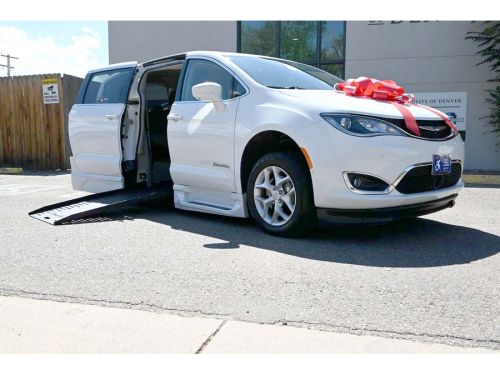

2020 Chrysler Pacifica Touring Mobility Handicap Van Handicap on 2040-cars

Denver, Colorado, United States

Engine:Pentastar 3.6L V6 287hp 262ft. lbs.

Fuel Type:Gasoline

Body Type:PV

Transmission:Automatic

For Sale By:Dealer

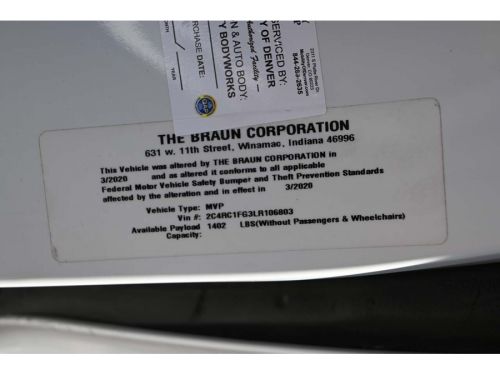

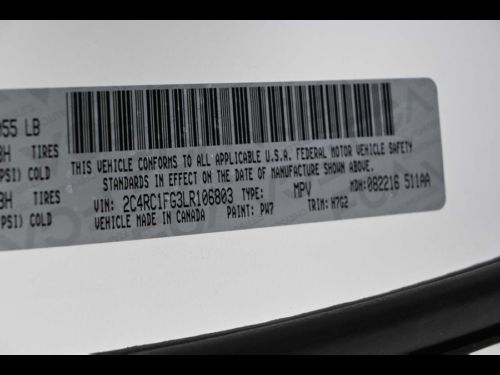

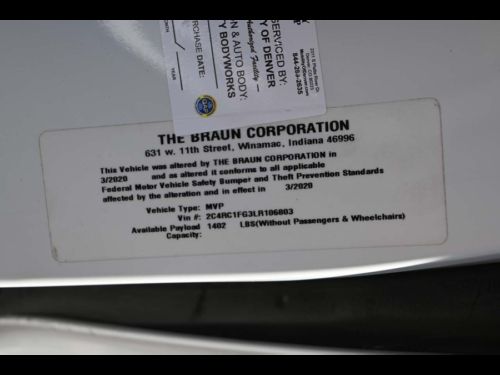

VIN (Vehicle Identification Number): 2C4RC1FG3LR106803

Mileage: 55644

Make: Chrysler

Trim: Touring Mobility Handicap Van Handicap

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Model: Pacifica

Chrysler Pacifica for Sale

2022 chrysler pacifica touring l(US $29,759.00)

2022 chrysler pacifica touring l(US $29,759.00) 2024 chrysler pacifica limited(US $47,434.00)

2024 chrysler pacifica limited(US $47,434.00) 2024 chrysler pacifica limited(US $46,172.00)

2024 chrysler pacifica limited(US $46,172.00) 2024 chrysler pacifica pinnacle(US $49,948.00)

2024 chrysler pacifica pinnacle(US $49,948.00) 2022 chrysler pacifica limited(US $28,808.00)

2022 chrysler pacifica limited(US $28,808.00) 2023 chrysler pacifica touring l(US $27,673.00)

2023 chrysler pacifica touring l(US $27,673.00)

