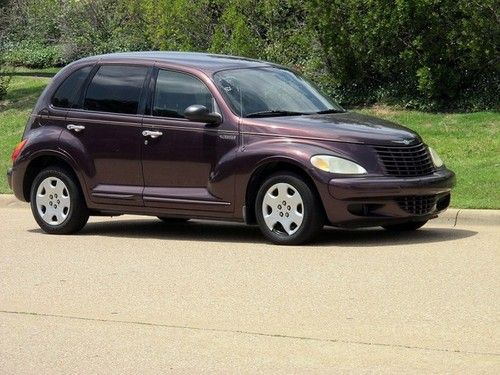

2006 Chrysler Pt Cruiser Touring Edition on 2040-cars

Huntingdon Valley, Pennsylvania, United States

Body Type:Wagon

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Make: Chrysler

Model: PT Cruiser

Mileage: 120,763

Options: CD Player

Sub Model: 4dr Wgn Tour

Power Options: Power Locks

Exterior Color: Black

Interior Color: Gray

Number of Cylinders: 4

Warranty: Vehicle does NOT have an existing warranty

Chrysler PT Cruiser for Sale

2006 chrysler pt cruiser touring wagon 4-door 2.4l no reserve 3 days only

2006 chrysler pt cruiser touring wagon 4-door 2.4l no reserve 3 days only 2004 chrysler pt cruiser touring 5spd. power windows cold a/c!(US $3,500.00)

2004 chrysler pt cruiser touring 5spd. power windows cold a/c!(US $3,500.00) Cool white 4 door, stick shift, base

Cool white 4 door, stick shift, base 2005 "woody" chrysler pt cruiser gt convertible 2-door 2.4l(US $6,800.00)

2005 "woody" chrysler pt cruiser gt convertible 2-door 2.4l(US $6,800.00) 2002 pt cruiser limited edition wagon no reserve(US $1,500.00)

2002 pt cruiser limited edition wagon no reserve(US $1,500.00) We finance 04 limited edition auto low miles heated leather seats cd changer 82k(US $6,000.00)

We finance 04 limited edition auto low miles heated leather seats cd changer 82k(US $6,000.00)

Auto Services in Pennsylvania

Valley Tire Co Inc ★★★★★

Trinity Automotive ★★★★★

Total Lube Center Plus ★★★★★

Tim Howard Auto Repair ★★★★★

Terry`s Auto Glass ★★★★★

Spina & Adams Collision Svc ★★★★★

Auto blog

Mystery shoppers love Infiniti, hate Tesla

Tue, Jul 12 2016Infiniti, followed by Lexus tied with Mercedes-Benz took the top two spots for best sales experience according to mystery shoppers from the latest Pied Piper Prospect Satisfaction Index, while EV manufacturer Tesla recorded the lowest overall score. Not surprisingly, premium brands dominated the top ranks. Including the three already mentioned, luxury brands occupied seven of the top ten spots and included Audi, BMW, Porsche, and the only American brand to crack the upper echelon, Cadillac. Toyota, Volkswagen, and Nissan rounded out the first ten positions. The news for domestic automakers isn't good. Aside from Caddy, the only other star-spangled automaker to score above the industry average is Chrysler. The rest of FCA, most of GM, and all of Ford fell below the line. But Pied Piper's mystery shoppers handed Tesla the biggest walloping – the company is ten full points below the next lowest brand, Volvo, and its score of 86 is 17 below the average of 103. It's baffling, considering the company's touted direct-sales model. "Tesla leaves me scratching my head," Fred O'Hagan, Pied Piper's president and CEO, told Wards Auto. "They own all of their stores, so you would think each one would be doing the same thing. But they're not. Tesla is consistent in its inconsistencies." O'Hagan added that there's a "huge variation" in Tesla's store-to-store effectiveness, and that in some cases, shoppers found showroom workers that acted more like "museum curators," Wards Auto reports. It might be popular to call Tesla the Apple of the car world, but based on Pied Piper's work, the brand has a long way to go to emulate the uniform shopping experience of an Apple Store. The news might be bad for Tesla, but even for the brands that scored below average, there's cause for celebration. Only Tesla and Mini lost points in this year's rankings, and only Mercedes and Lincoln held steady. Every other brand, including Infiniti, which topped the index for the first time, gained at least one point. The biggest improvements belong to Porsche, Land Rover, and Mitsubishi, which all jumped five points. Pied Piper's annual Prospect Satisfaction Index uses mystery shoppers – over 6,100 this year – from across the country to assess dealers and generate rankings from over 50 individual factors. News Source: Pied Piper via WardsAuto Green Audi BMW Cadillac Chrysler Infiniti Lexus Mercedes-Benz Nissan Tesla Toyota Car Buying Car Dealers study

