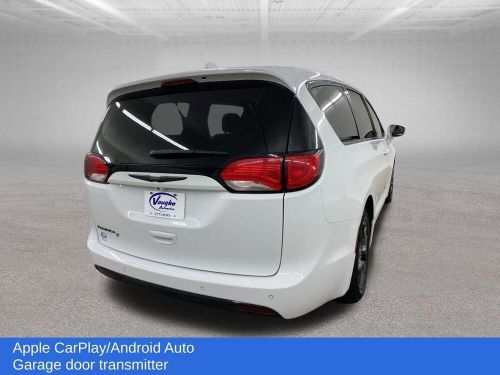

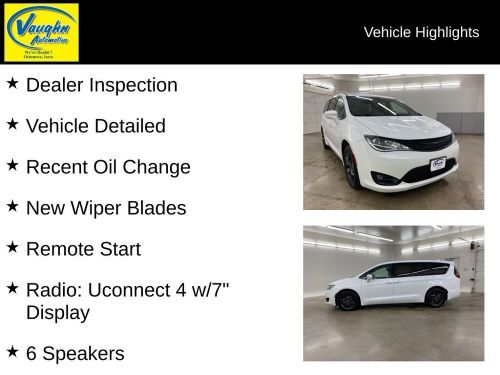

2020 Chrysler Pacifica Touring on 2040-cars

Engine:3.6L V6 24V VVT

Fuel Type:Gasoline

Body Type:4D Passenger Van

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C4RC1FG6LR150018

Mileage: 68818

Make: Chrysler

Trim: Touring

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: Pacifica

Chrysler Pacifica for Sale

2020 chrysler pacifica limited mobility handicap van handicap(US $34,900.00)

2020 chrysler pacifica limited mobility handicap van handicap(US $34,900.00) 2018 chrysler pacifica touring l(US $7,971.00)

2018 chrysler pacifica touring l(US $7,971.00) 2019 chrysler pacifica limited(US $14,179.90)

2019 chrysler pacifica limited(US $14,179.90) 2019 chrysler pacifica touring l(US $17,224.00)

2019 chrysler pacifica touring l(US $17,224.00) 2024 chrysler pacifica touring l(US $50,090.00)

2024 chrysler pacifica touring l(US $50,090.00) 2022 chrysler pacifica wheelchair, handicap, mobility(US $51,495.00)

2022 chrysler pacifica wheelchair, handicap, mobility(US $51,495.00)

Auto blog

Buy Ford and GM stock and make 5%

Tue, Feb 2 2016Want to make a five-percent return when 10-year treasuries are paying around two percent? Ford (F) and General Motors (GM) have solid balance sheets, strong cash flow, solid earnings, and growing markets. By all accounts, they are smart investments. But the market is down on these stocks. Why? Some of the stupid excuses include: They are cyclical companies The Detroit 3 have lost 3.5 million in sales since 2000 The world economy is shaky GM recently filed for bankruptcy Their markets have peaked They haven't changed their ways Let's take these criticisms one by one: They Are Cyclical Companies Yes, they are cyclical. Every company is cyclical. Every industry is cyclical. Some more than others, but not every company is immune from swings in the market. Banks used to be 'non-cyclical' leader, not anymore. Airline stocks are just as cyclical as auto stocks, yet they are trading at multiples greater than the auto industry. Why? And what accounts for the irrational stock price for Tesla (TSLA)? At least Ford (F) and General Motors (GM) make money and have positive cash flows. In fact, both companies have a net positive cash position. They have more cash on hand than liabilities. Auto sales in the United States hit a record 17.5 million vehicles in 2015. During the Great Recession, Ford (F) and General Motors (GM) cut their break even points to 10 million vehicles per year. Anything above an annual U.S. volume of 10 million vehicles is profit. And what a profit they make. Sales of Ford's F-150 continues to be the best-selling vehicle in the United States for over 30 years. Detroit 3 Have Lost 3.5 million in Sales Since 2000 Automotive News reports General Motors (GM), Ford (F) and Chrysler (FCA) have lost a combined 3.5 million vehicles sales since 2000. So how can they be making more money? Two big reasons – Fleet Sales and the UAW. Fleet Sales The Detroit 3 used to own car rental companies to keep their factories running. Ford owned Hertz (HTZ), General Motors owned all of National Car Rental and 29 percent of Avis, and Chrysler, the forerunner to Fiat Chrysler (FCA), used to own Thrifty Car Rental and Dollar Rent-A-Car. The Detroit 3 owned these rental companies to have a place to sell their bad product and keep their factories running. These were low margin sales, and in many cases, were money losers for the Detroit 3. They no longer own auto rental companies.

