Black,convertible,2door on 2040-cars

Wilmington, Delaware, United States

Chrysler Crossfire for Sale

2005 chrysler crossfire ~~~ srt-6 ~~~ low miles ~~~ best deal on ebay ~~~ look(US $8,990.00)

2005 chrysler crossfire ~~~ srt-6 ~~~ low miles ~~~ best deal on ebay ~~~ look(US $8,990.00) 2004 chrysler crossfire base coupe 2-door 3.2l(US $7,995.00)

2004 chrysler crossfire base coupe 2-door 3.2l(US $7,995.00) 2005 limited florida car 39k miles non smoker warranty

2005 limited florida car 39k miles non smoker warranty 2005 chrysler crossfire limited coupe 2-door black 3.2l v6 automatic(US $10,000.00)

2005 chrysler crossfire limited coupe 2-door black 3.2l v6 automatic(US $10,000.00) 2006 chrysler crossfire base coupe 2-door 3.2l(US $12,500.00)

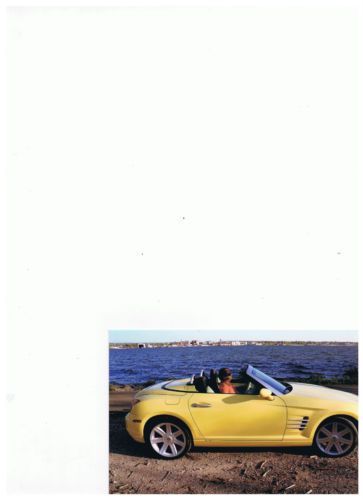

2006 chrysler crossfire base coupe 2-door 3.2l(US $12,500.00) 06 yellow convertable chrysler crossfire(US $23,000.00)

06 yellow convertable chrysler crossfire(US $23,000.00)

Auto Services in Delaware

Young`s Auto Body Inc ★★★★★

Scheidly Automotive ★★★★★

Powder Craft Inc. ★★★★★

Planet Honda ★★★★★

Dave`s Auto Service ★★★★★

Carney`s Auto Ctr & Repair ★★★★★

Auto blog

Fiat-Chrysler CEO: Please Don't Buy The Fiat 500e

Wed, May 21 2014Fiat-Chrysler's CEO had a strange request for electric vehicle shoppers on Wednesday: don't buy the all-electric Fiat 500e. While CEO Sergio Marchionne was speaking at a conference in Washington, he told the crowd he's tired of Chrysler-Fiat losing money, The Detroit News reported. "I hope you don't buy it [the 500e] because every time I sell one it costs me $14,000," he said to the audience at the Brookings Institution. "I'm honest enough to tell you that." Marchionne said federal and state fuel efficiency mandates are forcing the automaker to build unprofitable cars, according to Reuters. A normal Fiat 500 starts at $16,195, and the 500e starts at $32,650, before federal and state tax credits. There are no sales data to indicate how the 500e is performing. Related Gallery The Best Hybrids For The Money View 12 Photos Green Chrysler Fiat Car Buying Electric fiat 500e

2017 Chevy Camaro Z/28 Nurburgring crash caught on video

Thu, May 12 2016A 2017 Chevy Camaro Z/28 prototype crashed Thursday morning during testing on the Nurburgring in Germany. The driver appears to be unharmed, and the Camaro was not severely damaged. You can see the crash happen near the 1:35 mark of the video. Everything is going fine as the camo-clad Camaro accelerates onto the 'Ring. But as the driver goes through a turn the back wheels lock up. The driver then nails the brakes, the front wheels lock up, and he careens into the rail, getting airborne in the process briefly. The driver then navigates the Camaro to the other side of the circuit. A crumpled front fender and maimed aero is the only damage. View 11 Photos Mishap aside, this is an excellent look at what we believe is the track-focused Camaro Z/28. We see the huge wing in back and smaller winglets in front reminiscent of the Corvette Z06's Z07 Performance Pack. The new Z/28 has a throaty, almost buzzy V8 sound. We predict the seven-speed manual transmission from the Corvette, and perhaps the new 10-speed automatic trans from the Camaro ZL1, will be available. This prototype has a huge, gaping grille, blacked out wheels, and an aggressive front splitter. Look for the Z/28 to go on sale next year. A General Motors spokesperson said the company doesn't comment on development testing, but noted that "safety is our overriding priority." Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. Image Credit: Brian Williams / SpiedBilde Spy Photos Chrysler Coupe Performance Videos viral video chevy camaro z28

Conan releases extended cut of Chrysler's Super Bowl ad

Tue, 04 Feb 2014Chrysler's latest Super Bowl ad follows in the footsteps of its classic Imported From Detroit spot starring rapper Eminem and Half-Time in America ad starring Clint Eastwood. Featuring Bob Dylan's gravely voice asking, "Is there anything more American... than America?" the spot has been somewhat controversial, thanks to a few lines informing viewers that Germany can brew beer, Switzerland can make watches and Asia can assemble phones. The US, though, will build your car, Dylan tells us. When the ad aired, Shinola-wearing Detroiters simultaneously spit out their Atwater beer over the perceived slight.

Naturally, that controversy has spawned more than a few parodies, one of which comes from Conan O'Brien. Coco expands on the list of things that aren't made in the US, like French water, Danish cheese and Japanese animated, um, adult films. Beyond those examples, there are a number of other things that should be left to countries that aren't the United States. It's a chuckle-worthy parody, so scroll down and have a look, and compare it to the original Super Bowl ad below that.