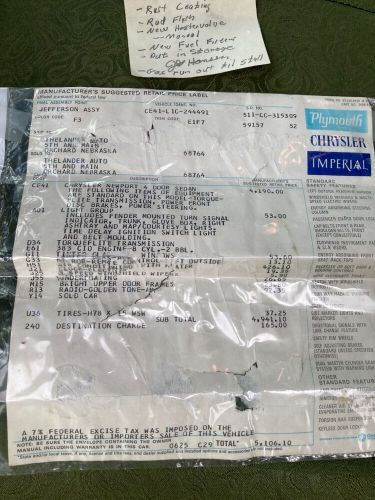

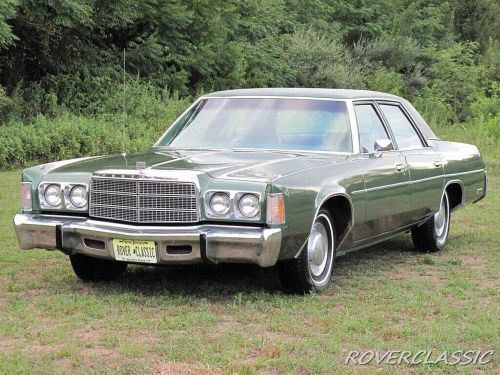

1968 Chrysler Newport on 2040-cars

North Brunswick, New Jersey, United States

Transmission:Automatic

Vehicle Title:Clean

VIN (Vehicle Identification Number): CE23G8C275987

Mileage: 65000

Car Type: Classic Cars

Model: Newport

Make: Chrysler

Chrysler Newport for Sale

1971 chrysler newport(US $3,500.00)

1971 chrysler newport(US $3,500.00) 1977 chrysler newport(US $7,300.00)

1977 chrysler newport(US $7,300.00) 1962 chrysler newport(US $24,000.00)

1962 chrysler newport(US $24,000.00) 1955 chrysler newport windsor deluxe(US $17,200.00)

1955 chrysler newport windsor deluxe(US $17,200.00) 1977 chrysler newport(US $11,995.00)

1977 chrysler newport(US $11,995.00) 1977 chrysler newport(US $10,995.00)

1977 chrysler newport(US $10,995.00)

Auto Services in New Jersey

Williams Custom Tops-Interiors ★★★★★

Volkswagon of Langhorne ★★★★★

Vip Honda Honda Automobiles ★★★★★

Tri State Auto Glass ★★★★★

Solveri Collision Center ★★★★★

Scotts Auto Service ★★★★★

Auto blog

Next Jeep Wrangler to get hybrid option?

Wed, Jan 21 2015This may the year a Jeep hybrid is officially announced. Really. The Chrysler division may finally be making plans for its first gas-electric powertrain to help boost the group's fuel economy, says UK's Auto Express, citing Mike Manley, CEO of FCA's Jeep division. The guinea pig of sorts may be the Wrangler, which moved almost a quarter-million units in the US last year. The Wrangler could get a hybrid drivetrain by the 2017 model year, as Jeep executives look to maintain the model's feel and torque while boosting its fuel economy. The Wrangler gets a pretty paltry 18 miles per gallon combined out of its six-cylinder mill, so the bar's set pretty low. Of course, we've heard this talk before. In late 2013, Chrysler Asia-Pacific product planning manager Steve Bartoli told Australia's Drive that a Jeep hybrid was pretty much inevitable, though not much has been mentioned since. FCA could use all the help it can get in the fuel economy department. The group brought up the rear among automakers when it came to fuel efficiency, the US Environmental Protection Agency (EPA) said in its EPA Trends report released last October. The FCA models combined for a 21.1 miles per gallon average for the 2014 model year, compared to the 24.2 mpg overall industry average. The group's only electric vehicle in the US is the low-volume Fiat 500e, though the company may start selling a plug-in hybrid version of its Chrysler Town & Country by the end of the year. Featured Gallery 2014 Jeep Wrangler Polar Edition View 9 Photos News Source: Auto Express Green Chrysler Jeep Fuel Efficiency Hybrid

