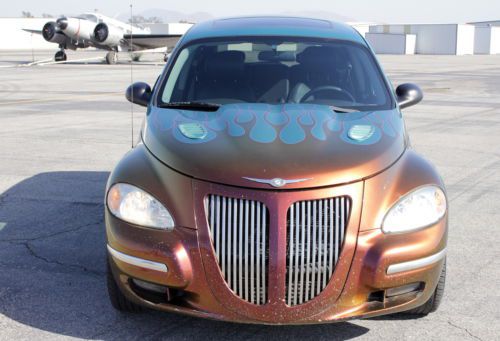

2004 Chrysler Pt Cruiser Gt By Pteazer With Autostick No Reserve on 2040-cars

Los Angeles, California, United States

Chrysler PT Cruiser for Sale

1968 ford mustang coupe(US $10,499.00)

1968 ford mustang coupe(US $10,499.00) 2003 chrysler pt cruiser base wagon 4-door 2.4l(US $3,200.00)

2003 chrysler pt cruiser base wagon 4-door 2.4l(US $3,200.00) 2001 chrysler pt cruiser limited edition clean florida car!

2001 chrysler pt cruiser limited edition clean florida car! 2005 chrysler pt cruiser touring convertible 2-door 2.4l

2005 chrysler pt cruiser touring convertible 2-door 2.4l 2001 pt cruiser(US $3,500.00)

2001 pt cruiser(US $3,500.00) 06 heated leather steering wheel radio controls cd player

06 heated leather steering wheel radio controls cd player

Auto Services in California

Zip Auto Glass Repair ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Repair Shop ★★★★★

Westside Body & Paint ★★★★★

Westcoast Autobahn ★★★★★

Westcoast Auto Sales ★★★★★

Auto blog

Fiat Chrysler's next-generation Uconnect is faster, built on Android

Mon, Jan 27 2020If you're a regular reader of Autoblog, you know that for a long time we've liked Fiat Chrysler's Uconnect infotainment system for its bright, clear, responsive touchscreen interface. Now, according to the company, it will be better than ever with Uconnect 5, the latest iteration of the system. It has upgraded hardware and a revamped graphic user interface (the stuff on the screen). Looking at sample screens shown above, there are characteristics shared with the old system, such as the time, status and shortcuts at the top and the menu icons at the bottom. In the middle, the major change is the addition of home screens that can be customized with favorite menus and readouts that are always available. Each of these home screens can have up to four functions and you can have five pages to flip through. The graphics themselves feature more legible fonts and updated icons. Each car brand will get its own set of icons, colors and textures to help create unique experiences. And while each Fiat Chrysler product will be able to have Uconnect, including Alfa Romeo that has until now lacked Uconnect, each brand has the ability to make small tweaks including the screen orientation. The system will support displays in landscape, portrait or square, so different brands may choose different shapes. Powering Uconnect 5 is a processor Fiat Chrysler says is six times more powerful than what's in current systems. It features 6 gigabytes of RAM and 64 gigabytes of internal storage. The processor also supports screens as large as 12.3 inches with as many as 15 million pixels, or nearly twice that of a 4K resolution TV. The system can display information on up to four screens, too. Uconnect 5's firmware is built on Google's Android operating system, joining a few other automakers in using Android as a base for their infotainment systems. Uconnect 5 brings with it a number of new features. It brings full Alexa integration, so you can use it just like you do at home, provided you have a data plan for the car. Apple CarPlay and Android Auto continue to be standard, but now they can be used wirelessly. You can also now connect two phones via Bluetooth wirelessly so you can access content from both. Navigation gets real time information and updates from TomTom. Users can create five profiles with unique climate, radio and instrument settings, plus one for a valet.

Here are all the vehicles sold by the 12 brands of the Fiat Chrysler PSA merger

Fri, Dec 20 2019Sven Gustafson and Ronan Glon contributed to this report. Whether or not the formal merger between Italian-American automaker Fiat Chrysler and European conglomerate PSA Group means the return of Peugeot to the U.S., one thingís for certain: The combined company will have a truckload of different brands. Sorting out what the deal means for all of them, including where they are sold and built, and whether and where there is product overlap, will be a key question for the two companies as they formalize the merger over the next 12 to 15 months. So far, both sides have steadfastly insisted that no job cuts or plant closures will result from the tie-up. We¬íll see about that. In the meantime, we¬íve compiled an alphabetical list of all the vehicles currently sold in Europe and in North America by the various FCA and PSA brands, along with the years they debuted. We've gone into more detail about the European vehicles you might be less familiar with. The joint empire also has an antique store's worth of heritage-laced models and dormant brands, like Plymouth, Imperial, Simca, and Panhard, and it would have been even bigger had FCA not spun off Ferrari in early 2016. Alfa Romeo A legacy Italian sports car brand with roots in racing, Alfa Romeo has been struggling with declining U.S. sales. Giulia (2015): Alfa¬ís rear-wheel drive sports sedan competes against German luxury sedans in North America and Europe. 4C (2013): The lightweight mid-engine rear-wheel-drive sports car is being phased out. Stelvio (2016): The Stelvio is a small luxury performance crossover that competes against the likes of the Porsche Macan and BMW X3 and is sold in both Europe and North America. Giulietta (2010): Sold in Europe, this compact hatchback is Alfa¬ís entry-level model. After initially planning a rear-wheel drive 2020 update, the Giulietta is reportedly being nixed as part of FCA¬ís latest product plans. ¬† Chrysler Despite lending its name to its parent company, questions abound about the future of this legendary but faded brand, which is not offered in Europe. 300 (2011): Despite rumors of its pending demise, the four-door sedan lives on mostly unchanged for the 2020 model year, at least. Pacifica (2016): The successor to the Town & Country is Chrysler¬ís bestselling model by a long shot and comes in gas-only and plug-in hybrid versions. Voyager (2019): Chrysler¬ís newest minivan launches as its entry-level minivan for the 2020 model year.

Dodge Viper production to end after 2017

Tue, Jun 21 2016We can't say we're surprised, but we're still saddened to report that the Dodge Viper will not live on past the 2017 model year. It's had a solid 25-year run, though, and that's worth celebrating. Fiat Chrysler Automobiles does just that for the Viper's final model year, with five special editions (some of which seem less special than others, admittedly): The 1:28 Edition ACR, GTS-R Commemorative Edition ACR, VoooDoo II Edition ACR, Snakeskin Edition GTC, and Dodge Dealer Edition ACR. Instead of running through what makes each of these 2017 Vipers special, we'll direct your attention to the press release below and the images above. All but the Dodge Dealer Edition commemorate memorable Viper models of the past 25 years, and the GTS-R is probably the pick of the litter with its classic blue-on-white paint scheme. Unless you prefer to err on the side of gaudy, in which case Dodge has you (and your car) covered with Snakeskin Green. If none of these special-edition Viper models strikes your fancy but you'd still like to park a 2017 Viper in your garage, fret not. Dodge is still offering its "1 of 1" customization program for the Viper's final year of production. Finally, instead of dwelling on the past, even when that past is as exciting as the Viper's, let's choose to look to the future with the only logical question left unanswered: What's next? Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.