Auto Services in Colorado

Weissach Performance ★★★★★

We are West Vail Shell ★★★★★

Vanatta Auto Electric ★★★★★

Tanner 4x4 Inc. ★★★★★

Sundance Automotive ★★★★★

Steffen Automotive ★★★★★

Auto blog

2017 North American Car, Truck, and Utility Vehicle of the Year finalists revealed

Tue, Nov 15 2016The finalists for the 2017 North American Car, Truck, and Utility Vehicle of the Year were announced Tuesday at AutoMobility LA ahead of the 2016 LA Auto Show. Approximately 60 judges, including Autoblog's editor-in-chief Mike Austin, evaluated over 40 vehicles and named three models as the finalists in each category. The award for the Utility Vehicle of the Year is new for 2017 and separates SUVs, crossovers, and minivans from pickup trucks. The finalists are: Car of the Year: Chevrolet Bolt Genesis G90 Volvo S90 Truck of the Year: Ford F-Series Super Duty Honda Ridgeline Nissan Titan Utility Vehicle of the Year Chrysler Pacifica Jaguar F-Pace Mazda CX-9 The winners for the 24th annual NACTOY awards will be named on January 9 at the Detroit Auto Show. Related Video: Chevrolet Chrysler Ford Honda Jaguar Mazda Nissan Truck Crossover Minivan/Van SUV Electric Luxury Sedan north american car of the year NACTOY

Recharge Wrap-up: Renault-Nissan at COP22, BMW launches Cruise e-Bike

Thu, Oct 6 2016The Renault-Nissan Alliance has been chosen to provide a fleet of electric cars for the UN's COP22 Climate Conference in Marrakesh, Morocco. The group will provide 50 passenger EVs – the Renault Zoe, Nissan Leaf, and Nissan e-NV200 – to shuttle delegates to and from conference venues. The Alliance will also provide more than 20 charging stations to support the shuttle fleet. The group provided electric shuttles for the historic COP21 summit in Paris last year. Read more from Renault-Nissan. FCA, Iveco, and gas grid company Snam have signed an agreement to boost natural gas as a cleaner alternative fuel for Italy. Under the Memorandum of Understanding, FCA and Iveco will work together to develop CNG vehicles, while Snam will invest in CNG supply facilities like filling stations to support a growing fleet. Italy leads Europe in the amount of natural gas consumed for transport, with 1 million vehicles currently on the road. Read more at Green Car Congress. LG Chem has officially announced it will build a battery plant in Poland to the tune of about $340 million. Located near Wroclaw in southwestern Poland, the plant is expected to produce 100,000 batteries a year for 200-mile EVs beginning in 2019. The plant could help Poland in its goal to reduce pollution by introducing a million EVs on its roads by 2025. "We will turn the Poland EV battery plant into a mecca of battery production for electric vehicles around the world," says UB Lee, President of LG Chem's Energy Solution Company. Construction begins in the second half of 2017. Read more from Automotive News Europe. BMW has introduced the Cruise e-Bike. Its Bosch Performance Line electric motor provides electric assistance at speeds of up to 15 mph. The battery can be either be removed or remain on the bike for charging, which takes 3.5 hours for a full charge. "BMW aims to be the leading provider of premium mobility services, and our bicycle collection furthers that mission," says BMW Accessory and Lifestyle Manager Eric Riehle. "As we enter the holiday season, these bikes make the perfect present for those wishing for their first BMW." The BMW Cruise e-Bike costs $3,430. Read more from BMW.

Marchionne offers belated apology for 'wop engine' comment

Wed, 22 May 2013Automotive News reports Fiat-Chrysler CEO Sergio Marchionne has issued a written apology for his comments regarding his decision to stick with an Italian engine for the upcoming Alfa Romeo 4C. As you may recall, back in January, Marchionne was quoted as saying, "I cannot come up with a schlock product, I just won't. I won't put an American engine into that car. With all due respect to my American friends, it has to be a wop engine." The CEO penned an apology to the Italian American ONE VOICE Coalition for using the racial epithet, saying that he made the comment in jest. Marchionne also said he realizes his remarks were unacceptable.

ONE VOICE, an organization aimed at fighting discrimination and stereotyping of Italian Americans, thanked Marchionne, Chrysler and Fiat for the apology. Marchionne is an Italian-born Canadian citizen, and he's gotten in trouble for other comments in the past. In 2011, he called high interest rates Chrysler was paying to the Canadian government "shyster rates." He apologized a day later.