Daily Driver, Blue, 4 Door, Good Condition, 383, 6.3l, Built In 1969 September on 2040-cars

Dickinson, North Dakota, United States

|

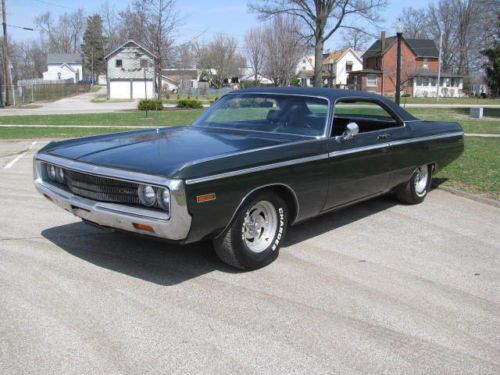

1970 Chrysler Newport Custom 383 V8 Automatic, Air Conditioning Jeff 701-609-1557 Hello, and welcome to my eBay listing. I have an all original, all matching numbers car with great options too. The original owner of this Chrysler Newport was a little old lady in North Dakota and when she could no longer drive a local farmer purchased it. It is a 1970 with a 383 V8 2 Barrel Carburetor. It really moves! It has an automatic transmission and air conditioning and power steering and brakes. The caretaker of the car used it as a once a week type driver. I put a new battery in it and put all new plugs and cap and rotor and plug wires and completed a compression test of all the cylinders and all is in good shape. It starts right up but the carb will need a good cleaning or rebuild. No smoke no drips no overheating.. Just a smooth running 383.. The transmission was smooth and perfect too. The brakes and suspension are good. The under body is in great condition but the exhaust does have a leak in it. The bad is really all cosmetic and mostly only on the interior. The paint is pretty fair for the most part. with a few worn spots. There is a dent/scrape on the rear passenger side. but the rest will polish out pretty well. The chrome is all in great shape except for a trim piece on the front grill. The interior is all factory and needs a good cleaning. The radio is original. The carpet is a bit tired. A little ArmorAll would go a long way on the interior areas. So that’s the story.. A good start to an easy restoration or a pretty cool and unique cruiser as it is. The miles are 67, 039. I wouldn’t call the car rusty, but there are some light rust spots here and there. The floors and frame are solid. The rear window has a little rust around the rear right corner. This Chrysler Newport has a ton of vintage appeal and will surely be one to hold on to for future appreciation. Here are my rules. #1. Only bid if you have intentions to buy. #2. Ask any and all questions before bidding. #3. Please contact me BEFORE BIDDING if you have zero or negative feedback. #4. This is an AS-IS sale. I have done my best to describe it exactly as I see it but it has no warranties or guarantees. #5. I will not accept Pay-Pal for the balance payment of the Chrysler Newport. Pay-Pal is for the deposits only, the balance must be paid by certified check or wire. Legitimate and legal buyers only please. Just be real and genuine and I will make sure that the winning bidder is happy with his or her purchase. I reserve the right to end early for the right offer so let me know what you are thinking. I’m Jeff my Phone number is 701-609-1557

|

Chrysler Newport for Sale

Auto Services in North Dakota

Wrenches R US Diesel Truck Repair ★★★★★

Larson Repair ★★★★★

Just-In Glass ★★★★★

Done Right Automotive ★★★★★

R + K Towing ★★★★

Miller Motors ★★★★

Auto blog

Recharge Wrap-up: Storm Pulse EV touring motorcycle, Elio COO launches YoYo car subscription service

Wed, Jun 8 2016The Eindhoven University of Technology in The Netherlands has created the Storm Pulse electric touring motorcycle. Its 28.5-kWh modular battery pack provides 236 miles of riding on a single charge. The batteries can be charged on a standard household outlet, and can be swapped out in a matter of minutes. The Storm Eindhoven team is raising money to take the prototype bike on a world tour this summer, covering 40,000 kilometers (24,855 miles) in 80 days, not just to show off the Pulse, but also to demonstrate the feasibility of electric mobility. Check it out in the video above, and read more at Technologic Vehicles. Chile is generating so much solar power that it is giving it away for free. Thanks to its well-developed solar infrastructure – which includes 29 solar farms with 15 more in the works – feeding its central grid (as well as problems distributing it to other parts of the country), the surplus means energy prices have dropped to zero in certain locales for well over a hundred days of the year. Chile is now trying to improve its transmission networks, though lack of revenue could slow future investment in solar power. Read more at Green Car Reports. Fiat Chrysler Automobiles (FCA) is reportedly talking to Uber Technologies about a possible partnership regarding driverless cars. Anonymous sources close to the matter have said that a venture could be announced by the end of 2016. Uber is also in talks with other automakers, according to one source. Having access to Uber's massive fleet of vehicles around the world provides large opportunities for gathering data and improving systems. Sources say Fiat has also been in contact with Amazon about autonomous delivery vehicles. Read more at Automotive News Europe. Former Elio Motors COO Hari Iyer is launching the YoYo car subscription service as its CEO. YoYo will offer cars on-demand with a concierge service, using a pay-per-mile model. Iyer will maintain a relationship with Elio as a member of its Board of Directors, and as a strategic advisor to CEO Paul Elio. "I am proud of our team's accomplishments [at Elio] and the progress we've made to date and will look on with pride when I see an Elio on the road," says Iyer. He adds, "My work at YoYo is continuing our shared mission to usher in a new era of affordable access to cars." Read more in the press release below.

