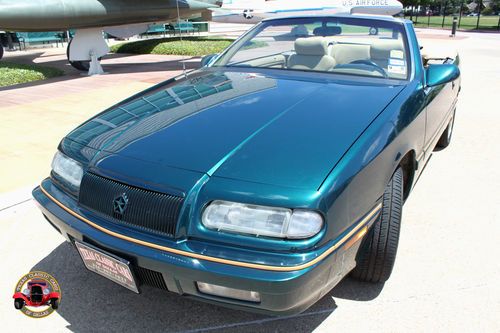

Chrysler Lebaron Convertible 1983 26,900 Orig Miles Excellent Condition 4 Cylind on 2040-cars

Carol Stream, Illinois, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:Mitsubishi 4 Cylinder 2.6 Liter

For Sale By:Private Seller

Exterior Color: White

Make: Chrysler

Model: LeBaron

Trim: Mark Cross Edition Designer

Options: Leather Seats, Convertible

Drive Type: Automatic

Power Options: Power Windows, Power Seats

Mileage: 26,900

1983 Chrysler LeBaron Convertible

*Mark Cross edition-Designer

*Mitsubishi Engine 4 cylinder 2.6 liter

*6 way power seat on driver side

*Power windows

*Power locks

*Power trunk

*"Talking Car" First year Chrysler computer system

*All Leather

*26.900 Original Miles

*Garage Kept, Excellent Condition

*AM/FM Stereo Radio

*Newer Tires

*New Power Steering Pump (May 2013)

*Fun car, great to drive kids around town, to golf course, ice cream with kids, etc.

Chrysler LeBaron for Sale

1982 chrysler lebaron convertible mark cross edition white w tan interior(US $9,650.00)

1982 chrysler lebaron convertible mark cross edition white w tan interior(US $9,650.00) 1993 chrysler lebaron convertible / one family owned

1993 chrysler lebaron convertible / one family owned Runs fine, great body, low reserve, call me....

Runs fine, great body, low reserve, call me.... 1984 chrysler lebaron base convertible 2-door 2.2l(US $2,900.00)

1984 chrysler lebaron base convertible 2-door 2.2l(US $2,900.00) 1993 chrysler lebaron gtc convertible 2-door 3.0l turbo engine

1993 chrysler lebaron gtc convertible 2-door 3.0l turbo engine 1983 chrysler lebaron mark cross town & country convertible(US $2,500.00)

1983 chrysler lebaron mark cross town & country convertible(US $2,500.00)

Auto Services in Illinois

World Class Motor Cars ★★★★★

Wilkins Hyundai-Mazda ★★★★★

Unibody ★★★★★

Turpin Chevrolet Inc ★★★★★

Tuffy Auto Service Centers ★★★★★

Triple T Car Wash Lube & Detail Center ★★★★★

Auto blog

FCA's Pentastar V6 gets more power, efficiency for 2016

Wed, Sep 2 2015Already a vital member of FCA's powertrain lineup, the 3.6-liter Pentastar V6 is receiving major efficiency improvements for 2016. Thanks to a massive amount of new tech attached to the mill, fuel economy is up six percent, and torque below 3,000 rpm jumps nearly 15 percent. The updates arrive first in the 2016 Jeep Grand Cherokee, but they should proliferate to other models eventually. At least in the Grand Cherokee, the tweaks push power up five horsepower to 295 ponies. FCA's engineers went through the Pentastar from top to bottom to eke out as much efficiency as possible. For example, there's now a two-speed variable-valve lift system that can run in low- or high-lift modes. This upgrade is responsible for 2.7-percent better economy, the company claims. A new intake manifold with longer runners and updated variable-valve times also helps boost the torque output. Further improvements come from pushing the compression ratio to 11.3:1, from 10.2:1 before. Perhaps most impressive is that despite all of the innovations, the latest Pentastar actually weighs four pounds less than the current version. Beyond the Pentastar improvements, all of the FCA US gasoline engines, except for the Viper's 8.4-liter V10, will be E15-compatible for 2016. The company says that it wants to be ready for the higher ethanol content fuel's greater use in the near future.

Chrysler IPO to be filed as early as this week

Mon, 16 Sep 2013An initial public offering for the Chrysler Group could happen this week, following Sergio Marchionne's comments to Financial Times in London, according to a report from The Detroit News. Fiat, which owns 58.5 percent of Chrysler, has been in a battle with the UAW retiree healthcare trust over its minority stake in the company. While the automotive union recognizes its role as a temporary shareholder, the two couldn't come to an agreement on how the shares should be priced.

As Marchionne explained to FT, a Chrysler IPO allows the market, rather than the two competing sides, to determine the value of the shares. The public offering is a risky move, which could potentially hang one side out to dry - if the shares go high, it's bad news for Fiat, but if they go low, the UAW stands to lose. Regardless of where the stock prices go in an IPO, though, it's a move that's being supported by analysts, who are quick to cite Chrysler's near-constant growth and a product lineup that is getting healthier with each new introduction.

FCA updates 700k-vehicle recall to replace ignition switches

Mon, Mar 9 2015FCA US is revising a previously announced recall of 702,578 minivans and SUVs; now specifying that owners replace their ignition switches, rather than just a component. The campaign affects the 2008-2010 Chrysler Town & Country, 2008-2010 Dodge Grand Caravan and 2009-2010 Dodge Journey. The National Highway Traffic Safety Administration initially opened an investigation last summer following complaints about the ignition switches in these models. FCA US (then Chrysler Group) responded with a recall of 695,957 examples of these vehicles because the key could appear to be in the "Run" position but not be fully engaged. If it slipped out, and there was an accident, then the airbags might not deploy. The company had initially planned to install a new detent ring to fix the problem. According to the timeline in a NHTSA document (available here as a PDF), the government agency and FCA US continued their research into the problem. The automaker found that the time needed to create a new ring design and updated software would be longer than replacing the whole ignition switch. The company worked with the supplier Marquardt to negotiate an accelerated schedule to manufacture the extra replacement parts. According to NHTSA, the investigation has now been closed because of FCA's recall. Company spokesperson Eric Mayne confirms to Autoblog via email, "No additional vehicles are affected and all affected customers have already been made aware their vehicles are subject to recall." FCA US sent out an initial notification advising owners of the problem in September 2014. The company will now send out a second letter in April and will replace the parts in two phases. Repairs for affected models from the 2008 and 2009 model years will begin in April, and 2010 examples will start being fixed in August. RECALL Subject : Ignition Switch may Turn Off , 1 INVESTIGATION(S) Report Receipt Date: JUN 26, 2014 NHTSA Campaign Number: 14V373000 Component(s): AIR BAGS , ELECTRICAL SYSTEM Potential Number of Units Affected: 702,578 All Products Associated with this Recall Vehicle Make Model Model Year(s) CHRYSLER TOWN AND COUNTRY 2008-2010 DODGE GRAND CARAVAN 2008-2010 DODGE JOURNEY 2009-2010 Details Manufacturer: Chrysler Group LLC SUMMARY: This defect can affect the safe operation of the airbag system. Until this recall is performed, customers should remove all items from their key rings, leaving only the ignition key.