2006 Chrysler Pt Cruiser Warranty Guaranteed Credit Approval Cd Player Nice Ride on 2040-cars

Trenton, New Jersey, United States

Vehicle Title:Clear

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Wagon

Fuel Type:GAS

Make: Chrysler

Warranty: Vehicle has an existing warranty

Model: PT Cruiser

Trim: Base Wagon 4-Door

Power Options: Power Windows

Drive Type: FWD

Vehicle Inspection: Inspected (include details in your description)

Mileage: 122,399

Exterior Color: Blue

Number of Cylinders: 4

Interior Color: Gray

Chrysler PT Cruiser for Sale

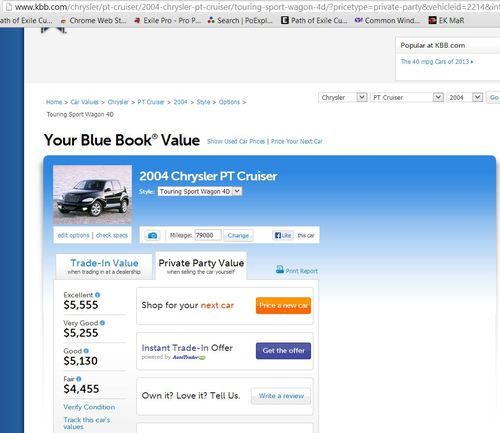

2004 chrysler pt cruiser gt wagon 4-door 2.4l(US $3,995.00)

2004 chrysler pt cruiser gt wagon 4-door 2.4l(US $3,995.00) 2004 chrysler pt cruiser touring wagon 4-door 2.4l

2004 chrysler pt cruiser touring wagon 4-door 2.4l One owner, 79.5k miles, well maintained

One owner, 79.5k miles, well maintained 2005 chrysler pt cruiser convertible super clean warranty automatic

2005 chrysler pt cruiser convertible super clean warranty automatic 2009 cd player heated seats tint we finance 866-428-9374

2009 cd player heated seats tint we finance 866-428-9374 2006 chrysler pt cruiser base wagon 4-door 2.4l

2006 chrysler pt cruiser base wagon 4-door 2.4l

Auto Services in New Jersey

Williams Custom Tops-Interiors ★★★★★

Volkswagon of Langhorne ★★★★★

Vip Honda Honda Automobiles ★★★★★

Tri State Auto Glass ★★★★★

Solveri Collision Center ★★★★★

Scotts Auto Service ★★★★★

Auto blog

Mystery shoppers love Infiniti, hate Tesla

Tue, Jul 12 2016Infiniti, followed by Lexus tied with Mercedes-Benz took the top two spots for best sales experience according to mystery shoppers from the latest Pied Piper Prospect Satisfaction Index, while EV manufacturer Tesla recorded the lowest overall score. Not surprisingly, premium brands dominated the top ranks. Including the three already mentioned, luxury brands occupied seven of the top ten spots and included Audi, BMW, Porsche, and the only American brand to crack the upper echelon, Cadillac. Toyota, Volkswagen, and Nissan rounded out the first ten positions. The news for domestic automakers isn't good. Aside from Caddy, the only other star-spangled automaker to score above the industry average is Chrysler. The rest of FCA, most of GM, and all of Ford fell below the line. But Pied Piper's mystery shoppers handed Tesla the biggest walloping – the company is ten full points below the next lowest brand, Volvo, and its score of 86 is 17 below the average of 103. It's baffling, considering the company's touted direct-sales model. "Tesla leaves me scratching my head," Fred O'Hagan, Pied Piper's president and CEO, told Wards Auto. "They own all of their stores, so you would think each one would be doing the same thing. But they're not. Tesla is consistent in its inconsistencies." O'Hagan added that there's a "huge variation" in Tesla's store-to-store effectiveness, and that in some cases, shoppers found showroom workers that acted more like "museum curators," Wards Auto reports. It might be popular to call Tesla the Apple of the car world, but based on Pied Piper's work, the brand has a long way to go to emulate the uniform shopping experience of an Apple Store. The news might be bad for Tesla, but even for the brands that scored below average, there's cause for celebration. Only Tesla and Mini lost points in this year's rankings, and only Mercedes and Lincoln held steady. Every other brand, including Infiniti, which topped the index for the first time, gained at least one point. The biggest improvements belong to Porsche, Land Rover, and Mitsubishi, which all jumped five points. Pied Piper's annual Prospect Satisfaction Index uses mystery shoppers – over 6,100 this year – from across the country to assess dealers and generate rankings from over 50 individual factors. News Source: Pied Piper via WardsAuto Green Audi BMW Cadillac Chrysler Infiniti Lexus Mercedes-Benz Nissan Tesla Toyota Car Buying Car Dealers study

