2022 Chrysler Pacifica Touring L on 2040-cars

Engine:3.6L V6 24V VVT

Fuel Type:Gasoline

Body Type:4D Passenger Van

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C4RC1BG7NR188253

Mileage: 45492

Make: Chrysler

Trim: Touring L

Features: --

Power Options: --

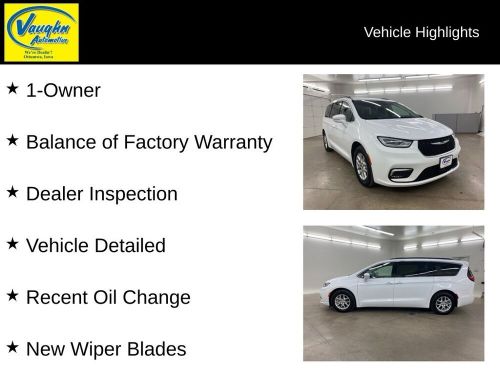

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: Pacifica

Chrysler Pacifica for Sale

2019 chrysler pacifica limited(US $25,967.00)

2019 chrysler pacifica limited(US $25,967.00) 2022 chrysler pacifica touring l(US $26,750.00)

2022 chrysler pacifica touring l(US $26,750.00) 2024 chrysler pacifica touring l(US $43,945.00)

2024 chrysler pacifica touring l(US $43,945.00) 2020 chrysler pacifica launch edition(US $39,998.00)

2020 chrysler pacifica launch edition(US $39,998.00) 2022 chrysler pacifica touring l(US $21,921.00)

2022 chrysler pacifica touring l(US $21,921.00) 2022 chrysler pacifica limited(US $25,997.00)

2022 chrysler pacifica limited(US $25,997.00)

Auto blog

470,000 Jeep Liberty, Chrysler 200, and Dodge Avenger models recalled for restraint defect

Sat, Oct 14 2017Fiat Chrysler Automobiles said on Friday it is recalling 470,000 vehicles worldwide to replace a component that may inhibit deployment of the vehicles' active head restraints in the event of a crash. Around 414,000 of those vehicles were sold in the United States. Apparently, "a component common to the modules of certain vehicles may degrade after extensive vehicle use." The recall covers 2012 Jeep Liberty sport utility vehicles and 2012-13 Chrysler 200 and Dodge Avenger midsize cars. FCA says a warning light may alert owners to the problem. The Italian-American automaker said it is unaware of any injuries or accidents related to the recall. The U.S. National Highway Traffic Safety Administration opened an investigation into the issue in June. (Reporting by David Shepardson; Editing by Steve Orlofsky) Related Video:

Chrysler banks $507 million in Q2, trims 2013 earnings forecast

Tue, 30 Jul 2013Chrysler has some good news and some bad news. First, profits were up 16 percent over the second quarter of 2012, bringing the Auburn Hills, Michigan-based manufacturer $507 million on the back of strong demand for trucks and SUVs (a recurring theme this quarter, particularly in the US). Q2 revenue was up as well, from $16.8 billion in 2012 to $18 billion in 2013. The bad news is that the Pentastar's overall earnings forecast for net income in 2013 has been trimmed from $2.2 billion to between $1.7 and $2.2 billion, according to Automotive News.

In addition to the adjusted net income forecast, Chrysler tweaked its operating profit from $3.8 billion to between $3.3 and $3.8 billion. This has gone largely unexplained by Chrysler, perhaps hoping the news of a three-percent increase in its transaction prices for Q2 will allow it to sweep this adjustment under the rug.

The star of the show for Chrysler has been its US sales, which saw a 10-percent jump, both bettering the industry average of eight percent and improving over the same stretch of 2012. As with the increase in transaction prices, Chrysler has the new Ram pickup and Jeep Grand Cherokee to thank. Perhaps most worrying from this report, though, is that every brand in the automaker's stable saw an increase in sales... except for the Chrysler brand itself.

Feds sue Fiat Chrysler, accuse it of cheating on diesel emissions

Tue, May 23 2017WASHINGTON - The US government has filed a civil lawsuit accusing Fiat Chrysler Automobiles NV of using software to bypass emission controls in diesel vehicles. The Justice Department suit, filed in US district court in Detroit, is a procedural step that may ramp up pressure on Fiat Chrysler. The suit could ultimately help lead to a settlement, as in an earlier probe of rival Volkswagen AG that will cost VW up to $25 billion, but which affected a much larger number of vehicles. VW admitted to intentionally cheating while Fiat Chrysler denies wrongdoing. It did not immediately comment on Tuesday. US-listed Fiat Chrysler shares were down 2.9 percent at $10.44. The suit also names Fiat Chrysler's unit V.M. Motori SpA, which designed the engine in question. Reuters reported last week the Justice Department and EPA have obtained internal emails and other documents written in Italian that look at engine development and emissions issues that raise significant questions. The investigation has scrutinized VM Motori. FCA acquired a 50 percent stake in VM Motori in 2010 and the remainder in October 2013. The lawsuit asserts the Italian-American automaker placed undeclared "defeat devices," or auxiliary emissions controls, in 2014-2016 Fiat Chrysler diesel vehicles that led to "much higher" than allowable levels of nitrogen oxide, or NOx pollution, which is linked to smog formation and respiratory problems. The suit seeks injunctive relief and unspecified civil penalties. EPA said in January the maximum fine is about $4.6 billion. In January, EPA and California accused Fiat Chrysler of illegally using undisclosed software to allow excess diesel emissions in 104,000 U.S. 2014-2016 Jeep Grand Cherokees and Dodge Ram 1500 trucks. Fiat Chrysler said on Friday it plans to update software that it expects will resolve the concerns of U.S. regulators about excess emissions in those vehicles. The January notice was the result of regulators' investigation of rival Volkswagen, which prompted the government to review emissions from all other passenger diesel vehicles. Volkswagen admitted in September 2015 to installing secret software allowing its cars to emit up to 40 times legal pollution levels. In total, VW has agreed to spend up to $25 billion in the United States to address claims from owners, environmental regulators, states and dealers and offered to buy back about 500,000 polluting US vehicles.