1977 Chrysler Other on 2040-cars

Jackson, Michigan, United States

Vehicle Title:Clean

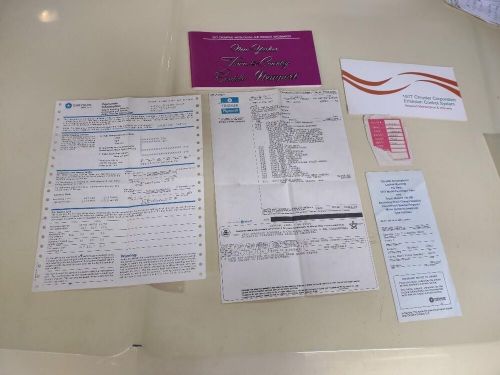

VIN (Vehicle Identification Number): SS22N7R135567

Mileage: 76000

Model: Other

Car Type: Classic Cars

Number of Seats: 5

Make: Chrysler

Chrysler Other for Sale

2011 chrysler other(US $6,000.00)

2011 chrysler other(US $6,000.00) 1988 chrysler other(US $1,100.00)

1988 chrysler other(US $1,100.00) 1961 chrysler other(US $100,000.00)

1961 chrysler other(US $100,000.00)

Auto Services in Michigan

Zoomers Express Care ★★★★★

Wetmore`s Inc ★★★★★

Westnedge Auto Repair ★★★★★

Warren Transmission ★★★★★

Village Ford ★★★★★

Vehicle Accessories ★★★★★

Auto blog

How the demise of Lincoln's Town Car has kick-started a limo revolution

Sun, 30 Dec 2012The deaths of the Ford Crown Victoria and the Lincoln Town Car have meant overhauls of three high-profile American fleets: police, taxi and livery car. Just as police fleets are more open to considering other options and a Nissan van is the new face of the NYC taxi, livery car companies are looking at replacements for the Town Car beyond The Blue Oval. Ford, via Lincoln, has made an MKT Town Car (pictured), but an article in the Detroit News claims "it has failed to win over most of the big limousine companies." The upstarts trying to move in include livery and limo editions of the Cadillac XTS, and livery specifications of the Toyota Avalon and Chrysler 300.

Each of those challengers, however, faces challenges. The Town Car was a workhorse, American, rear-wheel-drive sedan with plenty of rear legroom. Cadillac has been in the livery space before but with decontented models that were about selling the brand, not its luxury. It is taking the opposite approach with the XTS, pointing out that its livery edition is "contented in the upper half of the XTS range." Still, the CEO of Michigan's largest livery company says "it's quite a bit smaller than what we're used to," and he also prefers rear-wheel drive.

The Chrysler 300 is rear-wheel drive, and American, which matters to some companies, but Chrysler hasn't yet revealed the livery package for it. The livery Avalon marks Toyota's first time getting into that business in the US, a natural step after having done so well with taxi clients and with the Town Car out of the way. Still, the livery client is a different to taxi buyers, so the Avalon could face other soft-touch hurdles.

How fracking is causing Chrysler minivans to sit on Detroit's riverfront

Fri, 25 Apr 2014It's fascinating the way that one change to a complex system can have all sorts of unintended consequences. For instance, there are hundreds of new Chrysler Town and County and Dodge Grand Caravan minivans built in Windsor, Ontario, sitting in lots on the Detroit waterfront because of the energy boom in the Bakken oil field in the northern US and parts of Canada.

The huge amount of crude oil coming from these sites mostly use freight trains for transport, and that supply boom has resulted in a shortage of railcars to carry other goods. According to The Windsor Star, North American crude oil transport by train has gone from 9,500 carloads in 2008 to 434,032 carloads in 2013. Making matters worse, some North American rail infrastructure is still damaged because of this year's harsh winter, and that's slowing things down even further.

Chrysler admits to The Star that it has had some delivery delays due to the freight train shortage. In the meantime, it's using more trucks to deliver its vehicles. Trucking is a far less economical solution, partially because a train can carry so many more units at one time, but alternatives are slim. The Windsor plant alone has a deal for 33 trucks to distribute the minivans around Canada and the Midwestern US.

Jeep Renegade's development a template for new Fiat Chrysler Auto

Wed, 24 Sep 2014

"We figured we'd take the best of both worlds." - Ralph Gilles.

The international makeup of the 2015 Jeep Renegade will serve as a template for cooperation within the newly formed Fiat Chrysler Automobiles, Senior Vice President of Product Design Ralph Gilles said.