2020 Chrysler Pacifica on 2040-cars

Miami, Florida, United States

Transmission:Automatic

Fuel Type:Gasoline

For Sale By:Dealer

Vehicle Title:Flood, Water Damage

Engine:3.6

Year: 2020

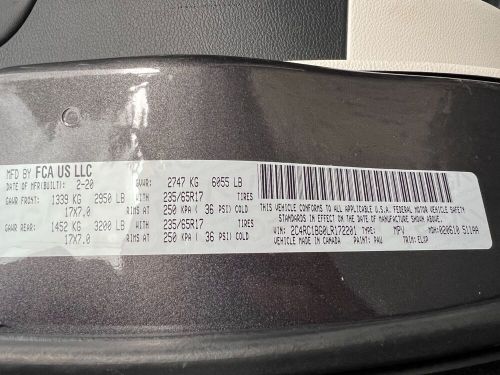

VIN (Vehicle Identification Number): 2C4RC1BG0LR172201

Mileage: 44535

Interior Color: Black

Number of Cylinders: 6

Make: Chrysler

Drive Type: FWD

Drive Side: Left-Hand Drive

Exterior Color: Brown

Model: Pacifica

Number of Doors: 4

Chrysler Pacifica for Sale

2024 chrysler pacifica touring l(US $46,495.00)

2024 chrysler pacifica touring l(US $46,495.00) 2024 chrysler pacifica touring l(US $46,495.00)

2024 chrysler pacifica touring l(US $46,495.00) 2024 chrysler pacifica touring l(US $46,495.00)

2024 chrysler pacifica touring l(US $46,495.00) 2019 chrysler pacifica limited(US $27,550.00)

2019 chrysler pacifica limited(US $27,550.00) 2022 chrysler pacifica touring l(US $19,790.00)

2022 chrysler pacifica touring l(US $19,790.00) 2023 chrysler pacifica touring l(US $27,673.00)

2023 chrysler pacifica touring l(US $27,673.00)

Auto Services in Florida

Zacco`s Import car services ★★★★★

Y & F Auto Repair Specialists ★★★★★

Xtreme Auto Upholstery ★★★★★

X-Treme Auto Collision Inc ★★★★★

Velocity Window Tinting ★★★★★

Value Tire & Alignment ★★★★★

Auto blog

Jeep Wrangler diesel likely after 2015 model refresh

Thu, 28 Feb 2013We automotive journalists aren't always the right people to ask about whether a US-spec vehicle should or should not be offered with a diesel powertrain (hint: the answer is usually "YES"). But when it comes to the iconic, off-road-ready Jeep Wrangler, we aren't the only ones who have been clamoring for an oil-burning engine behind that famous seven-slat grille. To that end, it appears there's good news on the horizon, as Jeep CEO Mike Manley recently told Ward's Auto that the "Wrangler is on the radar to get (a) diesel."

"I'm confident that the Grand Cherokee will show just how large a demand there is for diesel, and I think what that will do is reinforce the need for us to target Wrangler as a vehicle that can take a diesel," Manley told Ward's. The most rugged of Jeeps is scheduled to get an overhaul around 2015-16, and the diesel powertrain will likely be introduced around that time.

This year alone, Chrysler will be adding a diesel engine to the Grand Cherokee SUV, as well as the Ram 1500 pickup and Promaster utility van.

180,000 new vehicles are sitting, derailed by lack of transport trains

Wed, 21 May 2014If you're planning on buying a new car in the next month or so, you might want to pick from what's on the lot, because there could be a long wait for new vehicles from the factory. Locomotives continue to be in short supply in North America, and that's causing major delays for automakers trying to move assembled cars.

According to The Detroit News, there are about 180,000 new vehicles waiting to be transported by rail in North America at the moment. In a normal year, it would be about 69,000. The complications have been industry-wide. Toyota, General Motors, Honda and Ford all reported experiencing some delays, and Chrysler recently had hundreds of minivans sitting on the Detroit waterfront waiting to be shipped out.

The problem is twofold for automakers. First, the fracking boom in the Bakken oil field in the Plains and Canada is monopolizing many locomotives. Second, the long, harsh winter is still causing major delays in freight train travel. The bad weather forced trains to slow down and carry less weight, which caused a backup of goods to transport. The auto companies resorted to moving some vehicles by truck, which was a less efficient but necessary option.

Mystery shoppers love Infiniti, hate Tesla

Tue, Jul 12 2016Infiniti, followed by Lexus tied with Mercedes-Benz took the top two spots for best sales experience according to mystery shoppers from the latest Pied Piper Prospect Satisfaction Index, while EV manufacturer Tesla recorded the lowest overall score. Not surprisingly, premium brands dominated the top ranks. Including the three already mentioned, luxury brands occupied seven of the top ten spots and included Audi, BMW, Porsche, and the only American brand to crack the upper echelon, Cadillac. Toyota, Volkswagen, and Nissan rounded out the first ten positions. The news for domestic automakers isn't good. Aside from Caddy, the only other star-spangled automaker to score above the industry average is Chrysler. The rest of FCA, most of GM, and all of Ford fell below the line. But Pied Piper's mystery shoppers handed Tesla the biggest walloping – the company is ten full points below the next lowest brand, Volvo, and its score of 86 is 17 below the average of 103. It's baffling, considering the company's touted direct-sales model. "Tesla leaves me scratching my head," Fred O'Hagan, Pied Piper's president and CEO, told Wards Auto. "They own all of their stores, so you would think each one would be doing the same thing. But they're not. Tesla is consistent in its inconsistencies." O'Hagan added that there's a "huge variation" in Tesla's store-to-store effectiveness, and that in some cases, shoppers found showroom workers that acted more like "museum curators," Wards Auto reports. It might be popular to call Tesla the Apple of the car world, but based on Pied Piper's work, the brand has a long way to go to emulate the uniform shopping experience of an Apple Store. The news might be bad for Tesla, but even for the brands that scored below average, there's cause for celebration. Only Tesla and Mini lost points in this year's rankings, and only Mercedes and Lincoln held steady. Every other brand, including Infiniti, which topped the index for the first time, gained at least one point. The biggest improvements belong to Porsche, Land Rover, and Mitsubishi, which all jumped five points. Pied Piper's annual Prospect Satisfaction Index uses mystery shoppers – over 6,100 this year – from across the country to assess dealers and generate rankings from over 50 individual factors. News Source: Pied Piper via WardsAuto Green Audi BMW Cadillac Chrysler Infiniti Lexus Mercedes-Benz Nissan Tesla Toyota Car Buying Car Dealers study