Detroit automakers mulling helping DIA avoid bankruptcy looting

Tue, 13 May 2014It's not really a secret that the city of Detroit is in lots and lots of trouble. Even with an emergency manager working to guide it through bankruptcy, a number of the city's institutions remain in very serious danger. One of the most notable is the Detroit Institute of Arts, a 658,000-square-foot behemoth of art that counts works from Van Gogh, Picasso, Gauguin and Rembrandt (not to mention a version of Rodin's iconic "The Thinker," shown above) as part of its permanent collection.

Throughout the bankruptcy, the DIA has been under threat, with art enthusiasts, historians and fans of the museum concerned that its expansive collection - valued between $454 and $867 million by Christie's - could be sold by the city to help square its $18.5-billion debt.

Now, though, Detroit's hometown automakers could be set to step up and help save the renowned museum. According to a report from The Detroit News, the charitable arms of General Motors, Ford and Chrysler could be set to donate $25 million as part of a DIA-initiated campaign, called the "grand bargain." As part of the deal, the DIA would seek $100 million in corporate donations as part of a larger attempt at putting together an $816-million package that would be paid to city pension funds over 20 years. Such a move would protect the city's art collection from being sold off.

2.1 million vehicles recalled again over faulty airbags

Sat, Jan 31 2015Fiat Chrysler Automobiles, Honda and Toyota will recall 2.1 million vehicles to fix faulty airbag modules "after the manufacturers' original attempts to fix the defects proved ineffective in some vehicles." These vehicles had all previously been recalled, but the National Highway Traffic Safety Administration found that the airbags could still potentially malfunction. This recall will cover Acura MDX, Dodge Viper, Jeep Grand Cherokee, Honda Odyssey, Pontiac Vibe, Toyota Corolla, Toyota Matrix and Toyota Avalon models made in the early 2000s. NHTSA has reportedly received about 40 reports of airbag deployment in such vehicles, even though the vehicle had not been involved in a crash. Roughly one million of these same vehicles, all from Honda and Toyota, are also subject to recalls due to faulty Takata airbag modules, though this particular recall is for "an electronic component manufactured by TRW" that is separate from the actual airbags from Takata. According to NHTSA Administrator Mark Rosekind: "This is unfortunately a complicated issue for consumers, who may have to return to their dealer more than once. But this is an urgent safety issue, and all consumers with vehicles covered by the previous recalls should have that remedy installed. Even though it's a temporary solution until the new remedy is available, they and their families will be safer if they take the time to learn if their vehicle is covered and follow their manufacturers' instructions. A hassle is much better than a family tragedy." If you're the owner of an affected car, expect to hear more from the official automaker and government channels in short order. In the meantime, we'd suggest getting your car checked and fixed at your local dealer. The official statement and recall information can be found below. Previously Recalled Vehicle Remedies Not Working as Designed; NHTSA Announces Follow up Recall of 2.12 Million Cars and SUVs Saturday, January 31, 2015 Contact: Gordon Trowbridge, 202-366-9550, Public.Affairs@dot.gov WASHINGTON – U.S. Transportation Secretary Anthony Foxx announced today the recall of more than 2.12 million Acura, Dodge, Jeep, Honda, Pontiac, and Toyota vehicles for a defect that may cause airbags to deploy inadvertently. The recalls will provide vehicle owners with a new remedy after the manufacturers' original attempts to fix the defects proved ineffective in some vehicles.