1988 Chrsyler Lebaron Convertible on 2040-cars

Downers Grove, Illinois, United States

Vehicle Title:Clear

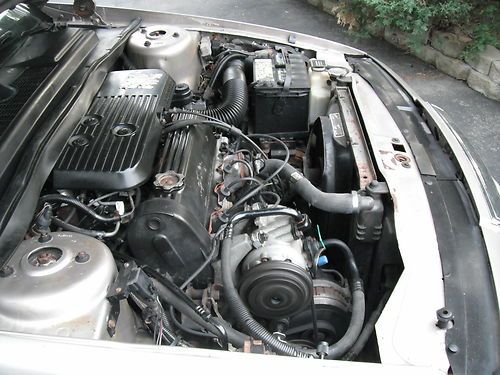

Engine:2.5 liter

Fuel Type:Gasoline

For Sale By:Private Seller

Transmission:Automatic

Make: Chrysler

Warranty: Vehicle does NOT have an existing warranty

Model: LeBaron

Trim: 2 door

Options: Leather Seats, CD Player, Convertible

Safety Features: Driver Airbag

Drive Type: front wheel drive

Power Options: Air Conditioning, Power Windows

Mileage: 108,000

Exterior Color: champagne

Interior Color: Brown

Disability Equipped: No

1988 Chrysler lebaron convertible one owner. 30 mpg . car has new engine new paint new top new exhaust new rack and pinion and new rear tires. all windows work as well as air conditioning. car has new battery and cd player. it is possible to deliver car depending on distance and cost. unfortunately the front windshield is cracked. happened putting new engine in. all lights and dash work fine.

Chrysler LeBaron for Sale

Chrysler lebaron town country woody turbo station wagon n/country squire

Chrysler lebaron town country woody turbo station wagon n/country squire 1995 chrysler lebaron gtc convertible 2-door 3.0l(US $1,500.00)

1995 chrysler lebaron gtc convertible 2-door 3.0l(US $1,500.00) 1983 chrysler lebaron woody convert,87,000 miles,like new cond.(US $12,000.00)

1983 chrysler lebaron woody convert,87,000 miles,like new cond.(US $12,000.00) 1995 chrysler lebaron gtc convertible v6 24k miles(US $6,300.00)

1995 chrysler lebaron gtc convertible v6 24k miles(US $6,300.00) Very clean 1979 chrysler lebaron(US $3,250.00)

Very clean 1979 chrysler lebaron(US $3,250.00) 1978 chrysler lebaron 97,000 original owner! beautiful car, excellent condition

1978 chrysler lebaron 97,000 original owner! beautiful car, excellent condition

Auto Services in Illinois

Wolf and Cermak Auto ★★★★★

Wheels Of Chicagoland ★★★★★

Urban Tanks Custom Vehicle Out ★★★★★

Towing Solutions ★★★★★

Top Coverage Ltd ★★★★★

Supreme Automotive & Trans ★★★★★

Auto blog

Chrysler stays IPO until 2014

Mon, 25 Nov 2013There will not be a Chrysler IPO in 2013. Fiat, according to a report from Forbes, has announced that it will not be able to make the American brand's initial public offering before the end of the year, saying that the short, five-week window that makes up the rest of 2013 is "not practicable."

Not surprisingly, the issue with the Chrysler IPO is the same as it's always been - a disagreement between parent company Fiat, which owns 58.5 percent of the Chrysler Group and a UAW healthcare trust, which owns 41.5 percent. Fiat wants to buy out the UAW VEBA healthcare trust, which is responsible for shouldering retiree healthcare costs, but the two sides are hung up on an actual price tag for the remaining two-fifths of the company.

The original idea saw an IPO as a way of setting a fair market price for the remaining shares, although it's not entirely clear what broke down and led to a delay of the IPO plan. As Forbes points out, by waiting until 2014, Chrysler could be risking a cool-off in the IPO market, which could mean less money in its pocket when the automaker finally goes public.

NYT profiles Blue Nelson, a reclusive and interesting CA car collector

Thu, 25 Sep 2014If it weren't for his Dale Earnhardt Sr. looks, Blue Nelson could be one one of those soft-spoken, nondescript guys whom you meet briefly and never learn much more about. However, as The New York Times shows in a recent profile and video, behind closed doors, Nelson keeps a fascinatingly eclectic collection of automotive oddities and vintage bicycles.

While his main career is in the movie industry, Nelson's other job is as a car hunter. He takes on clients searching for a specific model and helps them find and restore the dream vehicle that they're after. Hiring him takes some dedication, though, because Nelson doesn't advertise his services. "If people want to find me, they know how to find me," he says in the video.

Beyond being an automotive private detective, Nelson has a fantastically varied collection of vehicles of his own. He likes to have models that people don't usually see, and his garage holds a classic Chrysler New Yorker and an extremely rare Rometsch convertible. Although, the one that means the most to him is the 1962 Porsche 356 convertible that Blue came home in as a baby. Check out the video to learn more about Nelson and his philosophy about forming a bond with a car.

Weekly Recap: Chrysler forges ahead with new name, same mission

Sat, Dec 20 2014Chrysler is history. Sort of. The 89-year-old automaker was absorbed into the Fiat Chrysler Automobiles conglomerate that officially launched this fall, and now the local operations will no longer use the Chrysler Group name. Instead, it's FCA US LLC. Catchy, eh? Here's what it means: The sign outside Chrysler's Auburn Hills, MI, headquarters says FCA (which it already did) and obviously, all official documents use the new name, rather than Chrysler. That's about it. The executives, brands and location of the headquarters aren't changing. You'll still be able to buy a Chrysler 200. It's just made by FCA US LLC. This reinforces that FCA is one company going forward – the seventh largest automaker in the world – not a Fiat-Chrysler dual kingdom. While the move is symbolic, it is a conflicting moment for Detroiters, though nothing is really changing. Chrysler has been owned by someone else (Daimler, Cerberus) for the better part of two decades, but it still seemed like it was Chrysler in the traditional sense: A Big 3 automaker in Detroit. Now, it's clearly the US division of a multinational industrial empire; that's good thing for its future stability, but bittersweet nonetheless. Undoubtedly, it's an emotion that's also being felt at Fiat's Turin, Italy, headquarters as the company will no longer officially be called Fiat there. Digest that for a moment. What began in 1899 as the Societa Anonima Fabbrica Italiana di Automobili Torino – or FIAT – is now FCA Italy SpA. In a statement, FCA said the move "is intended to emphasize the fact that all group companies worldwide are part of a single organization." The new names are the latest changes orchestrated by CEO Sergio Marchionne, who continues to makeover FCA as an international automaker that has ties to its heritage – but isn't tied down by it. Everything from the planned spinoff of Ferrari, a new FCA headquarters in London and the pending demise of the Dodge Grand Caravan in 2016 has shown that the company is willing to move quickly, even if it's controversial. While renaming the United States and Italian divisions were the moves most likely to spur controversy, FCA said other regions across the globe will undergo similar name changes this year. Despite the mixed emotions, it's worth noting: The name of the merged company that oversees all of these far-flung units is Fiat Chrysler Automobiles. Obviously the Chrysler corporate name isn't completely history.