2024 Chrysler Pacifica Touring 4dr Mini Van on 2040-cars

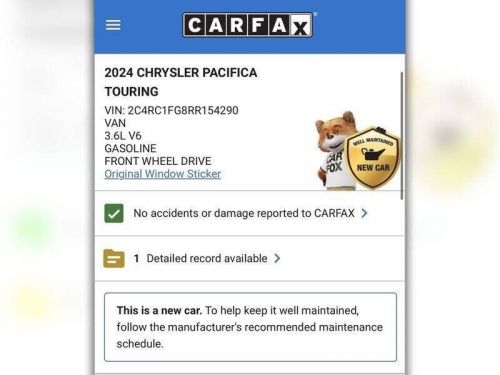

Engine:3.6L V6

Fuel Type:Gasoline

Body Type:Minivan

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C4RC1FG8RR154290

Mileage: 28

Make: Chrysler

Trim: Touring 4dr Mini Van

Drive Type: --

Number of Cylinders: 3.6L V6

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: Pacifica

Chrysler Pacifica for Sale

2021 chrysler pacifica touring l(US $16,774.00)

2021 chrysler pacifica touring l(US $16,774.00) 2022 chrysler pacifica touring l(US $21,794.00)

2022 chrysler pacifica touring l(US $21,794.00) 2024 chrysler pacifica touring l(US $45,940.00)

2024 chrysler pacifica touring l(US $45,940.00) 2024 chrysler pacifica touring l(US $39,450.00)

2024 chrysler pacifica touring l(US $39,450.00) 2024 chrysler pacifica touring l(US $39,255.00)

2024 chrysler pacifica touring l(US $39,255.00) 2024 chrysler pacifica touring l(US $43,945.00)

2024 chrysler pacifica touring l(US $43,945.00)

Auto blog

FCA fibbed on sales according to internal report

Mon, Jul 25 2016Following last week's news that Fiat Chrysler Automobiles (FCA) is under investigation by the Department of Justice and Securities and Exchange Commission for allegedly fudging sales figures, a new report in Automotive News says an internal investigation at FCA uncovered misreported sales. According to the AN story, 5,000 to 6,000 vehicles from various FCA brands were reported sold by dealers, but no customers existed for those cars. FCA sales chief Reid Bigland has already put a stop to the practice. One potential reason for the practice was to maintain the company's month-to-month sales increase streak, currently at 75 months. In April, FCA added a lengthy disclaimer to its sales announcements: "FCA US reported vehicle sales represent sales of its vehicles to retail and fleet customers, as well as limited deliveries of vehicles to its officers, directors, employees and retirees. Sales from dealers to customers are reported to FCA US by dealers as sales are made on an ongoing basis through a new vehicle delivery reporting system that then compiles the reported data as of the end of each month. "Sales through dealers do not necessarily correspond to reported revenues, which are based on the sale and delivery of vehicles to the dealers. In certain limited circumstances where sales are made directly by FCA US, such sales are reported through its management reporting system." FCA did not provide comment to Automotive News. Click through for the full story and more details. Related Video: Earnings/Financials Government/Legal Chrysler Dodge Fiat Jeep RAM sales Sergio Marchionne FCA USDOJ reid bigland

2015 Chrysler 300 looks to recapture its mojo in LA

Wed, 19 Nov 2014Chrysler's 300 sedan has never been a shrinking violet, but it arguably lost a bit of swagger when its second-generation model bowed. There was no way that an evolutionary design could ever upend the automotive establishment the way the original 2005 model did, but even so, something was clearly left on the table when the 2011 model bowed.

You don't have take our word for it - Chrysler knows it, too. Reflecting back upon the second-generation model's styling today, Ralph Gilles, Chrysler's senior vice president of design is refreshingly candid, telling Autoblog, "Our previous generation of leaders didn't understand the car very well, and kind of forced this front end on us." For 2015, Gilles and Co. have worked to recapture some of the 2005 design's lightning in a bottle. In Gilles' words, the brief for the refreshed 2015 model was to "give the car the attitude it deserves... up the attitude, up the presence."

Visually, the new 300 initially appears very similar to the current car, but closer inspection and side-by-side comparisons reveal countless changes, the most noticeable being a much larger front grille (by about 30 percent), redone light fixtures and a 'Mobius-strip' lower fascia that picks up where the new 200 left off. The cabin has been upgraded, too, with a standard seven-inch display in the gauge cluster, the latest UConnect infotainment system and improved material choices.

Recharge Wrap-up: Fiat 500X EV spotted? Senators request biodiesel increase

Thu, Feb 12 2015A group of 32 senators is asking the EPA to approve increased biodiesel volumes in the Renewable Fuel Standard. Delays in approving the RFS for 2014 forward is causing problems for the fuel produces affected by the law. "EPA's delays are endangering our industry," says Imperium Renewables CEO John Plaza. "Biofuel facilities around the nation are sitting idle, workers are being laid off, and some producers have been forced out of business entirely." Producers feel the EPA is underestimating domestic biodiesel production, and are concerned about importing fuel from Argentina. Read more in the press release below. Fiat Chrysler will help Israel develop a natural gas vehicle. The automaker, along with Iveco and Magneti Marelli, signed a memorandum of understanding with Israel's Prime Minister's Office as part of the Israel Fuel Choices Initiative. They are also considering extended research and development relationship with Israeli companies for alternative fuels and smart mobility. Israel seeks to become a hub for alternative fuel technology. Read more at Hybrid Cars. Spy photos suggest Fiat might build an electric 500X as a compliance car for California. The photos, sent by a reader to Green Car Reports, show a camouflaged Fiat 500X that appears to lack a tailpipe, suggesting it could be an EV. It was photographed on its way to Chrysler's SRT Engineering Center, which builds specialized, low-volume vehicles. The gas-powered 500X debuted in North America at the Los Angeles Auto Show last fall, so camouflage seems a bit unusual at this point if it's just a standard powertrain. It's possible the car could be sold mainly in California to comply with the state's zero-emissions requirements for automakers. Read more and see the photos at Green Car Reports. 32 U.S. Senators urge EPA to approve increased biodiesel volumes Imperium Renewables applauds Senators' action SEATTLE, Feb. 9, 2015 /PRNewswire/ -- A bipartisan group of 32 U.S. senators, including Washington state's Patty Murray and Maria Cantwell, is calling on the Environmental Protection Agency to move quickly in approving strong biodiesel volumes under the nation's Renewable Fuel Standards. The senators expressed concern about the agency's delays in implementing the RFS standards for 2014, 2015 and 2016, noting that the delays have created tremendous uncertainty for the U.S.