1978 Chrysler Newport Coupe ****40,000 Actual Miles***** on 2040-cars

Omaha, Nebraska, United States

|

A TRUE time capsule, a survivor with just over 40,000 actual miles. Recently purchased from an estate this is probably the nicest original 36 year old car you'll find...anywhere!! LOOK CLOSE AT THE PICTURES AND REMEMBER THIS CAR HAS HAD ABSOLUTELY NO RESTORATION...EVER!! It wears it's original paint, interior and drive train. The spare tire was installed by Chrysler Corporation in 1978 and it's NEVER been on the ground!! And of course never any rust...ever!!

Mechanically the car runs and drives great!! I just drove the car 125 miles on the interstate at 75 mph. The cruise works perfectly and it's just a great driving and running car. For those of us my age, we remember how cra**y Chrysler's Lean Burn System cars ran. They didn't work very well when they were new. Well...this one is the exception to the Lean Burn rule!! It starts right up, no chugging and choking. And it doesn't "stumble" as you accelerate. It's impressive how it runs. Quiet and smooth. The four barrel carb kicks right down and has decent power for such a big car. The factory AC is ice cold still on R12 refrigerant. Brakes and shocks work as they should. The tires are excellent. Options..there are many: 400 4-barrel, power steering, brakes and power driver seat. Cruise control and tilt steering with telescoping wheel. Cornering lights, fender skirts, am-fm radio. Front split bench seat with dual arm rests. Light package. Even rare for the time "delay" windshield wipers too!! Cosmetically there are just a very few flaws. As seen in the pics a few scratches, minor road rash very low behind the rear wheels. The vinyl top has a small area that has "curled" as you can see. The dash pad is perfect, the glas is original and very nice. The headliner is drooping. It's being sold this way but there's a possibility I can have it replaced by auction ends..WATCH FOR UPDATES regarding I will post. Summing it up: This car is ready for summer cruise nights and local car shows. It's a great classic piece of American iron at it's best from the company that was called Chrysler Corporation!! The reserve is low...very low to enable anyone that wants a nice LOW MILEAGE classic car to own it. I NEED TO PUT THE CAP BUTTON ON...DO NOT BID ON THIS CAR UNLESS YOU HAVE THE MEANS AND INTENTIONS TO BUY IT!! Have your financial affairs in order and permission from your spouse, partner or signifigant other PRIOR to bidding. ASK QUESTIONS BEFORE BIDDING. My phone is with me 24/7 and I'll answer your questions honestly and openly. Fly in drive the car home in total comfort, I can pick you up at the airport. Shipping is the buyers responsibility. The car is stored in a secure building. Winning bidder to send a $500 non-refundable deposit via Paypal 48 hours end of auction. Balance to be paid within 7-days via bank to bank wire transfer, certified bank funds or cash when picked up. Remember...call me anytime with any questions Tom 402-650-3849 |

Chrysler Newport for Sale

1967,chrysler, new port, convertable, red.(US $23,500.00)

1967,chrysler, new port, convertable, red.(US $23,500.00) 1962 chrysler newport wagon(US $20,900.00)

1962 chrysler newport wagon(US $20,900.00) Original paint chrysler newport convertible

Original paint chrysler newport convertible Beautiful black convertible - push button auto -361ci v8-stunning color combo(US $31,900.00)

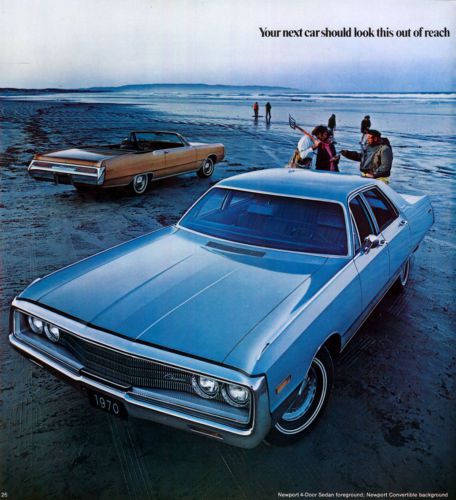

Beautiful black convertible - push button auto -361ci v8-stunning color combo(US $31,900.00) 1970 chrysler newport base hardtop 4-door 6.3l(US $4,299.00)

1970 chrysler newport base hardtop 4-door 6.3l(US $4,299.00) 1963 chrysler station wagon 4dr hard top 9 passenger project hot rat rod gasser(US $2,750.00)

1963 chrysler station wagon 4dr hard top 9 passenger project hot rat rod gasser(US $2,750.00)

