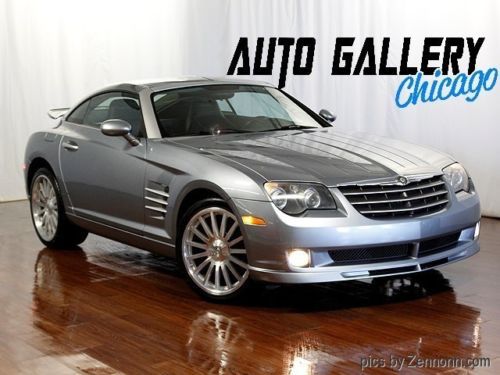

2005 Chrysler Crossfire Roadster Limited Convertible Bluetooth Usb Cd 5-speed on 2040-cars

Fort Myers Beach, Florida, United States

Chrysler Crossfire for Sale

05 blaze red 3.2l v6 autostick convertible *alloy wheels *low miles *florida

05 blaze red 3.2l v6 autostick convertible *alloy wheels *low miles *florida 330 hp srt-6,(US $11,990.00)

330 hp srt-6,(US $11,990.00) 2005 chrysler crossfire srt-6 convertible 2-door 3.2l(US $19,250.00)

2005 chrysler crossfire srt-6 convertible 2-door 3.2l(US $19,250.00) 2005 chrysler crossfire base convertible 2-door 3.2l(US $11,500.00)

2005 chrysler crossfire base convertible 2-door 3.2l(US $11,500.00) 2004 chrysler crossfires,white, estate sale ,clean title.

2004 chrysler crossfires,white, estate sale ,clean title. 2004 chrysler crossfire ltd. only 9,500 miles(US $12,500.00)

2004 chrysler crossfire ltd. only 9,500 miles(US $12,500.00)

Auto Services in Florida

Zacco`s Import car services ★★★★★

Y & F Auto Repair Specialists ★★★★★

Xtreme Auto Upholstery ★★★★★

X-Treme Auto Collision Inc ★★★★★

Velocity Window Tinting ★★★★★

Value Tire & Alignment ★★★★★

Auto blog

Ram helps power Chrysler to 11% gain in May

Mon, 03 Jun 2013Increasing consumer demand for Ram pickup trucks and big SUVs has helped to boost May sales for Chrysler. Ram sales were up a total of 24 percent year-over-year for the month of May. In addition, Dodge sales increased by 23 percent in May, with the standout Durango clocking a 24-percent year-over-year improvement (with an updated 2014 model in the wings, incentives are thick on the ground for 2013 inventory). Fiat and Jeep were up only a modest one percent, however, and Chrysler brand sales were down by two percent against last year's figures.

Chrysler is quite pleased overall with brand performance, saying that this May marks the company's strongest in the past six years. It was also the 38th consecutive month showing year-over-year sales gains.

Eight of the automaker's vehicles set sales records for May, as well: Jeep Wrangler and Compass, Dodge Avenger and Challenger, Fiat 500, Chrysler 200 and Ram pickups. Scroll down to read more detail in Chrysler's press release.

Germany threatens to ban FCA vehicles over diesel emissions dispute

Tue, May 24 2016Germany is threatening to ban sales of FCA products over diesel emissions. According to the newspaper Bild Am Sonntag, Germany's Federal Motor Transport Authority found evidence of a so-called defeat device that shuts down certain emissions controls after running for 22 minutes. A standard diesel emissions test in the European Union reportedly takes 20 minutes to complete. FCA denies the allegations. "We believe all our vehicles respect EU emissions standards and we believe Italian regulators are the competent authority to evaluate this," the company said in a statement. The latter part of that statement drew ire from German authorities, especially after FCA declined to meet with German transport minister Alexander Dobrindt to discuss the issue. Graziano Delrio, the Italian Minister of Infrastructure and Transport, vowed to work with German authorities on behalf of FCA. According to EU law, FCA is required to homologate its vehicles in Italy because that's where its regional operations are based. When will the diesel-scented soap opera end? We wish we knew, but our Magic 8 Ball is covered in soot. Related Video: News Source: Financial TimesImage Credit: Giuseppe Aresu/Bloomberg via Getty Government/Legal Green Chrysler Dodge Fiat Jeep RAM Emissions Diesel Vehicles FCA

UAW urging Chrysler to sell shares to investors

Thu, 10 Jan 2013The United Auto Workers union is pushing Chrysler to sell 16.6 percent of its stock to investors in an attempt to establish the value of the shares. The UAW is currently locked in a lawsuit with Chrysler parent company Fiat over how much the Italian automaker should pay to buy shares from the trust fund. Last year, Fiat told the trust it intended to exercise its right to purchase 3.3 percent of the union's shares at issue. But the union contended the 54,154 shares were worth closer to $381 million instead of the $155 million Fiat offered.

Currently, the UAW owns 41.5 percent of Chrysler while Fiat holds 58.5 percent of the company. Currently, it's unclear whether the UAW could force Chrysler to put the shares on the open market. Doing so would be the first step toward a much-anticipated initial public offering. Chrysler has said it will comply with its shareholders agreement, and Fiat has echoed that tune. According to The Detroit Free Press, the UAW Retiree Medical Benefits Trust has declined to comment on the situation.