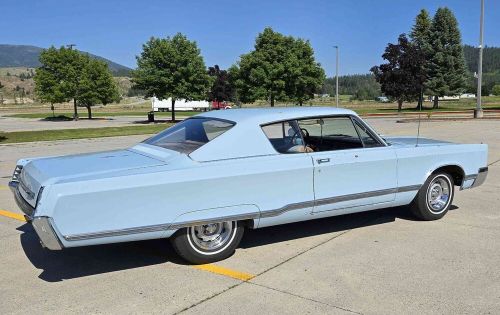

1965 Chrysler Newport Chrome on 2040-cars

Glendale, Arizona, United States

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

Engine:383

VIN (Vehicle Identification Number): 5R9185301

Mileage: 78000

Trim: chrome

Number of Cylinders: 8

Make: Chrysler

Drive Type: RWD

Model: Newport

Exterior Color: Black

Chrysler Newport for Sale

1968 chrysler newport convertible(US $20,968.00)

1968 chrysler newport convertible(US $20,968.00) 1966 chrysler newport(US $17,500.00)

1966 chrysler newport(US $17,500.00) 1966 chrysler newport(US $24,995.00)

1966 chrysler newport(US $24,995.00) 1955 chrysler newport windsor deluxe(US $16,500.00)

1955 chrysler newport windsor deluxe(US $16,500.00) 1967 chrysler newport custom(US $3,000.00)

1967 chrysler newport custom(US $3,000.00) 1968 chrysler newport(US $3,000.00)

1968 chrysler newport(US $3,000.00)

Auto Services in Arizona

Tri-City Towing ★★★★★

T & R upholstery & Body Works ★★★★★

Super Discount Transmissions ★★★★★

Stamps Auto ★★★★★

Solar Ray Auto Glass Repair ★★★★★

Sierra Toyota ★★★★★

Auto blog

Dodge Grand Caravan to live in fleets through 2017

Mon, Jun 22 2015After a hard-working career of hauling around families for decades, the Dodge Grand Caravan name was set to retire in 2016 under FCA's five-year plan for the US. The decision would have put all of the automaker's focus behind the next-generation Chrysler Town & Country, but that original strategy might have changed. Now, Dodge's minivan may have to work just a few more years before it can finally shuffle off. There are set to be 2016 and 2017 model year examples of the current Grand Caravan, according to an internal FCA production document obtained by Automotive News. This report suggests no changes in the minivan between those two years, and there's no mention of the company's intentions deeper into the future. "While we've announced the Grand Caravan will eventually be the minivan that goes away, we're not going into more detail at this time," a Dodge spokesperson said to AN. For the next Town & Country, production would start in Windsor, Ontario, in late February 2016. This document also suggests a brief run of 2016 Chrysler minivans based on the current model from August 2015 until February 2016. Automotive News speculates that the reprieve for the Grand Caravan could allow that model to focus on fleets and the Canadian market while the new Town and Country gets up and running. The latest generation T&C will reportedly debut at the 2016 Detroit Auto Show and will possibly carry a higher price to befit a vehicle with a more modern platform and improved tech.

Waymo heads to Atlanta to test its self-driving cars

Mon, Jan 22 2018Waymo continues to expand the pool of locations where it's testing its autonomous vehicle tech, and the latest destination is metro Atlanta. The former Google self-driving car company revealed the news on Twitter, noting that it's expanding considerably its geographic testing footprint now that it's got fully driverless test vehicles on the road in Phoenix. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Its test cars in cities outside of Arizona still have safety drivers at the wheel, but the more places it can get its Pacificas with autonomous tech on roads, the better for building an autonomous driving "brain" that can handle anything it encounters. Atlanta has some specific challenges, including bad traffic (commute and traffic issues are ranked among the worst locations in the U.S.) and one of the more dense greater metro areas in the U.S., and temperatures that regularly reach a humid 80+ degrees Fahrenheit. Metro Atlanta marks Waymo's 25th test city in total, including its recent return to San Francisco. Its testing so far has consisted of mapping the city with manually driven Waymo vehicles ahead of launching its testing program in full. A Waymo spokesperson provided the following statement to TechCrunch regarding the expansion: Now that we have the world's first fleet of fully self-driving cars on public roads, we're focused on taking our technology to a wide variety of cities and environments. We're looking forward to our testing in Metro Atlanta, and the opportunity to bring this lifesaving technology to more people in more places. Georgia Governor Nathan Deal also provided the statement below: With our talented workforce and legacy of innovation, Georgia is at the forefront of the most dynamic, cutting edge industries like autonomous vehicles. We are thrilled to welcome Waymo to our state because fully self-driving vehicle technology holds tremendous potential to improve road safety, and we are proud Georgia is paving the way for the future of transportation. Reporting by Darrell Etherington for TechCrunch.Related Video: Image Credit: Waymo Green Chrysler Technology Emerging Technologies Autonomous Vehicles Waymo

The problem with how automakers confront hacking threats

Thu, Jul 30 2015More than anyone, Chris Valasek and Charlie Miller are responsible for alerting Americans to the hacking perils awaiting them in their modern-day cars. In 2013, the pair of cyber-security researchers followed in the footsteps of academics at the University of Cal-San Diego and University of Washington, demonstrating it was possible to hack and control cars. Last summer, their research established which vehicles contained inherent security weaknesses. In recent weeks, their latest findings have underscored the far-reaching danger of automotive security breaches. From the comfort of his Pittsburgh home, Valasek exploited a flaw in the cellular connection of a Jeep Cherokee and commandeered control as Miller drove along a St. Louis highway. Remote access. No prior tampering with the vehicle. An industry's nightmare. As a result of their work, FCA US recalled 1.4 million cars, improving safety for millions of motorists. For now, Valasek and Miller are at the forefront of their profession. In a few months, they could be out of jobs. Rather than embrace the skills of software and security experts in confronting the unforeseen downside of connectivity in cars, automakers have been doing their best to stifle independent cyber-security research. Lost in the analysis of the Jeep Cherokee vulnerabilities is the possibility this could be the last study of its kind. In September or October, the U.S. Copyright Office will issue a key ruling that could prevent third-party researchers like Valasek and Miller from accessing the components they need to conduct experiments on vehicles. Researchers have asked for an exemption in the Digital Millennial Copyright Act that would preserve their right to analyze cars, but automakers have opposed that exemption, claiming the software that runs almost every conceivable vehicle function is proprietary. Further, their attorneys have argued the complexity of the software has evolved to a point where safety and security risks arise when third parties start monkeying with the code. Their message on cyber security is, as it has been for years, that they know their products better than anyone else and that it's dangerous for others to meddle with them. But in precise terms, the Jeep Cherokee problems show this is not the case. Valasek and Miller discovered the problem, a security hole in the Sprint cellular connection to the UConnect infotainment system, not industry insiders.