Bank Repo/no Reserve/below Wholesale on 2040-cars

North Dartmouth, Massachusetts, United States

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Private Seller

Engine:Gasoline

Transmission:Automatic

Make: Chrysler

Model: PT Cruiser

Options: CD Player

Trim: Touring Wagon 4-Door

Safety Features: Driver Airbag

Drive Type: FWD

Power Options: Air Conditioning, Power Locks

Mileage: 87,443

Exterior Color: Black

Interior Color: Gray

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 4

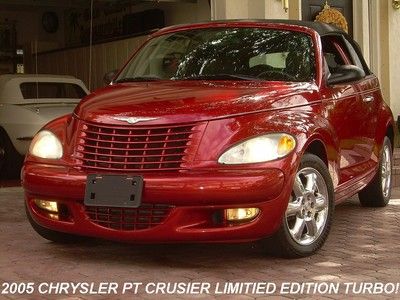

Chrysler PT Cruiser for Sale

2003 chrysler pt cruiser custom panel all metal well done pt cruiser turbo(US $21,995.00)

2003 chrysler pt cruiser custom panel all metal well done pt cruiser turbo(US $21,995.00) Turbo black convertible automatic

Turbo black convertible automatic 2004 chrysler pt cruiser limited wagon 4-door 2.4l

2004 chrysler pt cruiser limited wagon 4-door 2.4l 2005 chrysler pt crusier turbo convertible from florida! like brand new & sharp!

2005 chrysler pt crusier turbo convertible from florida! like brand new & sharp! 2005 chrysler pt cruiser convertible from florida! absolutely like new! no rust!

2005 chrysler pt cruiser convertible from florida! absolutely like new! no rust! No reserve auction,one owner,gt turbo convertible;leather,all original,like new

No reserve auction,one owner,gt turbo convertible;leather,all original,like new

Auto Services in Massachusetts

Woodlawn Autobody Inc ★★★★★

Tri-State Vinyl Repair ★★★★★

Tint King Inc. ★★★★★

Sturbridge Auto Body ★★★★★

Strojny Glass Co ★★★★★

Sonny Johnson Tire ★★★★★

Auto blog

Small number of 2013 Chrysler 200 and Dodge Avenger models recalled

Sun, 24 Feb 2013A small number of units of the 2013 Chrysler 200 (inset) and 2013 Dodge Avenger are being recalled over a broken control valve in the fuel tank assembly. The potential 1,785 sedans were manufactured late last year, and if affected with a broken control valve could suffer from stalling or fuel leakage.

A bulletin from the National Highway Traffic Safety Administration notes that the recall should begin next month, at which time owners can take their cars to dealers for repair free of charge. The full release with more information is just below.

8 automakers, 15 utilities collaborate on open smart-charging for EVs

Thu, Jul 31 2014We're going to lead with General Motors here. GM is one of eight automakers working with 15 utilities and the Electric Power Research Institute (EPRI) at developing a "smart" plug-in vehicle charging system. Why did we start with GM? Because it's the first automaker whose press release we read that mentioned the other seven automakers. Points for sharing. For the record, the collaboration also includes BMW, Toyota, Mercedes-Benz, Honda, Chrysler, Mitsubishi and Ford. The utilities include DTE Energy, Duke Energy, Southern California Edison and Pacific Gas & Electric. The idea is to develop a so-called "demand charging" system in which an integrated system lets the plug-ins and utilities communicate with each other so that vehicle charging is cut back at peak hours, when energy is most expensive, and ramped up when the rates drop. Such entities say there's a sense of urgency to develop such a system because the number of plug-in vehicles on US roads totals more than 225,000 today and is climbing steadily. There's a lot of technology involved, obviously, but the goal is to have an open platform that's compatible with virtually any automaker's plug-in vehicle. No timeframe was disclosed for when such a system could go live but you can find a press release from EPRI below. EPRI, Utilities, Auto Manufacturers to Create an Open Grid Integration Platform for Plug-in Electric Vehicles PALO ALTO, Calif. (July 29, 2014) – The Electric Power Research Institute, 8 automakers and 15 utilities are working to develop and demonstrate an open platform that would integrate plug-in electric vehicles (PEV) with smart grid technologies enabling utilities to support PEV charging regardless of location. The platform will allow manufacturers to offer a customer-friendly interface through which PEV drivers can more easily participate in utility PEV programs, such as rates for off-peak or nighttime charging. The portal for the system would be a utility's communications system and an electric vehicle's telematics system. As the electric grid evolves with smarter functionality, electric vehicles can serve as a distributed energy resource to support grid reliability, stability and efficiency. With more than 225,000 plug-in vehicles on U.S. roads -- and their numbers growing -- they are likely to play a significant role in electricity demand side management.

Fiat Chrysler Automobiles: The next five years

Tue, 06 May 2014Unless you've been living under a rock for the past 24 hours, you've no doubt read about all of the big future product news coming out of Fiat Chrysler Automobiles today. We had individual brand reports from Chrysler, Dodge, Jeep, Ram, Alfa Romeo, Fiat, Maserati and even Ferrari, but in the interest of simplifying and summarizing, we're going to list out the hard facts once more. Of course, with all of this still off in the future, there's still the possibility that a few changes will be made. But as of what we know right now, here's what's coming, and what's going away.

Chrysler

2014: Refreshed 300/300C, debuting at Los Angeles Auto Show