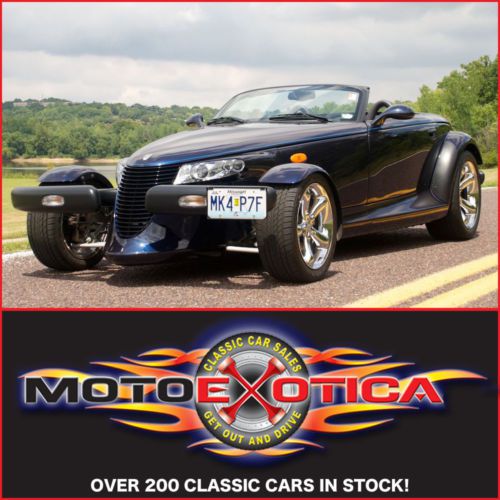

2001 Plymouth Prowler 3k Low Miles Automatic Leather Cruise Clean Carfax on 2040-cars

Grand Prairie, Texas, United States

Body Type:Convertible

Engine:3.5L 3497CC 215Cu. In. V6 GAS SOHC Naturally Aspirated

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Used

Year: 2001

Number of Cylinders: 6

Make: Chrysler

Model: Prowler

Trim: Base Convertible 2-Door

Warranty: Vehicle has an existing warranty

Drive Type: Rear Wheel Drive

Mileage: 3,626

Exterior Color: Blue

Number of Doors: 2 Doors

Interior Color: Tan

Chrysler Prowler for Sale

Chrysler prowler mullholland edition metallic blue color. head turner. low miles(US $20,600.00)

Chrysler prowler mullholland edition metallic blue color. head turner. low miles(US $20,600.00) 2002 chrysler prowler base convertible 2-door 3.5l

2002 chrysler prowler base convertible 2-door 3.5l 2001 chrysler prowler ** mullholland edition **

2001 chrysler prowler ** mullholland edition ** *16k miles* must see! free shipping / 5-yr warranty! rare loaded collector(US $35,995.00)

*16k miles* must see! free shipping / 5-yr warranty! rare loaded collector(US $35,995.00) 2002 chrysler prowler base convertible 2-door 3.5l(US $25,000.00)

2002 chrysler prowler base convertible 2-door 3.5l(US $25,000.00) 2001 chrysler prowler - mulholland edition - only 12,787 pampered miles - lqqk!!

2001 chrysler prowler - mulholland edition - only 12,787 pampered miles - lqqk!!

Auto Services in Texas

Whatley Motors ★★★★★

Westside Chevrolet ★★★★★

Westpark Auto ★★★★★

WE BUY CARS ★★★★★

Waco Hyundai ★★★★★

Victorymotorcars ★★★★★

Auto blog

2015 Chrysler 200 earns Top Safety Pick+ [w/video]

Tue, Aug 12 2014If safety is a priority in your next car purchase, the 2015 Chrysler 200 looks like a pretty good bet, according to a recent evaluation from the Insurance Institute for Highway Safety. The new sedan scored top marks in all of the agency's crash tests and a "Superior" score from its optional front crash prevention system to earn it a Top Safety Pick+ rating. In the latest small overlap front crash test (video below), the new Chrysler nabbed a score of "Good," the IIHS's top rating. In the 40-miles-per-hour evaluation of the front 25 percent of the vehicle, the agency found that there was a low risk of serious injuries. The safety systems kept the dummy's head in position, and the side airbags protected it well. It also beat out the previous generation 200 that only had an "Acceptable" in that test. As part of its "Superior" score, the front crash prevention system was able to completely stop the 200 in the IIHS 12-mph test and significantly slowed it down from 25 mph. Scroll down to watch the carnage unfold as the sedan gets put through the small-overlap crash and read the official IIHS announcement of its results. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. All-new Chrysler 200 aces small overlap front crash test, earns TOP SAFETY PICK+ ARLINGTON, Va. - The redesigned 2015 Chrysler 200, a midsize moderately priced car, earns the top rating of good in the Insurance Institute for Highway Safety's small overlap front crash test, a step up from the previous generation's rating of acceptable. With good ratings in all five of the Institute's crashworthiness evaluations, plus an available front crash prevention system that earns a superior rating, the 200 qualifies for the IIHS TOP SAFETY PICK+ award. In the small overlap test, the driver's space was maintained well, and injury measures recorded on the dummy indicated a low risk of any significant injuries in a real-world crash of this severity. The dummy's head was well controlled by the frontal airbag, which stayed in position during the crash. The side curtain airbag deployed and had sufficient forward coverage to protect the head from contact with side structures. The 200 earns a good rating in every measurement category for small overlap protection including structure, restraints and dummy kinematics, and injury measures for the head and neck, chest, pelvis, and legs and feet.

Audi gets Q2 and Q4 badges in trademark swap with FCA

Sun, Jan 17 2016Audi has swapped trademarks with Fiat Chrysler Automobiles to snare the rights to the Q2 and Q4 badges for upcoming crossover SUVs. Audi CEO Rupert Stadler confirmed at the Detroit Motor Show that the automaker had finally persuaded FCA to release the two names that would let Audi lock up the Q1 to Q9 badges for its growing SUV family. Audi already plans to drop the Q2 name onto its MQB-based city crossover five-door this year, while the Q4 badge will slot onto the rump of a coupe-like version of the next Q3. It will also reserve the Q1 badge for a 2018 baby crossover, based around the architecture of the next A1 hatch. The A1 will share a lot of its engineering with Volkswagen's Polo-based soft-roader, dubbed T-Cross in concept form. The German company has also pounced on the naming rights for SQ versions of all of its Q-cars, along with F-Tron to cover the day when it pushes hydrogen fuel cell cars into production. Stadler insisted that no money had changed hands in order to pry the two badges off FCA, admitting that they had "each found something we needed." "We promised each other we wouldn't disclose what it cost, but it was not something they were willing to sell," Stadler said. "We tried to get it years ago and they said 'No, never,' but there is never 'never' in business. ... This year I went back to them with a proposal and we talked and there were some negotiations and then we agreed to it." Those negotiations are believed to have centered on a trademark swap with a Volkswagen Group name that FCA desperately (evidently) wants to use on a Fiat, Alfa Romeo, Chrysler, Dodge or Maserati. Asked if Audi had given FCA a trademark in return for Q2 and Q4, Stadler replied, "Something very much like that, yes." Audi has used Italian names on past concept cars that FCA could be interested in, such as the 2001 Avantissimo concept and the 2003 Nuvolari coupe. The latter was named after legendary pre-war racer Tazio, who won grands prix for both Alfa Romeo and Audi's forerunner, Auto Union. Both are unlikely trade chips, with laws in Europe preventing the trademarking of the names of actual people. There is always "quattro" (Italian for "four"), but after investing nearly four decades locking it in as an Audi all-wheel-drive name, it's just not anything like trade bait.

FCA recalling 323,000 cars for wiring, software issues

Mon, Jul 25 2016The Basics: Fiat Chrysler Automobiles (FCA) is conducting a voluntary recall for an estimated 323,361 cars in the US. The affected vehicles were built after September 23, 2014 and include: the 2015 Chrysler 200, Ram ProMaster City, Jeep Renegade, and 2014 and 2015 Jeep Cherokees. The Problem: An insufficient crimp in the vehicles' wiring harness may result in a solenoid fault code, which could cause the engine to stop. The loss of power could lead to an accident. Injuries/Deaths: None reported. The Fix: FCA will update the affected vehicles' software and replace wire harnesses, as needed. According to FCA, owners that experience the problem can temporarily resolve the issue by restarting the vehicle. If you own one: FCA is reaching out to owners to schedule a service. Related Video: Statement: Wire Harness Crimp July 22, 2016 , Auburn Hills, Mich. - FCA US LLC is voluntarily recalling an estimated 323,361 vehicles in the U.S. to update certain software and replace wire harnesses, as needed. An examination of warranty data led to an FCA US investigation that discovered an insufficient crimp in a wire harness. Such a crimp may lead to a solenoid fault code that can cause propulsion loss. The Company is unaware of any related injuries or accidents. Most vehicles in the recall population will not experience this fault code over their lifetimes. However, should the condition occur, it can typically be temporarily resolved by stopping the vehicle and re-starting its engine. Accordingly, FCA US urges customers to heed the instructions on their recall notices. Affected are certain model-year 2015 Chrysler 200 midsize sedans, Ram ProMaster City small vans, Jeep Renegade and Cherokee SUVs. Certain model-year 2014 Cherokees are also affected. A change made in the harness-manufacturing process eliminates the need to recall any vehicle built after Sept. 23, 2014. An estimated 35,511 additional vehicles in Canada are included in the campaign; as are 7,067 in Mexico; and 43,927 outside the NAFTA region. Customers will be advised when they may schedule service. Those with questions may call the FCA US Customer Care Center at 1-800-853-1403. News Source: FCAImage Credit: AOL Recalls Chrysler Jeep RAM FCA jeep renegade ram promaster city

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.061 s, 7891 u