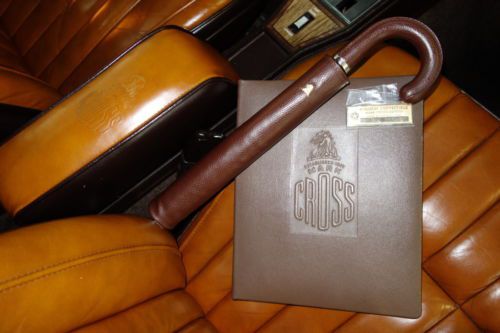

1984 Chrysler Lebaron Mark Cross Convertible 2-door 2.2l on 2040-cars

Dixon, Illinois, United States

|

1984 Chrysler Le Baron Convertible Drive Anywhere Turbo 2.2 Fuel Injected Automatic 77,000 Miles Updated AM/FM/CD and Four Speakers Front Seats need to be recovered and needs an A/C Compressor. The car has recently had new Brakes, Rotors, Front Struts, Tie Rod Ends and an alignment. Turbo works fine. Engine always maintained regular Mobil 1 oil changes. Clear Illinois title. Fly In Drive Home If your the winning bidder. Fly into Chicago Midway Airport and I'll pick you up and bring you to the car. |

Chrysler LeBaron for Sale

1994 gtc used 3l v6 12v fwd convertible

1994 gtc used 3l v6 12v fwd convertible Only 58k miles! super clean in & out! don't miss this cool lebaron convertible!!

Only 58k miles! super clean in & out! don't miss this cool lebaron convertible!! Collectors k car 1982 chrysler lebaron medallion mark cross edition convertible

Collectors k car 1982 chrysler lebaron medallion mark cross edition convertible 1988 chrysler lebaron base convertible 2-door 2.5l(US $2,000.00)

1988 chrysler lebaron base convertible 2-door 2.5l(US $2,000.00) Convertible classic 1994 chrysler lebaron gtc white on white 55,000 miles

Convertible classic 1994 chrysler lebaron gtc white on white 55,000 miles Beautiful 1988 le baron convertible - looks like almost new

Beautiful 1988 le baron convertible - looks like almost new

Auto Services in Illinois

X Way Auto Sales ★★★★★

Twins Auto Body Shop ★★★★★

Trevino`s Transmission & Auto ★★★★★

Thompson Auto Supply ★★★★★

Sigler`s Auto Ctr ★★★★★

Schob`s Auto Repair ★★★★★

Auto blog

FCA explains, updates sales reporting in wake of investigation

Tue, Jul 26 2016Fiat Chrysler Automobiles (FCA) is currently under investigation by the Department of Justice (DoJ) and Securities and Exchange Commission (SEC) for possible misappropriation of monthly sales. Not only that but a dealer group filed a lawsuit against the auto company for allegedly bribing dealers to falsify sales reports. In the wake of these mounting pressures, FCA released a report explaining their old sales reporting methods, as well as introducing the method they will use now. The report explains that sales will break down into three main categories. The first category is simply sales made by dealers in the United States that were purchased by your typical consumer. The second group is fleet sales that were purchased directly from FCA. The final group is a mix of various sales including sales by Puerto Rican dealers, cars used for marketing, and vehicles delivered to FCA employees and retirees. The original method of recording these sales relied mainly on the New Vehicle Delivery Report (NVDR). This system allowed dealers to report new car sales at the time of sale. These sales were used to create and report a total at the end of each month. Dealers also had the ability to "unwind" sales. What this means is that a dealer could cancel the sale of a car that was reported as sold in the event that a customer couldn't purchase the car or wanted a different vehicle. This would also return factory incentives to Chrysler and end the warranty period. Fleet and other sales were not recorded through this system, and were rather included in a separate "reserve" of vehicles. FCA explained that it did not know why this was the case, but the company speculated the reason may have been to avoid reporting vehicles that hadn't made it to road use yet. FCA also emphasized that their retail sales reports do not reflect quarterly earnings. The company explained that those earnings are based on vehicles purchased from FCA, which includes sales like the cars dealers buy for their local inventories. The new method also shows FCA's long run of sales increases wasn't as long as first thought. FCA has adopted a new system for calculating sales in light of concerns and confusion. This system retains the categories listed above, but changes how it counts them. The dealer reported numbers will now only include sold vehicles and will deduct sales of unwound vehicles that month.

