2006 Chrysler Pt Cruiser Touring Edition 4 Door Wagon 2.4 L 4cyl, No Reserve on 2040-cars

Houston, Texas, United States

Body Type:Sedan

Engine:2.4 L 4Cyl

Vehicle Title:Clear

Fuel Type:Gasoline

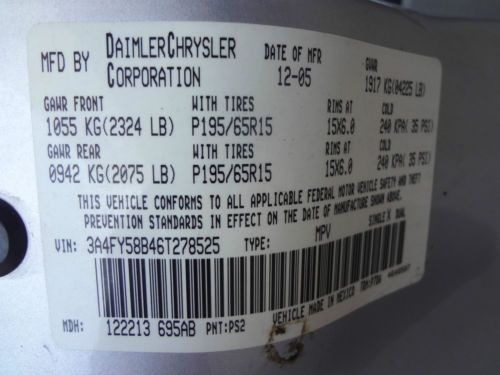

Year: 2006

Interior Color: Silver

Make: Chrysler

Number of Cylinders: 4

Model: PT Cruiser

Trim: Sedan

Drive Type: unknown

Mileage: 146,351

Warranty: Vehicle does NOT have an existing warranty

Exterior Color: White

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Chrysler PT Cruiser for Sale

2003 chrysler pt cruiser dream cruiser series 2, 4-door 2.4l turbo(US $5,500.00)

2003 chrysler pt cruiser dream cruiser series 2, 4-door 2.4l turbo(US $5,500.00) 2004 crysler pt cruiser gt turbo

2004 crysler pt cruiser gt turbo 2005 pt cruiser, no reserve

2005 pt cruiser, no reserve 2005 chrysler pt cruiser gt convertible 2-door 2.4l

2005 chrysler pt cruiser gt convertible 2-door 2.4l 2003 chrysler pt cruiser base wagon 4-door 2.4l awesome!(US $4,499.00)

2003 chrysler pt cruiser base wagon 4-door 2.4l awesome!(US $4,499.00) 2004 chrysler pt cruiser base wagon 4-door 2.4l

2004 chrysler pt cruiser base wagon 4-door 2.4l

Auto Services in Texas

Yang`s Auto Repair ★★★★★

Wilson Mobile Mechanic Service ★★★★★

Wichita Falls Ford ★★★★★

WHO BUYS JUNK CARS IN TEXOMALAND ★★★★★

Wash Me Down Mobile Detailing ★★★★★

Vara Chevrolet ★★★★★

Auto blog

Fiat shareholders green-light Chrysler merger, end of an Italian era

Fri, 01 Aug 2014Fiat has just taken a major step away from its Italian heritage, as shareholders officially approved the company's merger with Chrysler. That move will lead to the formation of Fiat Chrysler Automobiles NV, a Dutch company based in Great Britain and listed on the New York Stock Exchange, according to Automotive News Europe.

The company captured the two-thirds majority at a special shareholders meeting, although there are still a few situations that could defeat the movement. According to ANE, roughly eight percent of shareholders opposed the merger, which is a group large enough to defeat the plan, should they all exercise their exit rights outlined in the merger conditions.

Meanwhile, Fiat Chairman John Elkann (pictured above, right, with CEO Sergio Marchionne and Ferrari Chairman Luca Cordero di Montezemolo), the great-great-grandson of Fiat founder Giovanni Agnelli, reaffirmed his family's commitment to the company beyond the merger. Exor, the Agnelli family's holding company, still maintains a 30-percent stake in Fiat.

EU starts legal action against Italy over Fiat Chrysler emissions

Wed, May 17 2017BRUSSELS/ROME - The European Commission launched legal action against Italy on Wednesday for failing to respond to allegations of emission-test cheating by Fiat Chrysler, in a procedure that could lead to the country being taken to court. The Commission said Italy had failed to convince it that devices used to modulate emissions on Fiat Chrysler vehicles outside of narrow testing conditions were justified. "The Commission is now formally asking Italy to respond to its concerns that the manufacturer has not sufficiently justified the technical necessity – and thus the legality – of the defeat device used," the Commission said in a statement. Italy has two months to respond to the Commission's request and may be eventually taken to the European Court of Justice if the answer is found to be unconvincing. Italy had asked the European Union to postpone its plan to launch legal action against Rome over emissions at Fiat Chrysler, Transport Minister Graziano Delrio said. "Considering that after the end of the mediation process, we did not receive any request for further information ... we ask that you delay starting the infringement procedure while we await a letter asking for clarification on issues raised by your relevant offices," Delrio told EU Industry Commissioner Elzbieta Bienkowska, according to the ministry's statement. The European Commission has been mediating a dispute between Rome and Berlin after Germany accused Fiat Chrysler of using an illegal device in its Fiat 500X, Fiat Doblo and Jeep Renegade models. That mediation ended without fanfare in March. EU officials have become increasingly frustrated with what they see as governments colluding with the powerful car industry and the legal move is the biggest stick the European Commission has available to force nations to clamp down on diesel cars that spew out polluting nitrogen oxide (NOx). Delrio, however, said the material Italy had sent to the Commission during the mediation process showed that the vehicles' approval process was correctly performed. Under the current system, which the Commission is trying to overhaul, national regulators approve new cars and alone have the power to police manufacturers. But once a vehicle is approved in one country, it can be sold throughout the bloc. Last December, the Commission launched cases against five nations, including Germany, Britain and Spain, for failing to police the car industry adequately.

Ferrari raises $893M, valued at $12B

Wed, Oct 21 2015Ferrari's stock is moving as quickly on the New York Stock Exchange as the brand's iconic sports cars do on the road. The company's incredibly popular initial public offering has already raised $893.1 million by virtue of 17.18 million shares sold for $52 apiece. If the deal's underwriters buy in as well, the figure would grow to $982.4 million. Plus, even after shouldering some of FCA's debt, the automaker carries an enterprise value of $12 billion, Bloomberg reports. Just as the company starts trading on the New York Stock Exchange, the share price is already racing upward, too. As of this writing, Ferrari stock, which is listed under the symbol RACE, is priced at $57.59. At its high so far today, the value reached as high as $60.95. While Ferrari is looking strong, the big winner in this success looks to be FCA because the company should raise $4 billion in the spin-off, according to Bloomberg. With nine percent of the sports car maker on the NYSE and one percent for the underwriters, another 80 percent will be distributed to FCA investors in 2016. When that's through, Exor, the holding company for the Agnelli/Elkann family, should have the largest stake at about 30 percent. Piero Ferrari holds the remaining 10 percent and has no intention to sell it. Related Video: FCA Announces Pricing of Initial Public Offering of Ferrari N.V. Common Shares Fiat Chrysler Automobiles N.V. (NYSE: FCAU/MI: FCA) ("FCA") and its subsidiary Ferrari N.V. ("Ferrari") announce today the pricing of Ferrari's initial public offering of 17,175,000 common shares at an offering price of $52 per share for a total offering size of $893.1 million ($982.4 million if the underwriters exercise the option described below in full). The shares are expected to begin trading on the New York Stock Exchange on Wednesday, October 21, 2015, under the symbol "RACE", and closing of the offering is expected to occur on October 26, 2015. In addition, the underwriters have a 30-day option to purchase an aggregate of up to 1,717,150 common shares of Ferrari from FCA. The offering is intended to be part of a series of transactions to separate Ferrari from FCA. Following completion of this offering, FCA expects to distribute its remaining ownership interest in Ferrari to FCA shareholders at the beginning of 2016. UBS Investment Bank is acting as Global Coordinator for the offering.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.064 s, 7891 u