Florida Low 47k Crossfire Roadster Limited Leather Navi Heated Super Nice! on 2040-cars

Pompano Beach, Florida, United States

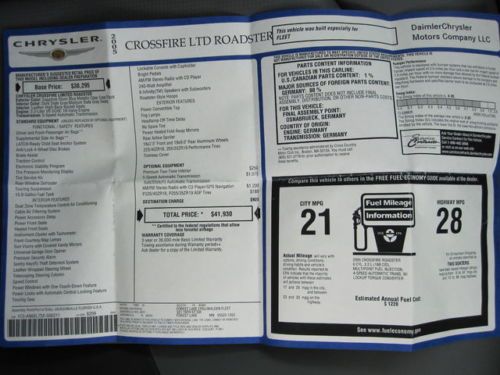

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Convertible

Fuel Type:GAS

Transmission:Automatic

Year: 2005

Warranty: Vehicle does NOT have an existing warranty

Make: Chrysler

Model: Crossfire

Options: Convertible

Trim: Limited Convertible 2-Door

Safety Features: Side Airbags

Power Options: Power Windows

Drive Type: RWD

Mileage: 47,233

Number of Doors: 2

Sub Model: LIMITED

Exterior Color: Silver

Number of Cylinders: 6

Interior Color: Gray

Chrysler Crossfire for Sale

2005 chrysler crossfire limited convertible 2-door 3.2l(US $11,750.00)

2005 chrysler crossfire limited convertible 2-door 3.2l(US $11,750.00) 2004 chrysler crossfire no reserve

2004 chrysler crossfire no reserve 2005 chrysler crossfire

2005 chrysler crossfire 2005 burgundy crossfire(US $10,000.00)

2005 burgundy crossfire(US $10,000.00) No reserve 2006 chrysler crossfire limited cpe 3.2l wrecked rebuildable salvage

No reserve 2006 chrysler crossfire limited cpe 3.2l wrecked rebuildable salvage 2005 chrysler crossfire coupe limited 6 speed manuual(US $9,995.00)

2005 chrysler crossfire coupe limited 6 speed manuual(US $9,995.00)

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

Autoblog Minute: New Civic, FCA UAW Agreement, Frankfurt

Fri, Sep 18 2015FCA reaches a tentative agreement with the UAW, Honda reveals the all-new 2016 Civic, and the Frankfurt Motor Show dazzles us again. Autoblog senior editor Greg Migliore reports on the Weekly Recap edition of Autoblog Minute. Show full video transcript text [00:00:00] FCA reaches a tentative agreement with the UAW, Honda reveals the all-new 2016 Civic, and the Frankfurt Motor Show dazzles us again. I'm senior editor Greg Migliore and this is your Autoblog Minute Weekly Recap. FCA reached a tentative labor agreement with UAW leadership. The major focus of the new deal reportedly includes: the eventual elimination of the two-tier pay scale [00:00:30] and pooling worker health care. Now that a leadership agreement is in place, the deal will be sent to FCA's rank-and-file. FCA has about 36,000 hourly employees. We got a first look at the interior and exterior of the 10th-generation Civic. Honda expects the new sedan to dominate the C-segment when it hits dealerships later this fall. Civic coupe, five-door hatchback, Si and Type R will all come later. The 2015 Frankfurt Motor Show is in the books and there was a lot of news to get excited about. [00:01:00] Porsche introduced a fully electric concept car in the Mission E. If they make this car, Porsche could give Tesla nightmares. We also saw SUVs from Jaguar and Bentley. There were two beautiful Italian convertibles from Ferrari and Lamborghini. Meanwhile, Mercedes introduced a concept of their own in the IAA - a vehicle that experiments with adaptable aerodynamics. Those are the highlights from the week that was. Be sure to check out my full recap this Saturday. Plus we'll have some added insight on General Motors' deal to [00:01:30] avoid federal prosecution. For Autoblog, I'm Greg Migliore. Autoblog Minute is a short-form video news series reporting on all things automotive. Each segment offers a quick and clear picture of what's happening in the automotive industry from the perspective of Autoblog's expert editorial staff, auto executives, and industry professionals. UAW/Unions Frankfurt Motor Show Bentley Chrysler Ferrari Honda Jaguar Lamborghini Mercedes-Benz Porsche Rolls-Royce Tesla Convertible SUV Concept Cars Electric Supercars Autoblog Minute Videos Original Video porsche mission e concept