Chrysler's Hurricane engine detailed ahead of 2016 launch

Fri, 20 Sep 2013We've been hearing distant rumblings about Chrysler's new Hurricane engine for some time now, but details have been hard to come by. Now, Automotive News is adding some specifics to the scuttlebutt, citing Chrysler documents. According to the industry publication, the Hurricane will blow onto the scene in 2016, but it's not an all-new engine. Rather, it will be rooted in the company's existing 2.0-liter four-cylinder Tigershark powerplant (shown above), albeit with "many new technologies to achieve excellent fuel economy."

It's not clear what sort of technologies Chrysler is referring to, but the Hurricane is expected to continue to use an aluminum block, and the finished product is expected to generate even better figures than the existing 2.0-liter's 160 horsepower and 148 pound-feet of torque (as found in the Dodge Dart). Automotive News notes that the updated 2.4-liter Tigershark debuting in the entry-level 2014 Jeep Cherokee has its basis in the 2.0-liter lump, but unlike the smaller engine, it's been fitted with MultiAir2 electrohydraulic variable valve timing to realize 184 hp and 171 lb-ft and greater efficiency.

Perhaps the Hurricane will incorporate the latter in its bag of tricks? Either way, we're hoping for a more generous torque curve than the what's in the current 2.0-liter Tigershark, which is something of a slug in the Dart - even for a base economy compact.

Ferrari officially files SEC paperwork to register future IPO

Thu, Jul 23 2015Late last year FCA announced plans to spin off Ferrari into a separate company, and after a long wait that process has finally become official. The Prancing Horse has now filed the necessary prospectus and other documents with the Securities and Exchange Commission to hold an initial public offering on The New York Stock Exchange. The paperwork doesn't mention a specific date for the Italian sportscar maker's IPO, but it's expected sometime in October. At this point, the documents also don't include some other vital data about the IPO. Ferrari lists neither the number of shares being offered nor their price. The company also doesn't have a stock symbol yet. UBS, BofA Merrill Lynch and Santander are acting as joint book runners for the deal. As part of the IPO, FCA initially intends to sell 10 percent of Ferrari's shares on the stock market. Another 10 percent of the company still belongs to Piero Ferrari. FCA is holding onto the remaining 80 percent in the short term for financial reasons but intends to distribute them to shareholders in early 2016. After the spin-off, about 24 percent of Ferrari would be owned by Exor, 10 percent by Piero Ferrari, and 66 percent by public shareholders, according to the SEC documents. FCA boss Sergio Marchionne believes that Ferrari could be worth over $11 billion. Although, his estimate might be slightly high. According to Reuters, Wall Street is actually putting the value somewhere between $5.5 billion and $11 billion. If you're thinking about investing in the company or just want to read the nitty-gritty about the brand's financial health, the entire SEC filing can be read here. Ferrari Files for Initial Public Offering LONDON, July 23, 2015 /PRNewswire/ -- Fiat Chrysler Automobiles N.V. ("FCA") announced today that its subsidiary, New Business Netherlands N.V. (to be renamed Ferrari N.V.), has filed a registration statement on Form F-1 with the U.S. Securities and Exchange Commission ("SEC") for a proposed initial public offering of common shares currently held by FCA. The number of common shares to be offered and the price range for the proposed offering have not yet been determined, although the proposed offering is not expected to exceed 10% of the outstanding common shares. In connection with the initial public offering, Ferrari intends to apply to list its common shares on the New York Stock Exchange.