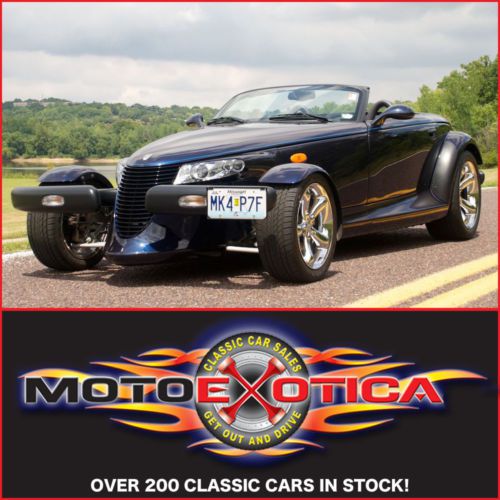

2001 Chrysler Prowler - Mulholland Edition - Only 12,787 Pampered Miles - Lqqk!! on 2040-cars

Saint Louis, Missouri, United States

Chrysler Prowler for Sale

Extremely nice! one of the very last ones out of detroit!(US $36,900.00)

Extremely nice! one of the very last ones out of detroit!(US $36,900.00) 2001 plymouth prowler black tie #19 brand new caqr 48 miles all documents mint(US $39,000.00)

2001 plymouth prowler black tie #19 brand new caqr 48 miles all documents mint(US $39,000.00) 2001 chrysler prowler(US $35,995.00)

2001 chrysler prowler(US $35,995.00) 2001 chrysler prowler base convertible 2-door 3.5l(US $27,500.00)

2001 chrysler prowler base convertible 2-door 3.5l(US $27,500.00) 2001 chrysler prowler convertible - 15k miles - prowler midnight blue -(US $30,900.00)

2001 chrysler prowler convertible - 15k miles - prowler midnight blue -(US $30,900.00) 2002 chrysler prowler, only 1877 miles,#76 of 92 silver one's made in 2002.(US $44,499.95)

2002 chrysler prowler, only 1877 miles,#76 of 92 silver one's made in 2002.(US $44,499.95)

Auto Services in Missouri

Unnerstall Tire & Muffler ★★★★★

Tim`s Automotive ★★★★★

St Charles Foreign Car Inc ★★★★★

Scherer Auto Service ★★★★★

Rogers Auto Center ★★★★★

Rev Diy Automotive Repair ★★★★★

Auto blog

Jeep Renegade's development a template for new Fiat Chrysler Auto

Wed, 24 Sep 2014

"We figured we'd take the best of both worlds." - Ralph Gilles.

The international makeup of the 2015 Jeep Renegade will serve as a template for cooperation within the newly formed Fiat Chrysler Automobiles, Senior Vice President of Product Design Ralph Gilles said.

FCA earnings improve in first quarter

Thu, Apr 30 2015Following on the recent global financial releases from Ford and from General Motors for the first quarter of 2015, FCA is now putting out its own numbers, and things look quite good for the company. The automaker posted adjusted earnings before taxes and interest of $895 million, a 22-percent jump from Q1 2014, and net profits of $103 million, a $296-million boost from last year. Revenue was also up 19 percent to $30 billion. Despite the favorable figures, actual worldwide shipments fell slightly by 2 percent to 1.1 million vehicles. FCA is giving some credit for these strong Q1 results to the automaker's performance in the NAFTA region. Shipments grew 8 percent to 633,000 vehicles, and net revenue jumped a strong 38 percent to $18.1 billion. Adjusted earnings reached $672 million, compared to $425 million in 2014. The company especially praised the Jeep Renegade, Chrysler 200, and Ram 1500 for helping the bottom line. The numbers could have been even higher, but the corporation admitted that "higher warranty and recall costs" partially drug things down. For the full year in 2015, FCA expects to ship between 4.8 and 5 million vehicles worldwide and post up to $5 billion in adjusted earnings. There should be about $1.3 billion in net profit, as well. FCA CLOSED Q1 WITH NET REVENUES OF ˆ26.4 BILLION, UP 19% AND ADJUSTED EBIT AT ˆ800 MILLION, UP 22% 30/04/15 FCA closed Q1 with net revenues of ˆ26.4 billion, up 19% and adjusted EBIT at ˆ800 million, up 22%. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion. Full year guidance confirmed. Worldwide shipments were 1.1 million units, 2% lower than Q1 2014, reflecting strong performance in NAFTA and weak market conditions in LATAM. Jeep's positive performance continued with worldwide shipments up 11% and sales up 22%. Net revenues were up 19% to ˆ26.4 billion (+4% at constant exchange rates, or CER). Adjusted EBIT was ˆ800 million, up ˆ145 million from Q1 2014, with all segments except LATAM posting positive results. The positive impact of foreign exchange translation was offset by negative impacts at a transactional level. Net profit was ˆ92 million, up ˆ265 million compared to the net loss of ˆ173 million in Q1 2014. Net industrial debt was ˆ8.6 billion, up ˆ0.9 billion from year-end mainly due to timing of capital expenditures and working capital seasonality. Liquidity remained strong at ˆ25.2 billion. The Group confirms its full-year guidance.

Weekly Recap: Obama reflects on the auto bailout's legacy

Sat, Jan 23 2016President Obama took a victory lap of sorts this week at the Detroit Auto Show, lauding the industry's progress and reflecting on the decision to bail out General Motors and Chrysler seven years ago. While the rescue was controversial at the time, historians will likely judge the president's actions to help save two of America's industrial symbols in a positive light. Much like Theodore Roosevelt's trust-busting tactics were controversial in the early 20th century, Obama's plan drew fire from critics who argued the free market should be left to its own devices. But providing financial aid and forcing the automakers to restructure had an enduring impact on the US economy. The auto industry has added more than 646,000 jobs since the companies emerged from bankruptcy, including manufacturing and retail positions. Make no mistake, GM and Chrysler were nearly dead in 2009. Now, GM is a powerhouse that's set to capitalize on a market that could see 18 million vehicles sold this year. Chrysler, which was renamed FCA US, survived as part of the Italian-American Fiat Chrysler Automobiles conglomerate. It's also performed well amid the strong industry conditions, though CEO Sergio Marchionne very publicly went looking for alliance partners last year, something from which he's since backed off. While Obama can claim a win, the bailout was actually started by George W. Bush, who provided short-term loans to GM and Chrysler in December 2008. Without that, they might not have made it much past Obama's inauguration. NEWS & ANALYSIS News: Spy Shooters captured the next-gen BMW Z4 during extreme cold weather testing. Analysis: The upcoming Z4 (which might be called the Z5) looks sharp. But the big deal is that BMW's much-anticipated sports-car project with Toyota is coming to fruition. Refresher: BMW and Toyota agreed to work together back in December 2011 and then announced an expansion of that deal to include sports cars in June 2012. Ultimately, it will provide BMW with a new Z4 and Toyota with another sports car, perhaps the Supra replacement. BMW is developing the platform, while Toyota is expected to chip in with hybrid technology. Big picture, this project is a good thing. It's providing enthusiasts with two modern sports cars that Toyota and BMW might not chose to develop on their own. This template has been shown to work, as the Fiat-Mazda alliance produced the MX-5 Miata and 124 Spider. News: The Jeep Grand Cherokee Hellcat was also spied, briefly.