Fiat Chrysler wins top Total Quality Award for first time

Mon, Jul 20 2015The Strategic Vision Total Quality Awards are 20 years old in 2015, and Chrysler has never topped the awards before. Until now, that is. Fiat Chrysler takes the overall award on the corporate level with six segment leaders from Fiat, Dodge, Jeep, and Ram. The Fiat 500 won Small Multi-Function Car, the 500e won Small Alternative Powertrain, the Dodge Challenger tied at the top in the Specialty Coupe category alongside the very un-coupe Mini Cooper Countryman, the Jeep Wrangler Unlimited took the Entry SUV category, the Dodge Durango won in Mid-Size SUV, and Ram took the overall in Best Non-Luxury Brand. The accolade means FCA has gone from one segment winner in 2010 to overall victory in five years. Cars have gotten so good, says Strategic Vision, that it is harder than ever to win. In fact, says the group, 18 years ago 85 percent of all vehicle brands had more than half a problem per vehicle. This year, no brand has more than half a problem per vehicle. The organization measures "over 155 specific aspects of the customer's experience," and scores are based on input from more than 46,000 customers. Other notables in and near the winner's circle include Volkswagen and General Motors, who tied for second place on the corporate scale, one point behind FCA. The Mini Cooper Roadster scored the highest of any model, the Corvette Stingray Convertible and Coupe scored the second- and third-highest. The Chevrolet Colorado is the first domestic Standard Pickup winner in more than ten years, and the Nissan Titan carried the Full-Size Pickup category. The press release below has all the details on how winners and losers are selected, and the full list of automakers and how they finished. "The Customer's 'Total' Experience Defines Quality, Fiat Chrysler Scores Highest in Total Quality," says Strategic Vision The 2015 Total Quality Awards« SAN DIEGO, Friday, July 17, 2015 ┬Ś Unknown to many, when some consumer research firms rank a car company's quality performance they often do so by simply "counting problems." In the past, this may have been acceptable, but in today's modern and efficient manufacturing world the difference between the worst brand and best brand is LESS than half-a-problem per vehicle. Thus, any "quality ranking" based on this method is severely lacking in the complete picture of the "Total" Quality experience that customers actually use to judge their product ownership.

Fiat Chrysler target 850k sales in China by 2018

Sun, 11 May 2014Behind the vanguard of numerous Jeep models, two Chryslers, a smattering of Fiats and Alfa Romeos and local production through a joint venture with Guangzhou Automotive Group (GAG), Fiat Chrysler wants to increase sales in China more than six-fold by 2018. The group sold 130,000 cars in China in 2013, the aim for 2018 being 850,000 cars.

Ultimately it's expected that the Jeep Grand Cherokee, Cherokee, Wrangler, Renegade, the coming Grand Wagoneer and a sub-Renegade-sized crossover will either be built in or exported to the People's Republic. The Chrysler Town & Country and 300 will join the export list in 2016 and 2018 respectively, according to a report in Automotive News.

With a number of those vehicles not in production or perhaps even envisaged yet, and others not due on the local market until 2018, it will be interesting to see how Fiat Chrysler plans to achieve the target in the specified timeframe. The joint venture with GAG builds two products now, the Dodge Dart-based Fiat Viaggio launched two years ago - supposedly designed just for China - and the just-launched Fiat Ottimo, a hatchback version of the Viaggio. Fiat projected 300,000 Viagio sales in its first two years, that number has been adjusted downward to 94,000 and there doesn't appear to be an analyst alive that sees a good future for Fiat in China's overrun mainstream market. Still, last year's 130,000 group sales in China is a huge jump from 2012 sales of 66,000 units, but less than half the 300,000 units it projected.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.318 s, 7896 u