America was the unexpected theme at the 2017 Detroit Auto Show thanks to Trump

Wed, Jan 11 2017President-elect Donald Trump was not in attendance at this year's Detroit Auto Show, but it sure seemed like he was the target audience for many of the press conferences and announcements surrounding the event. Several manufacturers chose to play up existing and future commitments to the US in general and American jobs specifically in their presentations to the press, and we're pretty sure that has everything to do with Trump's recent targeting of automakers on Twitter. To us, it seemed automakers were going on the offensive to try and preempt any future tweet-shaming for investing in auto manufacturing anywhere but the US. The pro-America sentiment started the week prior to the auto show, with Ford announcing that it would build several future electrified vehicles at its Flat Rock Assembly Plant in Michigan and also cancel a $1.6 billion factory planned for Mexico. Ford announced the two items on the same day, but the reality is that they likely have no relation to each other; the Mexican plant is being skipped because the company doesn't need the extra capacity to build the Ford Focus right now. Trump was still happy to share the news on Twitter. Then, on Sunday, FCA announced it would invest $1 billion in manufacturing plants in Ohio and Michigan to produce the new Jeep Wagoneer, Grand Wagoneer, and Wrangler-based pickup. It's not as though those potential new jobs were on their way out of the US, necessarily, but FCA took the opportunity to mention that plant upgrades at the Warren Truck Plant would allow the company to build Ram heavy duty trucks, which are currently assembled in Mexico, there. CEO Sergio Marchionne confirmed that Trump and his proposed tariffs had nothing to do with the decision. We certainly believe that, but we also have to believe that the timing of the release, positive outcome for America, and zero gain for Mexico were all orchestrated. Again, Trump sent out a victory tweet as if this had been his doing. Ford then used its press conference at the show on Monday to reiterate the plans for Flat Rock and also confirm that the Ford Bronco and Ranger nameplates will be returning to the US market, and that both will be built at a plant in Michigan. Announcements of manufacturing locations are usually aimed at the UAW, which certainly has a stake in these things, but again this one was broadcast to the auto show crowd in general.

Ferrari raises $893M, valued at $12B

Wed, Oct 21 2015Ferrari's stock is moving as quickly on the New York Stock Exchange as the brand's iconic sports cars do on the road. The company's incredibly popular initial public offering has already raised $893.1 million by virtue of 17.18 million shares sold for $52 apiece. If the deal's underwriters buy in as well, the figure would grow to $982.4 million. Plus, even after shouldering some of FCA's debt, the automaker carries an enterprise value of $12 billion, Bloomberg reports. Just as the company starts trading on the New York Stock Exchange, the share price is already racing upward, too. As of this writing, Ferrari stock, which is listed under the symbol RACE, is priced at $57.59. At its high so far today, the value reached as high as $60.95. While Ferrari is looking strong, the big winner in this success looks to be FCA because the company should raise $4 billion in the spin-off, according to Bloomberg. With nine percent of the sports car maker on the NYSE and one percent for the underwriters, another 80 percent will be distributed to FCA investors in 2016. When that's through, Exor, the holding company for the Agnelli/Elkann family, should have the largest stake at about 30 percent. Piero Ferrari holds the remaining 10 percent and has no intention to sell it. Related Video: FCA Announces Pricing of Initial Public Offering of Ferrari N.V. Common Shares Fiat Chrysler Automobiles N.V. (NYSE: FCAU/MI: FCA) ("FCA") and its subsidiary Ferrari N.V. ("Ferrari") announce today the pricing of Ferrari's initial public offering of 17,175,000 common shares at an offering price of $52 per share for a total offering size of $893.1 million ($982.4 million if the underwriters exercise the option described below in full). The shares are expected to begin trading on the New York Stock Exchange on Wednesday, October 21, 2015, under the symbol "RACE", and closing of the offering is expected to occur on October 26, 2015. In addition, the underwriters have a 30-day option to purchase an aggregate of up to 1,717,150 common shares of Ferrari from FCA. The offering is intended to be part of a series of transactions to separate Ferrari from FCA. Following completion of this offering, FCA expects to distribute its remaining ownership interest in Ferrari to FCA shareholders at the beginning of 2016. UBS Investment Bank is acting as Global Coordinator for the offering.