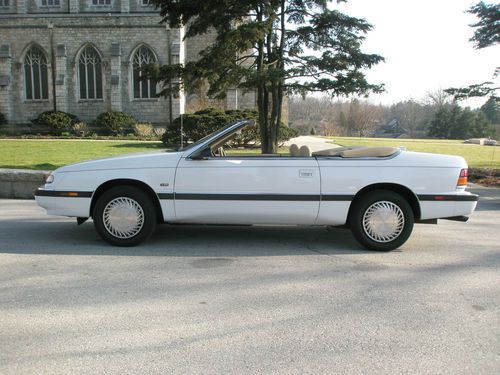

1988 Chrysler Lebaron Convertible - Ultimate Gtc Turbo - Two Owners - No Reserve on 2040-cars

Las Vegas, Nevada, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:3.0 V-6

Fuel Type:Gasoline

For Sale By:Private Seller

Number of Cylinders: 6

Make: Chrysler

Model: LeBaron

Trim: GTC TURBO

Options: Cassette Player, Leather Seats, CD Player, Convertible

Drive Type: FRONT WHEEL DRIVE

Safety Features: Driver Airbag

Mileage: 127,250

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Exterior Color: White

Interior Color: Blue

Chrysler LeBaron for Sale

Rare, don't miss this one!

Rare, don't miss this one! 1992 chrysler lebaron convertible,beautiful, original, excellent condition!

1992 chrysler lebaron convertible,beautiful, original, excellent condition! 1995 chrysler lebaron gtc convertible 2-door 3.0l

1995 chrysler lebaron gtc convertible 2-door 3.0l Amazingly well-maintained survivor car, loaded with all the options, rare(US $8,995.00)

Amazingly well-maintained survivor car, loaded with all the options, rare(US $8,995.00) 1993 chrysler le baron convertible 29,000 miles clean history excellent(US $5,995.00)

1993 chrysler le baron convertible 29,000 miles clean history excellent(US $5,995.00) 1988 chrysler lebaron candy apple red in color, 2 door, convertible

1988 chrysler lebaron candy apple red in color, 2 door, convertible

Auto Services in Nevada

Winners Circle Kustom Autobody ★★★★★

Wayne`s Automotive Center ★★★★★

Total Eclipse Window Tinting ★★★★★

Sudden Impact Auto Body and Collision Repair Specialists ★★★★★

Steel & Son Motors ★★★★★

Quick Auto Repair Service ★★★★★

Auto blog

Chrysler dealers terminated in bankruptcy still stuck in court

Mon, 14 Apr 2014Part of the deal for the federal bailouts of Chrysler and General Motors was that both organizations were required to trim their vast array of dealerships. This move did not sit well with the people that would be losing out on franchises, though, and in Chrysler's case, 148 of the shuttered dealers have fought for money they feel they are entitled to.

These dealers believe that they should be compensated by the federal government, as Chrysler wouldn't have trimmed its sales centers had it not been ordered to by Uncle Sam. Now, thanks to the ruling of three judges on the US Court of Appeals for the Federal Circuit, the dealers will get a chance to argue their point.

According to Automotive News, the dealers argue that the mandatory shuttering of dealers was unconstitutional, because the federal government was taking property without compensation. If the dealers are victorious, not only would the government be out millions of dollars, but a precedent could be set that would allow similarly closed GM dealerships to cash in.

Chrysler killing off the 200 Convertible, Dodge Avenger

Sun, 23 Feb 2014When Chrysler rolled out the first-generation 200 to replace the Sebring range in 2010, it included replacements for both the sedan and the convertible. The Sebring Coupe, however, was left out of the mix. And now that the second-generation Chrysler 200 is descending upon us, Auburn Hills is paring things down even further. But this time, it's the convertible that reportedly isn't making the cut. Shame, too, since the rendering above shows what could have been quite an attractive droptop.

As our compatriots at Edmunds point out, sales of the convertible model accounted for less than five percent of overall Chrysler 200 sales, and at those numbers, the considerable cost of engineering a new drop-top couldn't be justified. With the Toyota Camry Solara and Volkswagen Eos also gone from the market (well, the VW isn't gone quite yet), the discontinuation of the Chrysler 200 Convertible leaves the affordable convertible segment largely to the sportier likes of the Ford Mustang and Chevy Camaro and smaller European offerings like the Mini Cooper and VW Beetle.

The Chrysler 200 Convertible isn't the only derivative being left behind with the new model: so too is the Dodge Avenger. That will leave a glaring hole in the Dodge lineup, with nothing to bridge the gap between the compact Dart and the larger Charger. Whether the Dodge brand has any plans to replace the Avenger with another model, not to be based on the 200, remains to be seen.

CES 2022 was huge for EVs | Autoblog Podcast #711

Fri, Jan 7 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. CES took place this week, and there were some nice electric surprises from automakers, especially General Motors. John has been driving the Ram 1500 Power Wagon, as well as what seems to be its polar opposite, the electric Mini Cooper SE. Greg talks about the differences between the Acura TLX A-Spec long-termer (which is back in the shop) and the Type S loaner that's filling in for it. John's also got some interesting thoughts on leather interiors. Finally, the editors reach into the mailbag and help a repeat customer decide on a suitable replacement for a 2008 Lexus GX 470 in this week's Spend My Money segment. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #711 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown CES 2022 2024 Chevy Silverado EV revealed: 664 hp — and Midgate's back 2024 Chevy Silverado EV vs. 2022 Ford F-150 Lightning | How do they compare? Chevy Equinox EV and Blazer EV confirmed for production in 2023 Chrysler Airflow concept previews the brand's all-electric future Mercedes-Benz Vision EQXX shoots for 620-mile range Cadillac InnerSpace reimagines the personal luxury coupe What we're driving: 2022 Ram 1500 Power Wagon 2021 Acura TLX A-Spec and Type S long-termers 2022 Mini Cooper SE John's unpopular opinion: Let's do away with leather for good Spend My Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related Video: