mirrors, Power Sunroof, Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Drive Type: Front wheel drive (FWD)

Mileage: 42,843

Exterior Color: Blue

Disability Equipped: No

Interior Color: Black

Number of Doors: 4

Number of Cylinders: 6

Warranty: Powertain & Manufacturers extended.

Chrysler Sebring for Sale

2005 chrysler sebring convertible 4cylinder gas saver runs fl car no rust(US $3,500.00)

2005 chrysler sebring convertible 4cylinder gas saver runs fl car no rust(US $3,500.00) 2002 chrysler sebring

2002 chrysler sebring Amazing 2002 chrysler sebring lxi with 58,000 miles!!!!

Amazing 2002 chrysler sebring lxi with 58,000 miles!!!! Chrysler sebring jxi convertible georgia owned leather seats no reserve

Chrysler sebring jxi convertible georgia owned leather seats no reserve 1998 chrysler sebring limited convertible - awesome!! no reserve!!

1998 chrysler sebring limited convertible - awesome!! no reserve!! 1998 chrysler sebring jxi convertible 2-door 2.5l

1998 chrysler sebring jxi convertible 2-door 2.5l

Auto blog

Apple picks up former FCA quality boss Doug Betts

Wed, Jul 22 2015Apple made a significant personnel move that further signals its entry into the automotive world, hiring former Fiat Chrysler executive Doug Betts for an unspecified role. The information was obtained by The Wall Street Journal, which cites Betts' LinkedIn page. His career included stints at Toyota and Nissan before joining Chrysler Group (now FCA US LLC) in 2007, although his time there didn't end well. He left FCA, where he served as the automaker's head of quality, after the company's dismal showing in Consumer Reports' 2014 Annual Auto Reliability Survey. According to Betts' LinkedIn profile, which has since been pulled down, his job title reads "Operations – Apple Inc" in the San Francisco Bay area. Apple, meanwhile, was unwilling to divulge anything to the WSJ, although there's plenty to infer based on the hire. Betts wasn't the only big auto-related hire. According to the WSJ, Cupertino also lured an unnamed but "leading" autonomous vehicle researcher from Europe, who will be part of a team being setup to study driverless systems. Related Video:

FCA scion John Elkann tries to pull off a Marchionne-sized merger

Tue, May 28 2019MILAN, Italy — When John Elkann lost his ally last year with the sudden death of Sergio Marchionne, some questioned whether the softly-spoken scion of the Agnelli clan would be able to emerge from his shadow to ensure Fiat Chrysler's future. But New York-born Elkann, who became Fiat chairman in 2010, acted decisively to fill the vacuum left by the larger-than-life Marchionne and get closer to the big merger deal the legendary executive was unable to deliver. At just 28, Elkann was thrust into the role of Fiat vice chairman after the deaths of his grandfather and great-uncle "because there was really nobody else" to take the wheel. For Elkann, who got his first taste of the car industry as an intern at a factory producing headlights in Birmingham, England, the first 18 months with responsibility for the family-owned carmaker and its long heritage were "terrible." But from that low point, Elkann, 43, is now trying to merge Fiat Chrysler (FCA) with French rival Renault to form the world's third largest carmaker and tackle new challenges facing the industry. Elkann will become chairman of the merged FCA-Renault if the deal goes ahead, ensuring the Agnelli dynasty plays a central role in the next chapter of automotive history. At an event in Milan on Monday, the usually-shy Elkann looked happy and confident. His first big break came with an instrumental role in persuading Marchionne, who was running one of the businesses owned by the Agnelli family, to become chief executive in 2004 and give Fiat "a new start," Elkann said in a "Masters of Scale" podcast last year. Fiat was at the time almost on the brink of collapse. This involved a "very long night ... and many grappas" but proved to be a turning point in the fortunes of the Italian company founded by Elkann's great-great-grandfather Giovanni Agnelli, which built its first car in 1899. In 2005, Elkann backed Marchionne in negotiating the breakup of an alliance Fiat had entered into with General Motors in 2000, receiving $2 billion from GM in return for canceling a deal that could have required GM to buy the remainder of Fiat Auto. Marchionne then used GM's money to fund a turnaround at Fiat, which involved taking the Italian carmaker into a transformation alliance and then full-blown merger with U.S. automaker Chrysler as Elkann agreed to the Agnellis loosening their grip.

UAW may be key to forced FCA merger with GM

Wed, Jul 29 2015Sergio Marchionne doesn't give up on a business deal easily. While outwardly not much has recently been said about FCA's attempted merger with General Motors, Marchionne might be hoping to garner a powerful, new ally that could help break things wide open. The United Auto Workers retiree health care trust is the single largest shareholder of GM with 8.7 percent of the stock, and having its support would certainly improve FCA's position in getting a deal done. "Whatever happens in terms of consolidation, it would never be done without the consent and support of the UAW," Marchionne said when FCA recently began contract talks with the UAW, The Detroit News reports. The boss is also allegedly on good terms with the union president Dennis Williams. Still, using the organization for a hostile takeover could be very difficult because of the way its votes are structured. Other activist investors might already be on board, though. Marchionne believes that consolidation in the industry is vital because automakers are investing to create the same technologies. A GM/FCA merger still has many roadblocks, though, including the fact that Marchionne's company is smaller than GM. From a regulatory perspective, the size of the merged company could raise serious anti-trust concerns among regulators, according to The Detroit News. There's also the concern for lost jobs from redundant work with the two combined businesses. Even if the UAW angle doesn't work out, there are contingency plans afoot for other merger targets. According to The Detroit News speaking to anonymous insiders, FCA bigwigs have a meeting in London on Thursday to take a close look at other options. In addition to GM, they are investigating possible deals with Volkswagen and the Renault-Nissan Alliance. In the past, PSA Peugeot Citroen and multiple Asian automakers have also been brought up as partners, and UBS has reportedly been providing financial advice on what to do.