2004 Chrysler Pt Cruiser White Front Wheel Drive Am/fm/cd Ac Power Windows/locks on 2040-cars

Henrico, Virginia, United States

Vehicle Title:Clear

For Sale By:Dealer

Engine:2.4L 2429CC 148Cu. In. l4 GAS DOHC Naturally Aspirated

Body Type:Wagon

Fuel Type:GAS

Make: Chrysler

Warranty: Unspecified

Model: PT Cruiser

Trim: Base Wagon 4-Door

Vehicle Inspection: Inspected (include details in your description)

Drive Type: FWD

Mileage: 117,942

Number of Cylinders: 4

Exterior Color: White

Interior Color: Gray

Chrysler PT Cruiser for Sale

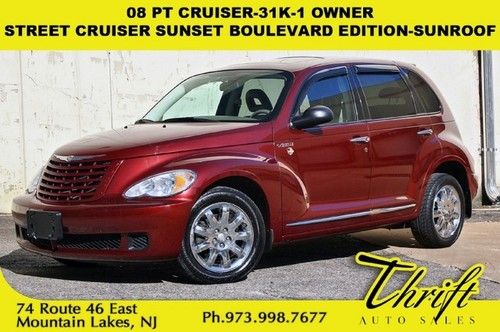

08 pt cruiser-31k-1 owner-street cruiser sunset boulevard edition-sunroof(US $8,995.00)

08 pt cruiser-31k-1 owner-street cruiser sunset boulevard edition-sunroof(US $8,995.00) 2007 pt cruiser(US $4,500.00)

2007 pt cruiser(US $4,500.00) Pt cruiser convertible turbo

Pt cruiser convertible turbo 2006 chrysler pt cruiser touring convertible 2-door 2.4l(US $8,600.00)

2006 chrysler pt cruiser touring convertible 2-door 2.4l(US $8,600.00) 2004 chrysler pt cruiser

2004 chrysler pt cruiser No reserve 7 day auction~50+pics~serviced & maintained~gas saver!!

No reserve 7 day auction~50+pics~serviced & maintained~gas saver!!

Auto Services in Virginia

Williamsburg Honda-Hyundai ★★★★★

Webb`s Auto Body ★★★★★

Twins Auto Repair ★★★★★

Transmissions Inc. ★★★★★

Sweden Automotive Inc ★★★★★

Surratt Tire & Auto Center ★★★★★

Auto blog

FCA under investigation for fraud by FBI, SEC, and DOJ

Tue, Jul 19 2016The US Justice Department is currently in the initial stages of investigating Fiat Chrysler Automobiles for fraud, according to two anonymous sources that spoke with Bloomberg. According to the unnamed sources, prosecutors are examining whether FCA violated US securities laws. As part of a coordinated investigation into FCA's sales reporting practices, investigators from the Federal Bureau of Investigation and the Securities and Exchange Commission visited the automaker's field staff in their offices and homes earlier this month, reports Automotive News. According to an anonymous source that spoke to Automotive News, federal staff attorneys visited FCA's US headquarters in Auburn Hills, MI on July 11. The unnamed source told the outlet that employees were advised to seek counsel before speaking with investigators. Investigators also visited the automaker's offices in Dallas, California, and Orlando, the unnamed source told Automotive News. The investigation comes after FCA claimed it had recorded the best month of sales in the US in the automaker's history in December with a total of 217,527 vehicles sold, reports Bloomberg. The claim now seems untrustworthy. According to a previous report from Automotive News, a Chicago-based dealership group filed a lawsuit against FCA earlier this year. The suit accused the automaker of paying dealers to fake new-vehicle sales. At the time, the automaker claimed the allegations were baseless and had no merit. After the lawsuit, FCA started to add an extended disclaimed at the end of its monthly sales reports, according to Automotive News. In a statement, FCA claimed that the automaker is cooperating with the SEC investigation and pointed out that it records "revenues based on shipments to dealers and customers, not on reported vehicle unit sales to end customers." We'll have more on the investigation as it unfolds. Related Video: News Source: Automotive News-sub.req., Automotive News-sub.req, Bloomberg, GIUSEPPE CACACE/AFP/Getty Images Government/Legal Chrysler Fiat FCA USDOJ investigation

Minivan market not what it used to be, but margins make up for it

Thu, 05 Jun 2014

Residual values for last year's minivans are higher than they were in 2000.

Much like the station wagon was the shuttle of Baby Boomer generation, the minivan has been the primary means of transport for Generations X and Y. Just as the boomers abandoned the Country Squire, though, those kids that were toted around in Grand Caravans and Windstars are adults, and they certainly don't want to be seen in the cars their parents drove.

Feds fretting over remote hack of Jeep Cherokee

Fri, Jul 24 2015A cyber-security gap that allowed for the remote hacking of a Jeep Cherokee has federal officials concerned. An associate administrator with the National Highway Traffic Safety Administration said Thursday that news of the breach conducted by researchers Chris Valasek and Charlie Miller had "floated around the entire federal government." "The Homeland Security folks sent out broadcasts that, 'Here's an issue that needs to be addressed,'" said Nathaniel Beuse, an associate administrator with the National Highway Traffic Safety Administration. Valasek and Miller commandeered remote control of the Cherokee through a security flaw in the cellular connection to the car's Uconnect infotainment system. From his Pittsburgh home, Valasek manipulated critical safety inputs, such as transmission function, on Miller's Jeep as he drove along a highway near St. Louis, MO. The scope of the remote breach is believed to be the first of its kind. The prominent cyber-security researchers needed no prior access to the vehicle to perform the hack, and the scope of the remote breach is believed to be the first of its kind. A NHTSA spokesperson said the agency's cyber-security staff members are "putting their expertise to work assessing this threat and the response, and we will take action if we determine it's necessary to protect safety." A Homeland Security spokesperson referred questions about the hack to Chrysler. Fiat Chrysler Automobiles has already been the subject of a federal hearing this month, in which officials scrutinized whether the company had adequately fixed recalled vehicles and repeatedly failed to notify the government about defects. But cyber-security concerns are a new and different species for the regulatory agency. Only hours before the Jeep hack was announced by Wired magazine earlier this week, NHTSA administrator Dr. Mark Rosekind said hacking vulnerabilities were a threat to privacy, safety, and the public's trust with new connected and autonomous technologies that allow vehicles to communicate. NHTSA outlined its response to the cyber-security challenges facing the industry in a report issued Tuesday. In it, the agency summarized its best practices for thwarting attacks and said it will analyze possible real-time infiltration responses. But the agency's ability to handle hackers may only go so far.