Chrysler gets presidential in ads for 200 and 300

Mon, Feb 15 2016Many people are already tired of the candidates in the 2016 presidential race, but Chrysler's new spokesmen are two former Commanders-in-Chief that just about everyone can support – Martin Sheen and Bill Pullman. Sheen had Aaron Sorkin's writing to guarantee he always knew the right thing to say as President Josiah Bartlet on The West Wing, and Pullman fought an alien invasion from a fighter jet as president in Independence Day. Now, these former on-screen presidents help Chrysler sell the 300 and 200 in two new ads. American-est (above) lets Sheen go wild spouting meaningless patriotic aphorisms while slipping in references to the cars' features. Swerve (below) gets a little more directly political by joking about pandering to "nuts" on the fringe during the primary, but the actors still slide in a mention of the vehicles' safety tech. These spots might help Chrysler move a few more units of the 200 before the company impeaches the sedan from the lineup, and the automaker also promises more commercials with Sheen and Pullman in the coming months. We hope Pullman jokes about his fight against aliens in one of the future commercials. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. CHRYSLER PUTS ELECTION YEAR TWIST ON ITS NEW "PRESIDENTIAL" MARKETING CAMPAIGN FEATURING MARTIN SHEEN AND BILL PULLMAN Martin Sheen and Bill Pullman reprise presidential roles in series of television spots "Premium to the People" marketing campaign debuts just in time for President's Day Additional television spots in campaign series with Martin Sheen and Bill Pullman will be introduced in coming months Campaign's first two spots, "American-est" and "Swerve" feature both the Chrysler 200 and Chrysler 300 360-degree campaign to feature television, print, online, social and digital extensions February 15, 2016 , Auburn Hills, Mich. - The Chrysler brand is launching a new campaign, "Premium to the People," featuring actors Martin Sheen and Bill Pullman. The campaign will launch with two commercials – "American-est" and "Swerve" – both featuring the Chrysler 200 and Chrysler 300. A :60-second "American-est" will launch across online, in addition to the :30-second "Swerve" across both television and online, today, February 15 (President's Day). Additional television spots will roll out in the coming weeks and months. A :30-second version of "American-est" debuted across television on Sunday, February 14.

Ferrari borrows $2.6 billion to finance FCA spinoff

Tue, Dec 1 2015Ferrari announced Monday that it is borrowing about $2.6 billion to finance its spinoff from Fiat Chrysler Automobiles. Here's how it breaks down: Ferrari NV, the automaker's parent company based in the Netherlands, is taking out loans totaling 2.5 billion euros. That's equivalent to $2.64 billion at current exchange rates, and is divided between a term loan of $2.12 billion and a revolving credit facility of $529 million. The larger term loan "will be used to refinance indebtedness owing to Fiat Chrysler Automobiles," among other purposes. That ought to constitute the lion's share of the $2.38 billion which the Prancing Horse marque was, according to reports last year, slated to pay its current parent company in order to help FCA fund its ambitious growth plans. The separate line of credit is earmarked "to be used from time to time for general corporate and working capital purposes of the Ferrari group." Though Ferrari is not expected to take any other Fiat Chrysler properties with it, the "group" in this case would include its various financial services and distribution arms around the world that may have been separately incorporated. As noted in the statement below, the financial arrangement "represents a further step towards the separation of Ferrari from the FCA Group," following the separate stock issues from both companies as independent from each other. FERRARI N.V. SIGNS ˆ2.5 BILLION SYNDICATED CREDIT FACILITY Ferrari N.V. (NYSE: RACE) ("Ferrari") announced today that it has entered into a ˆ2.5 billion syndicated loan facility with a group of ten bookrunner banks. The facility comprises a bridge loan (the "Bridge Loan") and a term loan (the "Term Loan") of ˆ2 billion in aggregate and a revolving credit facility of ˆ500 million (the "RCF"). Proceeds of the Bridge Loan and Term Loan will be used to refinance indebtedness owing to Fiat Chrysler AutomobilesN.V. (NYSE: FCAU) ("FCA") and other indebtedness and for other general corporate purposes. Proceeds of the RCF may be used from time to time for general corporate and working capital purposes of the Ferrari group. The Bridge Loan has a 12 month maturity with an option for Ferrari to extend once for a six-month period. Ferrari intends to refinance the Bridge Loan prior to its maturity with longer term debt, including through capital markets or other financing transactions. The Term Loan, which comprises a majority of the total facility, and the RCF each have a maturity of five years.