*mega Deal* 2008 Pt Cruiser - 1 Owner - Clean Carfax - Boston Stereo - on 2040-cars

Hollywood, Florida, United States

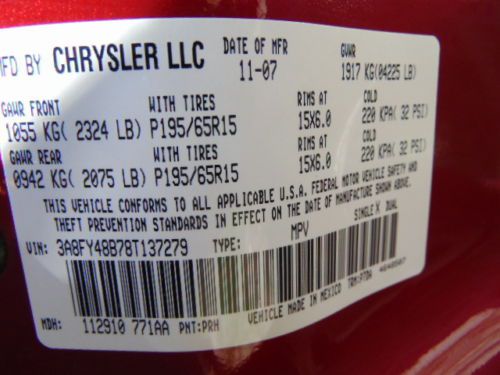

Chrysler PT Cruiser for Sale

2006 chrysler pt cruiser base wagon 4-door 2.4l(US $2,500.00)

2006 chrysler pt cruiser base wagon 4-door 2.4l(US $2,500.00) Chrysler pt cruiser, 2007, good condition low miles(US $3,500.00)

Chrysler pt cruiser, 2007, good condition low miles(US $3,500.00) 2006 chrysler pt cruiser, no reserve

2006 chrysler pt cruiser, no reserve 06 keyless entry sunroof tint cd player auxiliary input window vent visors

06 keyless entry sunroof tint cd player auxiliary input window vent visors Pt cruiser.....touring edition.....convertible.....2.4 l turbo......

Pt cruiser.....touring edition.....convertible.....2.4 l turbo...... 2006 chrysler pt cruiser...only 16,078 miles!!(US $7,450.00)

2006 chrysler pt cruiser...only 16,078 miles!!(US $7,450.00)

Auto Services in Florida

Zip Automotive ★★★★★

X-Lent Auto Body, Inc. ★★★★★

Wilde Jaguar of Sarasota ★★★★★

Wheeler Power Products ★★★★★

Westland Motors R C P Inc ★★★★★

West Coast Collision Center ★★★★★

Auto blog

Chrysler 200 replacement coming in January

Mon, 18 Mar 2013Autoweek reports the next Chrysler 200 will bow early next year. CEO Sergio Marchionne has said the 2015 model will debut next January, and Chrysler plans to cut the 2014 200 model year short to make way for the model's successor. According to AW, internal documents reveal 2014 model production will start this July and run through early January, 2014. The memos don't specify whether its Dodge Avenger twin will also see a shortened model year (the latter was originally rumored for discontinuation, but a successor is apparently back on the table). Chrysler is investing some $1 billion to construct paint and body facilities at its Sterling Heights, Michigan plant for the next-generation 200.

From what we've heard so far, we can expect the 2015 200 to bring a new design language to the Chrysler brand that will eventually bleed into the automaker's other products. Early reports have also suggested the four door will boast a nine-speed automatic transmission and return up to 38 miles per gallon.

Chrysler executed a very successful facelift in 2011, turning the flailing Sebring into the newly minted 200. Buyers responded enthusiastically, with sales jumping 44 percent in 2012. That step up was enough to make the 200 the brand's best-selling car. The momentum hasn't slackened, either, with sales up 21 percent during the first two months of this year.

Why the Detroit Three should merge their engine operations

Tue, Dec 22 2015GM and FCA should consider a smaller merger that could still save them billions of dollars, and maybe lure Ford into the deal. Fiat-Chrysler CEO Sergio Marchionne would love to see his company merge with General Motors. But GM's board of directors essentially told him to go pound sand. So now what? The boardroom battle started when Mr. Marchionne published a study called Confessions of a Capital Junkie. In it, Sergio detailed the amount of capital the auto industry wastes every year with duplicate investments. And he documented how other industries provide superior returns. He's right, of course. Other industries earn much better returns on their invested capital. And there's a danger that one day the investors will turn their backs on the auto industry and look to other business sectors where they can make more money. But even with powerful arguments Marchionne couldn't convince GM to take over FCA. And while that fight may now be over, GM and FCA should consider a smaller merger that could still save them billions of dollars, and maybe lure Ford into the deal. No doubt this suggestion will send purists into convulsions, but so be it. The Detroit Three should seriously consider merging their powertrain operations, even though that's a sacrilege in an industry that still considers the engine the "heart" of the car. These automakers have built up considerable brand equity in some of their engines. But the vast majority of American car buyers could not tell you what kind of engine they have under the hood. More importantly, most car buyers really don't care what kind of engine or transmission they have as long as it's reliable, durable, and efficient. Combining that production would give the Detroit Three the kind of scale that no one else could match. There are exceptions, of course. Hardcore enthusiasts care deeply about the powertrains in their cars. So do most diesel, plug-in, and hybrid owners. But all of them account for maybe 15 percent of the car-buying public. So that means about 85 percent of car buyers don't care where their engine and transmission came from, just as they don't know or care who supplied the steel, who made the headlamps, or who delivered the seats on a just-in-time basis. It's immaterial to them. And that presents the automakers with an opportunity to achieve a staggering level of manufacturing scale. In the NAFTA market alone, GM, Ford, and FCA will build nearly nine million engines and nine million transmissions this year.

Renault delays decision on merger with Fiat Chrysler

Wed, Jun 5 2019PARIS — Renault has delayed a decision on whether to merge with Fiat Chrysler Automobiles, a deal that could reshape the global auto industry as carmakers race to make electric and autonomous vehicles for the masses. The deal still looks likely, but faced new criticism Tuesday from Renault's leading union and questions from its Japanese alliance partner Nissan. The French government is also putting conditions on the deal, including job guarantees and an operational headquarters based in France. The French carmaker's board will meet again at the end of the day Wednesday to "continue to study with interest" last week's merger proposal from FCA, Renault said in a statement. A Renault board meeting Tuesday to study the deal was inconclusive. The company didn't explain why, but a French government official said board members don't want to rush into a deal and are seeking agreement on all parts of the potential merger. The official, who spoke on condition of anonymity in line with government policy, told The Associated Press the conditions outlined by France's finance minister still "need to be met." France and Italy are both painting themselves as winners in the deal, which could save both companies 5 billion euros ($5.6 billion) a year. But workers worry a merger could lead to job losses, and analysts warn it could bog down in the challenges of managing such a hulking company across multiple countries. And a possible loser is Japan's Nissan, whose once-mighty alliance with Renault and Mitsubishi is on the rocks since star CEO Carlos Ghosn's arrest in November. Nissan CEO Hiroto Saikawa cast doubt Tuesday on whether his company will be involved in a Renault-Fiat Chrysler merger — and suggested adding Fiat Chrysler to the looser Renault-Nissan-Mitsubishi alliance instead. Saikawa said in a statement that the Renault-Fiat Chrysler deal would "significantly alter" the structure of Nissan's longtime partnership with Renault, and Nissan would analyze its contractual relationships to protect the company's interests. If Renault's board says "yes" to Fiat Chrysler, that would open the way for a non-binding memorandum of understanding to start exclusive merger negotiations. The ensuing process — including consultations with unions, the French government, antitrust authorities and other regulators — would take about a year. A merger would create the world's third-biggest automaker, worth almost $40 billion and producing some 8.7 million vehicles a year.