1976 Chrysler New Yorker Brougham Hardtop 4-door 7.2l 440 Drives Great Low Miles on 2040-cars

Cincinnati, Ohio, United States

Chrysler New Yorker for Sale

1963 chrysler new yorker 85k original miles 4 door automatic sell worldwide

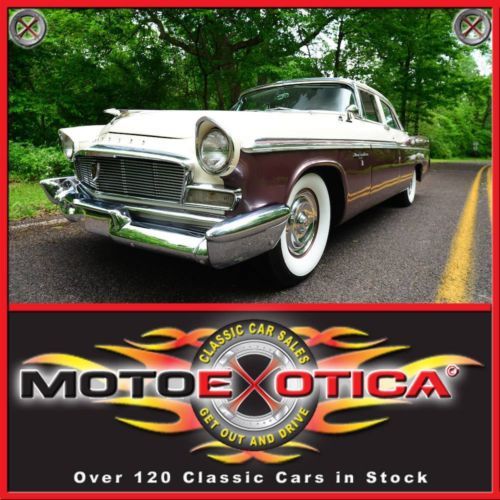

1963 chrysler new yorker 85k original miles 4 door automatic sell worldwide 1956 chrysler new yorker-fresh chrome and paint-rebuilt 354 cid hemi-awesome!(US $19,900.00)

1956 chrysler new yorker-fresh chrome and paint-rebuilt 354 cid hemi-awesome!(US $19,900.00) 1977 chrysler new yorker brougham hardtop 4-door 7.2l

1977 chrysler new yorker brougham hardtop 4-door 7.2l 1979 chrysler new yorker(US $7,500.00)

1979 chrysler new yorker(US $7,500.00) Beautiful vintage 1964 chrysler new yorker "salon"(US $7,999.00)

Beautiful vintage 1964 chrysler new yorker "salon"(US $7,999.00) 1953 chrysler new yorker with real deal hemi and fluid drive automatic

1953 chrysler new yorker with real deal hemi and fluid drive automatic

Auto Services in Ohio

Zink`s Body Shop ★★★★★

XTOWN PERFORMANCE ★★★★★

Wooster Auto Service ★★★★★

Walker Toyota Scion Mitsubishi Powersports ★★★★★

V&S Auto Service ★★★★★

True Quality Collision ★★★★★

Auto blog

Chrysler and Fiat offering $1,000 rebates to VW owners as Marchionne gets tough

Mon, 10 Dec 2012The throw-down between Fiat CEO Sergio Marchionne and Volkswagen has heated up in earnest. According to Bloomberg, Fiat and Chrysler are now offering current Volkswagen owners in the US $1,000 rebates to trade in their ride. It's the latest in a series of shots Marchionne has taken at his German rival. As you may recall, the Fiat executive entered into a spat with Volkwagen board chairman Ferdinand Piëch and CEO Martin Winterkorn in October after the duo called for Marchionne's resignation from presidency of the European Automotive Manufacturers Association (AECA). At the time, the Volkswagen executives were quoted as saying Fiat would not survive the European economic downturn.

In response, Marchionne called the German executives "reprehensible," and accused Volkswagen of using a pricing strategy that has created created a "bloodbath" in the EU. Volkswagen has taken to steep discounting to carve out ever-larger slices of market share in Europe, but the company has a much smaller foothold in the US. Marchionne may be trying to hit Volkswagen where the manufacturer is weakest with the new Fiat new incentive program.

Late last week, the Fiat executive was voted to a second term as ACEA president.

Chrysler UConnect wins AOL Autos Technology of the Year Award

Wed, 09 Jan 2013The first annual AOL Autos Technology of the Year Award has been won by Chrysler's upgraded UConnect system.

Over 35 entries were considered and narrowed down to six finalists in three categories: Connectivity, Telematics and Active Safety. The judges, which included editors from AOL Autos, Autoblog and Engadget, as well as a number of other auto and tech journalists and luminaries, chose UConnect over the MyFord Mobile app, Audi Connect with Google Maps, Cadillac CUE, Honda's LaneWatch technology and Nissan's Tire Pressure Alert and Refill System. Even readers who were polled on which technology should win chose UConnect.

AOL Autos Editor in Chief David Kiley remarked that Chrysler's UConnect deserved the first Technology of the Year Award not because of what it does, but for how UConnect performs every time it's used. Kiley went on to say UConnect works the way it's supposed to, fills a need and puts a smile on your face. By meeting those requirements, UConnect very much deserved AOL Auto's first Tech of the Year award.

Michigan ponders its automotive future in the connected age

Wed, May 31 2017Few people take cars more seriously than Michiganders. I've been to the home of BMW in Germany. I've been to Kia's HQ in Korea. I've seen Honda's goods in Japan. No one, from the factory worker to the executive in her pinstriped suit, is more obsessed with cars than Michigan Inc. That's why it was interesting this week to see the state have a moment of introspection four hours north of the Motor City on a scenic island called Mackinac. Ironically, cars are not allowed here. Normally a tourist trap, it played placed host to the Mackinac Public Policy conference this week. While politics took center stage ( I may be the only person here not considering a run for governor) the evolution of the industry through connectivity and data was a theme of the conference. If you're reading this in New York, Silicon Valley, or one of the automotive heartlands listed above, you do care about this. If Michigan rethinks its approach to the car business – and makes moves to become more competitive – that affects you the consumer and enthusiast. It's jobs. It's technology, and it's a competition to see who's going to be the leader. More than a century after Henry Ford made mass production a thing, more than 70 years after Detroit's Arsenal of Democracy helped win World War II, and nearly a decade after the historic bankruptcies of General Motors and Chrysler, the car business is on solid footing again and looking to the future. What's next? Michigan is still home to thousands of auto workers, tech centers (including gleaming facilities built by Toyota and Hyundai), and the headquarters of the three American carmakers. Just because the economy is good doesn't mean it's a given connected cars and mobility advancements are going to come from this state. A lot of it's not. Tesla, Uber, Lyft, Faraday Future, and other transportation mediums have spouted up other places. Michigan leaders and Detroit's carmakers understand this reality. Reflecting on the past means admitting the future is not a given, a key undertone this week in Mackinac. It's about using existing resources, like skilled labor, to move forward. "We do have the number of technicians and technical expertise here in this state," says Stephen Polk," conference chair and former CEO of auto data firm R.L. Polk & Co. To that end, Ford is placing increased emphasis on a division called Smart Mobility, which is an in-house unit focusing on autonomy, connectivity, and forward-looking ideas.