2020 Chrysler Pacifica on 2040-cars

Miami, Florida, United States

Vehicle Title:Salvage

Fuel Type:Bi-Fuel

Year: 2020

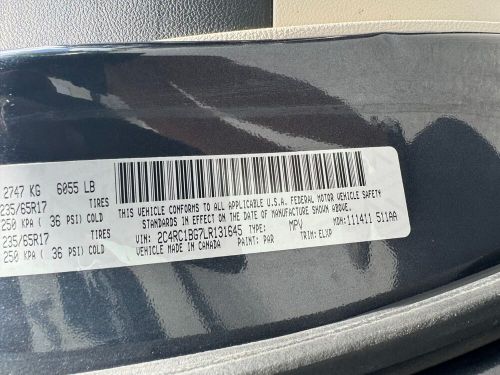

VIN (Vehicle Identification Number): 2C4RC1BG7LR131645

Mileage: 67915

Interior Color: Black

Model: Pacifica

Exterior Color: Green

Number of Doors: 6

Make: Chrysler

Drive Type: FWD

Chrysler Pacifica for Sale

2017 chrysler pacifica touring(US $12,942.00)

2017 chrysler pacifica touring(US $12,942.00) 2017 chrysler pacifica(US $16,900.00)

2017 chrysler pacifica(US $16,900.00) 2023 chrysler pacifica touring l(US $31,500.00)

2023 chrysler pacifica touring l(US $31,500.00) 2022 chrysler pacifica limited(US $19,179.30)

2022 chrysler pacifica limited(US $19,179.30) 2018 chrysler pacifica touring l fwd(US $500.00)

2018 chrysler pacifica touring l fwd(US $500.00) 2020 chrysler pacifica touring l(US $13,433.70)

2020 chrysler pacifica touring l(US $13,433.70)

Auto Services in Florida

Yokley`s Acdelco Car Care Ctr ★★★★★

Wing Motors Inc ★★★★★

Whitt Rentals ★★★★★

Weston Towing Co ★★★★★

VIP Car Wash ★★★★★

Vargas Tire Super Center ★★★★★

Auto blog

Total auto recalls already on record pace in 2014

Tue, 08 Apr 2014If you've noticed that there have been more recalls than usual this year, you may be on to something. According to a report from the National Highway Traffic Safety Administration, the US market is on pace to break a record for recalls. In 2013, 22 million cars were recalled. We're only a third of the way through 2014, though, and we've already halved that figure, with 11 million units recalled. That's wild.

Considering the past few months, it shouldn't be a surprise that General Motors is leading the charge, with six million of the 11 million units recalled coming from one of the General's four brands. Between truck recalls, CUV recalls and the ignition switch recall, 2014 hasn't been a great year for GM.

Other recall leaders include Nissan (one million Sentra and Altima sedans), Honda (900,000 Odyssey minivans), Toyota (over one million units in a few recalls), Volkswagen (150,000 Passat sedans), Chrysler (644,000 Dodge Durango and Jeep Grand Cherokee SUVs) and most recently, Ford (434,000 units, the bulk of which were early Ford Escape CUVs). So while it's been a bad year for GM so far, its competitors aren't doing too well, either.

Jeep Renegade's development a template for new Fiat Chrysler Auto

Wed, 24 Sep 2014

"We figured we'd take the best of both worlds." - Ralph Gilles.

The international makeup of the 2015 Jeep Renegade will serve as a template for cooperation within the newly formed Fiat Chrysler Automobiles, Senior Vice President of Product Design Ralph Gilles said.

Chrysler readying Hellcat V8 with Viper-like power

Tue, 21 May 2013A monstrous supercharged V8 engine could be in store for Chrysler and SRT products, if recent rumors are to be believed. Allpar is reporting that the forced-induction V8 - Chrysler's first, if this goes down - could make its debut this summer.

The story goes that the Hellcat would be based on a 6.2-liter Hemi engine, rather than on the existing 5.7- or 6.4-liter versions of the company's vaunted mill. In any case, the general consensus is that the motor will have gobs of power. Modest estimates call for between 500 to 570 horsepower, with some outliers predicting a figure as high as 600 hp. That figure would put the output would place the Hellcat awfully close to that of the 640-hp V10 in the SRT Viper, too. Allpar contends that a slightly lower powered version would allow Chrysler to keep costs below that of the more powerful Ford Shelby GT500, which might be a sweet spot.

The Hellcat could debut in a number of SRT products. SRT versions of the Charger, Challenger and 300 are all up for grabs, as is the rumored SRT Barracuda.