Major automakers urge Trump not to freeze fuel economy targets

Mon, May 7 2018WASHINGTON — Major automakers are telling the Trump administration they want to reach an agreement with California to avoid a legal battle over fuel efficiency standards, and they support continued increases in mileage standards through 2025. "We support standards that increase year over year that also are consistent with marketplace realities," Mitch Bainwol, chief executive of the Alliance of Automobile Manufacturers, a trade group representing major automakers, will tell a U.S. House of Representatives panel on Tuesday, according to written testimony released on Monday. The Trump administration is weighing how to revise fuel economy standards through at least the 2025 model year, and one option is to propose freezing the standards through 2026, effectively allowing automakers to delay investments in technology to cut greenhouse gas emissions from burning petroleum. The National Highway Traffic Safety Administration has not formally submitted its joint proposal with the Environmental Protection Agency to the White House Office of Management and Budget for review. Even so, last week, California and 16 other states sued to challenge the Trump administration's decision to revise U.S. vehicle rules. Auto industry executives have held meetings with the Trump administration for months and have urged the administration to try to reach a deal with California even as they support slowing the pace of reduction in carbon dioxide emissions that the Obama administration rules outlined. One automaker official said part of the message to President Donald Trump at a meeting on Friday will be to consider California like a foreign trade deal that needs to be renegotiated. Automakers want to urge him to get automakers a "better deal" — as opposed to potentially years of litigation between major states and federal regulators. On Friday, Trump is set to meet with the chief executives of General Motors, Ford, Fiat Chrysler and the top U.S. executives of at least five other major automakers, including Toyota, Volkswagen AG and Daimler AG, to talk about revisions to the vehicle rules. Senior EPA and Transportation Department officials will also attend. Environmental groups are eager to keep the rules in place, saying they will save consumers billions in fuel costs. A coalition of groups plans to stage a protest outside Ford's headquarters in Michigan.

Auto Mergers and Acquisitions: Suicide or salvation?

Tue, Sep 8 2015We love the Moses figure. A savior riding in from stage right with the ideas, the smarts, and the scrappiness to put things right. Alan Mullaly. Carroll Shelby. Lee Iacocca. Andrew Carnegie. Steve Jobs. Elon Musk. Bart Simpson. Sergio Marchionne does not likely view himself with Moses-like optics, but the CEO of Fiat Chrysler Automobiles recently gave a remarkable, perhaps prophetic interview with Automotive News about his interest and the inevitability of merging with a potential automotive partner like General Motors. Marchionne has been overtly public about his notion that GM must merge with FCA. For a bit of context, GM sold 9.9 million vehicles in 2014, posting $2.8 billion in net income, while FCA sold 4.75 million units and earned $2.4 billion in net income, painting a very rosy FCA earnings-to-sales picture. But that's not the entire picture. Most people in the auto industry still remember the trainwreck that was the DaimlerChrysler "merger" written in what turned out to be sand in 1998. It proved to be a master class in how not to fuse two companies, two cultures, two continents, and two management teams. Oh, it worked for the two individuals at both helms pre-merger. They got silly rich. And the industry itself was in a misty romance at the time with mergers and acquisitions. BMW bought Rolls-Royce. Volkswagen Group bought Bentley, Bugatti, and Lamborghini, putting all three brands into their rightful place in both products and positioning. No marriages there, so no false pretense. Finally, Nissan and Renault got married in 1999. A successful marriage requires several rare elements in this atmosphere of gas fumes and power lust. But a successful marriage requires several rare elements in this atmosphere of gas fumes and power lust, the principle part being honesty. Daimler and Chrysler lied to each other. The heads of each unit, the product planners, and finance all presented their then-current and long-range forecasts to each other with less-than-forthright accuracy. Daimler was the far greater equal and no one from the Chrysler side enjoyed that. The cultures were entirely different, too, and little was done to bridge that gap. Which brings me back to the present overtures by Marchionne to GM. "There are varying degrees of hugs," Marchionne stated in the Automotive News piece. "I can hug you nicely, I can hug you tightly, I can hug you like a bear, I can really hug you." Seriously?