Auto Services in Nebraska

Troy`s Automotive ★★★★★

Rojam Machine ★★★★★

Parkway 66 Service ★★★★★

Ming Auto Beauty Center ★★★★★

Lakeside Auto Recyclers ★★★★★

CARSTAR Glenn`s Body Shop ★★★★★

Auto blog

Fiat Chrysler joins open pool with Tesla to avoid paying EU emissions fines

Sun, Apr 7 2019According to a report from the Financial Times, Fiat Chrysler has agreed to pay Tesla "hundreds of millions of euros" in order to pool their fleets together in Europe. This move will reportedly allow FCA to use Tesla's zero-emission vehicle sales to offset fines it would have to pay for failing to meet European Union carbon emissions rules, which fall to 95 grams per kilometer starting next year. According to the report, FCA joined a so-called open pool with Tesla on February 25. The electric car company created the pool and gave other automakers "the chance to join" three days prior. The pool will be valid "for several years," according to Julia Poliscanova, a senior director at the Transport & Environment lobbying group. Toyota and Mazda apparently created a similar pool on the same day, but that agreement doesn't elicit quite the same eyebrow raise since Toyota owns a five-percent stake in Mazda. It's not clear exactly how much money FCA will pay Tesla through this arrangement, but similar deals have been part of Tesla's financial strategy for years. FT reports Tesla earned more than $100 million by selling electric vehicle credits in the United States last year and close to $300 million the prior year.

10 years later, a look back at U.S. auto industry’s near-death experience

Wed, Apr 3 2019The U.S. auto industry this month marks a grim and harrowing milestone: A decade ago, the entire industry was staring into the abyss of total collapse. By 2009, of course, the broader economy was teetering on the brink, with mortgage default rates and foreclosures spiraling and the real estate market in the tank. Both Lehman Brothers and Bear Stearns had collapsed, President George W. Bush had signed the Troubled Asset Relief Program, or TARP, infusing $700 billion of taxpayer money to stabilize Wall Street, and Insurer AIG, stung by huge losses on subprime mortgages, won a federal bailout. Virtually the entire decade had been particularly unkind to the Detroit Three automakers, which were over-reliant on gas-guzzling trucks and SUVs as gasoline prices crept toward the $4 mark, and whose labor costs — especially for health care and retiree pension obligations — were dragging them billions into the red. It was a dreadful, frightening time in Detroit, especially, with reports of plant closures and mass layoffs appearing with alarming regularity. Seeing the federal government's largess with Wall Street, General Motors and Chrysler both went calling for government assistance for themselves. (Ford managed to avoid following suit only by mortgaging all of its assets, including its very brand, years earlier in exchange for billions of dollars in loans.) Yet instead of giving them the "bridge loans" they sought, the incoming Obama administration instead pushed back against GM and Chrysler, eventually guiding them into bankruptcy protection, as the Detroit Free Press recalls in a multimedia story recounting the industry's tumultuous and perilous recent past. The piece uses images of the newspaper's front pages from those days, splashed with what former newsroom colleagues and I would often refer to as "Pearl Harbor font" headlines ("NO DEAL" read the Freep's Dec. 12, 2008, edition). There are also timelines, interactive graphics and snippets of video interviews with two insiders: freshman U.S. Rep. Haley Stevens of Michigan, who served as chief of staff for President Obama's auto task force; and U.S. Rep. Debbie Dingell, the wife of the late longtime U.S. Rep. and industry ally John Dingell, who was then an executive at GM.

The Chrysler brand could be axed under Stellantis management

Sun, Jan 3 2021MILAN — While running NissanÂ’s North American operations from 2009 to 2011, Carlos Tavares had a reputation for closely watching costs with little tolerance for vehicles or ventures that didnÂ’t make money. Experts say that means Tavares, currently the head of PSA Group, is likely to follow that blueprint when he becomes leader of a merged PSA and Fiat Chrysler Automobiles. The low-performing Chrysler brand might get the axe as could slow-selling cars, SUVs or trucks that lack potential. Already the companies are talking about consolidating vehicle platforms — the underpinnings and powertrains — to save billions in engineering and manufacturing costs. That could mean job losses in Italy, Germany and Michigan as PSA Peugeot technology is integrated into North American and Italian vehicles. “You canÂ’t be cost efficient if you keep the entire scale of both companies,” said Karl Brauer, executive analyst for the iSeeCars.com auto website. “WeÂ’ve seen this show before, and weÂ’re going to see it again where they economize these platforms across continents, across multiple markets.” Shareholders of both companies are to meet Monday to vote on the merger to form the worldÂ’s fourth-largest automaker, to be called Stellantis. The deal received EU regulatory approval just before Christmas. Tavares, who for years has wanted to sell PSA vehicles in the U.S., wonÂ’t take full control of the merged companies until the end of January at the earliest. He likely will target Europe for consolidation first, because thatÂ’s where Fiat vehicles overlap extensively with PSAÂ’s, said IHS Markit Principal Auto Analyst Stephanie Brinley. Europe has been a money-loser for FCA, and factories in Italy are operating way below capacity — a concern for unions, given FiatÂ’s role as the largest private sector employer in the country. “We are at a crossroads,Â’Â’ said Michele De Palma of the FIOM CGIL metalworkersÂ’ union. “Either there is a relaunch, or there is a slow agonizing closure of industry, in particular the auto industry, in Italy.” ItalyÂ’s hopes lie with the luxury Maserati and sporty Alfa Romeo brands, but De Palma said investments are needed to bring hybrid and electric technology up to speed. FiatÂ’s Italian capacity stands at 1.5 million vehicles, but only a few hundred thousand are being produced each year. Most factories were on rolling short-term layoffs due to lack of demand, even before the pandemic.