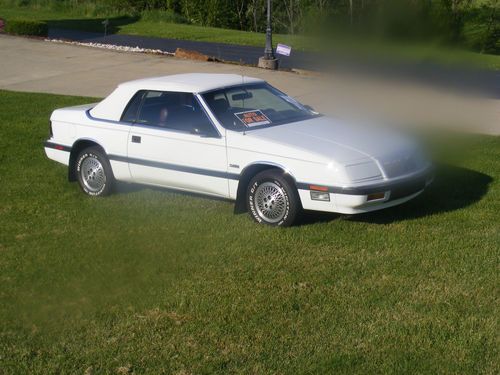

1988 Chrysler Turbo Convertible Excellent No Reserve 45000 Actual Miles on 2040-cars

Scottdale, Pennsylvania, United States

Vehicle Title:Clear

Engine:4CYL TURBO

Fuel Type:Gasoline

For Sale By:PRIVATE OWNER

Number of Cylinders: 4 TURBOCHARGED

Model: LeBaron

Trim: CONVERTIBLE

Options: Cassette Player, Leather Seats, CD Player, Convertible

Drive Type: FRONT

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 45,500

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: White

Interior Color: Red

CHRYSLER LEBARON CONVERTIBLE in excellent condition with only 45000 miles.just inspected till 5 -14 and with no problems total electronic dash, all power equipment like power windows, door locks, seat, mirrors, . tilt steering wheel, all leather interior. Has new top and window.Stored every winter no rust any where ORIGINAL PAINT AND INTERIOR NEVER WRECKED gets 24 mpg city 32 highway 45 000 MILES classic plates . excellent graduation present DIAL 724 244 3309 anytime THIS IS A GREAT CAR PROFESSIONALLY MAINTAINED MUST GO THIS WEEK !! 724-244 3309 ANYTIME $500.00 DEPOSIT IS REQUIRED WITHIN 24 HOURS BALANCE IN 5 DAYS i reserve the right to end this auction at any time vehicle is for sale locally thanks

Chrysler LeBaron for Sale

Chrysler: mark cross limited edition convertible

Chrysler: mark cross limited edition convertible 1989 chrysler lebaron 2dr convertible gt turbo 1-owner(US $4,900.00)

1989 chrysler lebaron 2dr convertible gt turbo 1-owner(US $4,900.00) We finance 94 lebaron lx conv soft top low miles cd stereo cruise a/c 68k 3.0l(US $3,800.00)

We finance 94 lebaron lx conv soft top low miles cd stereo cruise a/c 68k 3.0l(US $3,800.00) Absolutely stunning - rust free - original mileage - mint condition

Absolutely stunning - rust free - original mileage - mint condition 1994 lebaron convertible 49000 miles from new

1994 lebaron convertible 49000 miles from new 1984 chrysler lebaron woody convertible turbo, mark cross interior

1984 chrysler lebaron woody convertible turbo, mark cross interior

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

Young`s Auto Body Inc ★★★★★

Wilcox Garage ★★★★★

Tint-Pro 3M ★★★★★

Sutliff Chevrolet ★★★★★

Steve`s Auto Repair ★★★★★

Auto blog

Chrysler minivans spied in group test

Mon, Dec 14 2015The 2017 Chrysler Town & Country is just a few weeks from its debut at the 2016 Detroit Auto Show, and the company continues to evaluate its new minivan. A massive batch of spy shots now shows a whole fleet of them testing, along with the current model and competitors like the Honda Odyssey and Kia Sedona. Several of these examples drop the heavy cladding from earlier prototypes. Compared to today's model, the new Town & Country gets a major styling upgrade. These shots provide another glimpse at the updated front end with its narrow mesh grille and Chrysler 200-like headlights. The swirling camouflage along the side can't hide the more sculpted shape, including a character line that slices through the door handles. Three of the photos also provide a glance at the instrument panel, including the display between the gauges. In this case, it shows the tire pressures, and there's a digital speedometer on top. Rumors suggest at least two powertrains for the new Town & Country: an all-wheel drive plug-in hybrid version or one with a 3.2-liter V6. The van should also offer plenty of connectivity, with reports of USB ports for each row of seats and optional foot-activated side doors. Related Video:

Ferrari stock demand exceeding supply

Sun, Oct 18 2015As with the Ferrari cars, so it is with shares in the company's initial public offering: When Ferrari has a limited quantity of something to sell, demand far outstrips supply. Investors told banks weeks ago that bids for the $1 billion in stock – up to 18.89 million shares – would exceed the number of shares available over the entire expected range of $48 to $52. Ten percent of the company is going on the block' Bloomberg reports that the books close on the IPO on Monday at 4:00 pm. The final price will be set on Tuesday, and trading will begin Wednesday under the ticker symbol RACE on the New York Stock Exchange. Piero Ferrari, the son of Enzo Ferrari, will hold onto the ten-percent stake he currently has in the company. Fiat Chrysler will disburse the final 80 percent to its investors sometime in 2016. In combination with spinning Ferrari off from its parent company next year, the share sale is expected to put $4 billion into Fiat Chrysler coffers, which will be used to help fuel the growth of Alfa Romeo, Jeep, and Maserati. Assuming all goes to plan, Bloomberg says Ferrari will be valued at roughly $12 billion, a number $1 billion greater than the valuation Fiat Chrysler CEO Sergio Marchionne put on Ferrari earlier this year and higher than the brand's own internal assessment. Related Video:

Chrysler, Nissan looking into claim that their cars are industry's most hackable

Sun, 10 Aug 2014A pair of cyber security experts have awarded the ignominious title of most hackable vehicles on American roads to the 2014 Jeep Cherokee, 2014 Infiniti Q50 and 2015 Cadillac Escalade.

Charlie Miller and Chris Valasek are set to release a report at the Black Hat hacking conference in Las Vegas, Automotive News reports. The two men found the Jeep, Caddy and Q50 were easiest to hack based not on actual tests with the vehicles, but a detailed analysis of systems like Bluetooth and wireless internet access - basically, anything that'd allow a hacker to remotely gain access to the vehicle's systems.

Considering this lack of hands-on testing, the pair acknowledge that "most hackable" could be a relative term - they point out that the vehicles may actually be quite secure.