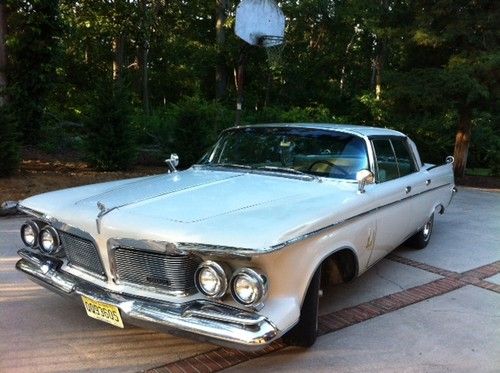

1962 Chrysler Imperial Crown Convertible on 2040-cars

Charlotte, North Carolina, United States

Body Type:Convertible

Vehicle Title:Clear

Engine:413 CID V-8; 340HP; Gas

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Chrysler

Model: Imperial

Trim: Chrome

Options: Leather Seats, Convertible

Power Options: Air Conditioning, Power Locks, Power Windows, Power Seats

Drive Type: Automatic

Mileage: 99,843

Exterior Color: Gold

Disability Equipped: No

Interior Color: Black Leather Seats

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: Eight

Chrysler Imperial for Sale

Auto Services in North Carolina

Wheel Works ★★★★★

Vintage & Modern European Service ★★★★★

Victory Lane Quick Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

University Ford North ★★★★★

University Auto Imports Inc ★★★★★

Auto blog

2013 Dodge Dart gets all Moparized

Fri, 08 Feb 2013Last year, Chrysler announced it would be offering more than 150 Mopar parts and accessories on the 2013 Dodge Dart, and we got a look at some of these parts firsthand at the Chicago Auto Show. Showing off all the optional parts at once would surely create a gaudy monstrosity, so Chrysler chose to equip this particular Dart GT with just a handful of Mopar goodies, which still gave the car a nice and tasteful custom look that is available straight from the dealership (and with a full warranty, too).

Decked out in a factory color called Header Orange Clear Coat - also a very appropriate show car hue - this car added exterior styling parts such as the vented, carbon fiber hood, the bolt-on front chin spoiler and a matte black decklid spoiler. Looking inside the car, you'd think the red-accented interior is part of the Mopar parts bin, too, but this is actually what the standard Dart GT cabin will look like when it goes on sale.

Chrysler Recalls 350K Vehicles To Fix Ignition Switches

Thu, Sep 25 2014Chrysler is recalling nearly 350,000 cars and SUVs to fix ignition switches that could unexpectedly shut off the engines. The recall covers 2008 Jeep Commander and Grand Cherokee SUVs, Chrysler 300 and Dodge Charger sedans, and Dodge Magnum wagons. All were built before May 12, 2008. Chrysler says the ignitions may not fully return to the "on" position after being started. The switches could move to "accessory" or "off." That could shut off the engine and knock out power-assisted steering and other features. Chrysler knows of one crash and no injuries from the problem. It's telling people to use the key alone in the ignition and confirm that switches have returned to "on" after starting their cars. Chrysler is investigating the cause. Customers will be notified when repairs are ready. Related Gallery The Trucks And SUVs Consumers Are Liking Most View 11 Photos

Chrysler taking big risk snubbing NHTSA

Wed, 05 Jun 2013Maker Insists Feds Overstate Risk Of Fires With Grand Cherokee, Liberty Models

It's not often that recall stories make it above the fold, in that old newspaper parlance, but when one shows up as the lead story on the network evening news programs, you know it's something big.

And so it is with Chrysler snubbing its nose at a request by the National Highway Traffic Safety Administration to recall 2.7 million Jeeps the feds insist are at risk of potentially catastrophic fuel tank fires in a rear-end collision.

1962 imperial crown 4 dr sedan great ride!!

1962 imperial crown 4 dr sedan great ride!! 1965 chrysler imperial crown 4 door

1965 chrysler imperial crown 4 door 1964 chrysler imperial base convertible no reserve

1964 chrysler imperial base convertible no reserve 1981 chrysler imperial frank sinatra edition

1981 chrysler imperial frank sinatra edition 2-owner / stunning restoration no reserve

2-owner / stunning restoration no reserve 1951 imperial club coupe--few built---rock solid----very rare

1951 imperial club coupe--few built---rock solid----very rare