Scandal-rocked UAW extends Ford, FCA contracts, prepares to strike GM

Fri, Sep 13 2019DETROIT — Leaders of the United Auto Workers union have extended contracts with Ford and Fiat Chrysler indefinitely, but the pact with General Motors is still set to expire Saturday night. The move puts added pressure on bargainers for both sides as they approach the contract deadline and the union starts to make preparations for a strike. The contract extension was confirmed Friday by UAW spokesman Brian Rothenberg, who declined further comment on the talks. The union has picked GM as the target company, meaning it is the focus of bargaining and would be the first company to face a walkout. GMÂ’s contract with the union is scheduled to expire at 11:59 p.m. Saturday. ItÂ’s possible that the four-year GM contract also could be extended or a deal could be reached, but itÂ’s more likely that 49,200 UAW members could walk out of GM plants as early as Sunday because union and company demands are so far apart. Picket line schedules already have been posted near the entrance to one local UAW office in Detroit. Art Wheaton, an auto industry expert at the Worker Institute at Cornell University, expects the GM contract to be extended for a time, but he says the gulf between both sides is wide. “GM is looking through the windshield ahead, and it looks like nothing but land mines,” he said of a possible recession, trade disputes and the expense of developing electric and autonomous vehicles. “I think thereÂ’s really going to be a big problem down the road in matching the expectations of the union and the willingness of General Motors to be able to give the membership what it wants.” Plant-level union leaders from all over the country will be in Detroit on Sunday to talk about the next steps, and after that, the union likely will make an announcement. But leaders are likely to face questions about an expanding federal corruption probe that snared a top official on Thursday. Vance Pearson, head of a regional office based near St. Louis, was charged with corruption in an alleged scheme to embezzle union money and spend cash on premium booze, golf clubs, cigars and swanky stays in California. ItÂ’s the same region that UAW President Gary Jones led before taking the unionÂ’s top office last year. Jones and other union executives met privately at a hotel at Detroit Metropolitan Airport on Friday. After the meeting broke up, JonesÂ’ driver and others physically blocked an AP reporter from trying to approach him to ask questions.

Dodge Dart pushed toward the grave with simplified lineup

Tue, Apr 12 2016FCA announced a while back that the Dodge Dart and its Chrysler 200 half-sibling are on the way out due to lack of interest. The 2016 model year will be the Dart's last, and Dodge has just reconfigured the lineup mid-year to lower (relative) pricing and streamline ordering. Streamlined is a nice way of saying there will be fewer choices, with three models (down from five) and limited customization beyond choosing the paint color. The odd thing is that the Dart continues to offer three different engines. And while the prices of the individual models have decreased, the former SE base trim is now gone. That means an early-2016 Dart was available for as little as $17,990, while the late-2016 Dart starts at $18,990. For that sum you get the new base model, the SXT Sport, which replaces the SXT and comes with the 2.0-liter Tigershark four-cylinder (160 horsepower, 148 lb-ft of torque) and a six-speed manual; a six-speed automatic is an available option. Standard equipment includes normal entry-level car stuff, black cloth upholstery, 16-inch wheels, and grille shutters that help improve fuel economy. The SXT Sport can be dressed up with one of three different appearance packages; Chrome adds bright accents to parts including the grille and door handles, Rallye has a black grille and a touring suspension, and the Blacktop package makes pretty much everything on the exterior black and includes a sport-tuned suspension. All three packages come with bigger wheels, too. From there it's on to the new Dart Turbo, for $20,490. It comes with the 1.4-liter turbo four (160 hp, 184 lb-ft of torque) and comes exclusively with a six-speed manual transmission. This is supposed to be the model for enthusiasts, which is how Dodge is selling the switch to manual-only. Ditching the disliked dual-clutch automatic that was previously offered with this engine doesn't hurt. This engine was also used in the former Aero model, as it's the most fuel-efficient in the lineup. The Turbo gets the Rallye appearance stuff and a different hood. At the top is the Dart GT Sport, starting at $21,900. It has the 184-hp, 2.4-liter Tigershark four-cylinder and a choice of six-speed manual or automatic transmission. This is the one with features, including a power driver's seat, the 8.4-inch Uconnect infotainment unit, digital reconfigurable gauges, dual-zone auto climate, keyless start, and a rearview camera. The latter-part-of-2016 Dart will be available in eight colors.

1970 newport custom drive + show no reserve

1970 newport custom drive + show no reserve 1965 chrysler newport base hardtop 2-door 6.3l

1965 chrysler newport base hardtop 2-door 6.3l 1967 chrysler newport 300 convertible barn find !!!!

1967 chrysler newport 300 convertible barn find !!!! 1962 chrysler newport base 5.9l

1962 chrysler newport base 5.9l 1968 chrysler newport convertible

1968 chrysler newport convertible 1975 chrysler newport custom sedan 4-door 6.6l

1975 chrysler newport custom sedan 4-door 6.6l