1981 Chrysler Imperial 100% California Car Zero Rust. Runs Like New 74k Miles on 2040-cars

Oakley, California, United States

For Sale By:Private Seller

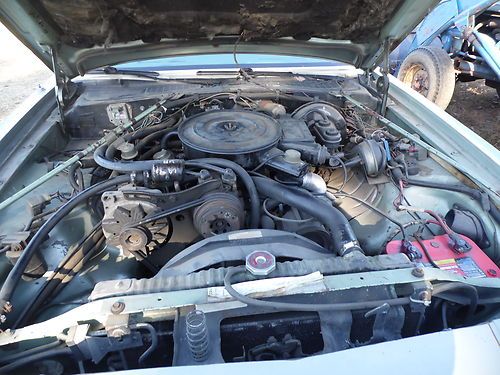

Engine:V-8 318 LA

Transmission:Automatic

Body Type:Hardtop

Vehicle Title:Clear

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Model: Imperial

Mileage: 74,000

Exterior Color: Jade Green

Year: 1981

Interior Color: Jade Green

Trim: Imperial

Number of Cylinders: 8

Drive Type: REAR

Disability Equipped: No

Warranty: Vehicle does NOT have an existing warranty

I am selling my elderly fathers 1981 Chrysler Imperial.

2 owner car.

Runs like new. Has 74k original miles on it. A/C blows cold.

Body is straight, stainless is excellent. ZERO rust this is an original and still lives in, California car.

It could use paint, but you can drive this CAR ANYWHERE. Buy it, fly out and drive it home.

Centerline wheels with excellent tires.

Plush jade interior.

All the electronics function perfectly in this vehicle.

The car does not run hot, miss, smoke or have any mechanical issues.

It is a 318 V-8 2 barrel car. It is not lean burn and unbelieveably it gets pretty decent fuel mileage at +/- 18mpg

Hope to see it go to a good home that will cruise it and maybe restore its original patina as it was a beauty when new.

The interior is in good shape with no damaged door panels, excellent color and a not too common plush pillow top jade green.

Chrysler Imperial for Sale

1962 chrysler imperial convertible

1962 chrysler imperial convertible 1962 chrysler imperial crown great collectors piece limited production

1962 chrysler imperial crown great collectors piece limited production 1993 chrysler imperial base sedan 4-door 3.8l

1993 chrysler imperial base sedan 4-door 3.8l 1952 chrysler imperial crown barn find hemi 331 project rare resto rat rod hot(US $10,900.00)

1952 chrysler imperial crown barn find hemi 331 project rare resto rat rod hot(US $10,900.00) 1974 chrysler imperial 440 727 hd dana 60 hemi mopar(US $1,250.00)

1974 chrysler imperial 440 727 hd dana 60 hemi mopar(US $1,250.00) 1968 chrysler imperial crown convertible - super rare mopar!!!

1968 chrysler imperial crown convertible - super rare mopar!!!

Auto Services in California

Zoe Design Inc ★★★★★

Zee`s Smog Test Only Station ★★★★★

World Class Collision Ctr ★★★★★

WOOPY`S Auto Parts ★★★★★

William Michael Automotive ★★★★★

Will Tiesiera Ford Inc ★★★★★

Auto blog

Chrysler 300 Glacier edition ready to chill with AWD

Sat, 19 Jan 2013It seems that word is finally out on the redone Chrysler 300, as evidenced by the fact that the model's sales almost doubled last year compared to 2011 (when the distinctive sedan was a little slow out of the gates). One thing that's likely helping the car is a growing number of unique models like the 300S, 300 SRT8 and the new 300C John Varvatos Luxury Edition, and now one more trim has joined the lineup. Initially announced back in September, the 300 Glacier is on sale now with a starting price of $36,845 (*not including a $995 destination charge).

Designed with cold-weather climates in mind, the 300 Glacier is only available with all-wheel drive. Chrysler says the Glacier will run an additional $1,500 over the 300S AWD off which this car is based, but that extra money gets unique 19-inch aluminum wheels, an exclusive Glacier Blue Pearl Coat paint job and special interior treatments including piano black accents and fancier leather seats and stitching. Like the 300S, power from the Pentastar V6 has been bumped up to an even 300 horsepower (up from 292 hp) with the aid of a cold-air induction and freer-breathing exhaust. Naturally, the 363-hp Hemi V8 is still available, too.

For more information, scroll down to check out Chrysler's official press release.

Former Treasury boss unaware auto task force fired GM's Wagoner

Wed, 14 May 2014We dig a good political tell-all every once in a while (how else will we get our political fix while waiting for House of Cards' third season?). Today, we get just that from former Treasury Secretary Timothy Geithner's new book, "Stress Test," which details, among other parts of the 2009 financial catastrophe, the structured bankruptcy that allowed Chrysler and General Motors to emerge as competitive players in the auto industry.

In the book, which is nicely recapped by The Detroit News, Geithner discusses the firing of GM CEO Rick Wagoner while explaining how much trust he had in the auto industry task force that executed the move without his knowledge.

Auto Czar Steve Rattner "didn't even consult me before he fired General Motors CEO Rick Wagoner; if anything, that move increased my confidence in Team Auto," Geithner wrote.

Fiat Chrysler and Renault are in advanced partnership talks

Sun, May 26 2019Fiat Chrysler Automobiles and Renault are in advanced discussions about a possible alliance, according to a report from the Financial Times citing an anonymous "person familiar with the matter." The news isn't particularly surprising, as FCA has been a constant subject of merger and alliance talks for as long as many of us can remember. We've reported on a potential tie-up between these two automakers several times, as far back as 2008 and as recently as two months ago. FCA CEO Mike Manley has mentioned the company's openness to merging with another automaker. At the Geneva Motor Show a few months back, he said, "We have a strong independent future, but if there is a partnership, a relationship or a merger which strengthens that future, I will look at that." It's no secret that FCA is much stronger in the United States than it is in Europe. For its part, Renault has basically zero presence in the United States. A partnership or potential alliance between the two could shore up each automaker's weak spots and allow the group to split investment money into new technologies, including electric vehicles and autonomy. Of course, Renault is already tied up with Nissan and Mitsubishi, but that partnership has been a little tattered since the arrest of former Nissan and Renault CEO Carlos Ghosn on charges of financial misconduct in Japan. And in addition to Renault, FCA is understood to have discussed various partnership strategies with the PSA Peugeot Citroen group. What a final agreement – if there's any agreement at all – could look like between the two global automakers remains to be seen, and the report from Financial Times cautions that many different options for FCA and Renault are currently on the table. In other words, stay tuned.