1967 Chrysler Imperial Crown Coupe Near Mint on 2040-cars

Henderson, Nevada, United States

Body Type:Coupe

Vehicle Title:Clear

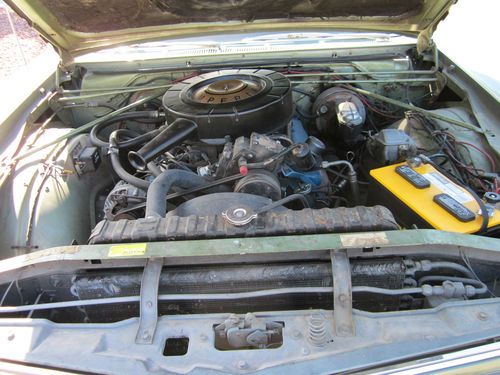

Engine:440

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chrysler

Model: Imperial

Warranty: Vehicle does NOT have an existing warranty

Trim: Crown Coupe

Options: CD Player

Drive Type: Rear Wheel Drive

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 113,000

Exterior Color: Haze Green

Interior Color: Black

Disability Equipped: No

Number of Cylinders: 8

Chrysler Imperial for Sale

1982 chrysler imperial frank sinatra edition 2-door 5.2l

1982 chrysler imperial frank sinatra edition 2-door 5.2l 1962 chrysler imperial lebaron 6.8l

1962 chrysler imperial lebaron 6.8l Style and grace chrysler imperial crown convertible(US $35,000.00)

Style and grace chrysler imperial crown convertible(US $35,000.00) 1968 chrysler imperial - the green hornet(US $24,399.00)

1968 chrysler imperial - the green hornet(US $24,399.00) 1969 imperial lebaron(US $8,999.00)

1969 imperial lebaron(US $8,999.00) 1951 chrysler imperial(US $1,500.00)

1951 chrysler imperial(US $1,500.00)

Auto Services in Nevada

Welge Automotive ★★★★★

Transmission Specialists ★★★★★

Scorpion Motorsports ★★★★★

Ramirez Windshields And Glass ★★★★★

Preferred Auto Care ★★★★★

Pick-n-Pull ★★★★★

Auto blog

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.

Detroit 3 and UAW set for showdown over tiered wages

Mon, Mar 23 2015This week, thousands of United Auto Workers will converge on Cobo Center in Detroit for the Special Convention on Collective Bargaining, an every-four-year event that lets members tell UAW leaders what the negotiating priorities should be during contract negotiations. This is where a lot of sand and a lot of lines start coming together in preparation for contract negotiations between the UAW and the Detroit 3 automakers, which will happen later this year. Number one on the UAW agenda is the end of the two-tier wage system created in 2007 to help the automakers get through bankruptcy; veteran workers are paid the Tier 1 rate of around $29.00 per hour, new hires are paid the Tier 2 rate of between $15 and $20 and get about half the benefits of Tier 1. Tier 2 hiring has been an undoubted success for the automakers, allowing them to keep factories in the US and hire more workers. By agreement, it is capped at a certain percentage of each automaker's workforce, and while the union's ultimate position is to get rid of the dual-scale system entirely; one leader said Ford could easily afford the $335 million it would take to convert all its workers to Tier 1 out of its $6.9 billion in 2014 North American profit, and General Motors could do the same out of the $5 billion it is handing to investors through the (admittedly forced) share buyback. Other delegates say that at the very least they'd be happy with enforcement of the current caps in the new contract. The automakers, conversely, would welcome expansion of the Tier 2 ranks. Including benefits, import automakers pay workers "in the high $40 range" per hour, according to an analyst, while Ford and GM pay about $59 in wages and benefits per hour. More Tier 2 workers on the rolls would let those two companies get labor cost parity with the competition. Fiat-Chrysler pays wages closer to the imports because of special exceptions in its UAW contract that allow unlimited Tier 2 hiring; those exceptions will end on September 14 and bring FCA into line with the other domestics, unless the new contract maintains them. FCA CEO Sergio Marchionne is opposed to the two-tier system, having called it "almost offensive." One analyst says the UAW might win a sizable pay raise for Tier 2 and a small increase for Tier 1, but the keystone issue will be how the hiring matrix can help the automakers keep overall wages in line with the imports.

Question of the Day: Most heinous act of badge engineering?

Wed, Dec 30 2015Badge engineering, in which one company slaps its emblems on another company's product and sells it, has a long history in the automotive industry. When Sears wanted to sell cars, a deal was made with Kaiser-Frazer and the Sears Allstate was born. Iranians wanted new cars in the 1960s, and the Rootes Group was happy to offer Hillman Hunters for sale as Iran Khodro Paykans. Sometimes, though, certain badge-engineered vehicles made sense only in the 26th hour of negotiations between companies. The Suzuki Equator, say, which was a puzzling rebadge job of the Nissan Frontier. How did that happen? My personal favorite what-the-heck-were-they-thinking example of badge engineering is the 1971-1973 Plymouth Cricket. Chrysler Europe, through its ownership of the Rootes Group, was able to ship over Hillman Avanger subcompacts for sale in the US market. This would have made sense... if Chrysler hadn't already been selling rebadged Mitsubishi Colt Galants (as Dodge Colts) and Simca 1100s as (Simca 1204s) in its American showrooms. Few bought the Cricket, despite its cheery ad campaign. So, what's the badge-engineered car you find most confounding? Chrysler Dodge Automakers Mitsubishi Nissan Suzuki Automotive History question of the day badge engineering question