2005 Chrysler Crossfire Limited Convertible 37k Miles Call.text (716)512-8650 on 2040-cars

Buffalo, New York, United States

Engine:3.2L 3200CC 195Cu. In. V6 GAS SOHC Naturally Aspirated

Vehicle Title:Clear

Body Type:Convertible

Fuel Type:GAS

For Sale By:Dealer

Mileage: 37,146

Make: Chrysler

Exterior Color: Yellow

Model: Crossfire

Interior Color: Tan

Trim: Limited Convertible 2-Door

Warranty: Vehicle has an existing warranty

Drive Type: RWD

Number of Cylinders: 6

Options: Leather Seats, Convertible

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Disability Equipped: No

Number of Doors: 2

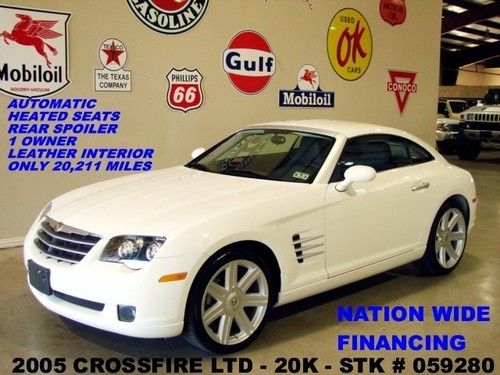

2005 Chrysler Crossfire Limited

Rare Yellow with Bisque Leather

Dual Power Heated Seats

Power Top

Ice Cold Air

Premium sound

37,000 Original Miles

Nicest One in the Country

Must Sell Today

Will Consider Buy It Now Offers

Text Scott Dubinsky (716)512-8650

Chrysler Crossfire for Sale

2005 chrysler crossfire(US $9,950.00)

2005 chrysler crossfire(US $9,950.00) 2005 crossfire limited rwd,automatic,heated leather,18 & 19 whls,20k,we finance!(US $14,900.00)

2005 crossfire limited rwd,automatic,heated leather,18 & 19 whls,20k,we finance!(US $14,900.00) 2008 chrysler crossfire limited coupe 2-door 3.2l

2008 chrysler crossfire limited coupe 2-door 3.2l 2005 chrysler crossfire(US $9,995.00)

2005 chrysler crossfire(US $9,995.00) 2005 limited 3.2l auto blue(US $9,495.00)

2005 limited 3.2l auto blue(US $9,495.00) '05 chrysler crossfire ltd roadster, black w/gray, 6 speed manual, 37,813 miles!(US $15,900.00)

'05 chrysler crossfire ltd roadster, black w/gray, 6 speed manual, 37,813 miles!(US $15,900.00)

Auto Services in New York

Walton Service Ctr ★★★★★

Vitali Auto Exchange ★★★★★

Vision Hyundai of Canandaigua ★★★★★

Tony B`s Tire & Automotive Svc ★★★★★

Steve`s Complete Auto Repair ★★★★★

Steve`s Auto & Truck Repair ★★★★★

Auto blog

Chrysler investing $20M in Toledo plant to support 9-speed auto production

Sun, 28 Apr 2013In 2011, Chrysler announced a $72-million investment in its Toledo Machining Plant to modernize production of the eight- and nine-speed torque-converters for automatic transmissions made there. That upgrade work won't be finished until Q3 of this year, but Chrysler has already announced a further $19.6-million investment to increase production capacity for the nine-speeders.

The extra units will be necessary because the nine-speed transmission they'll be mated to is going into three popular models: it will debut on the 2014 Jeep Cherokee, then go into the Chrysler 200 and Dodge Dart. The company predicted that this year alone it would sell 200,000 units equipped with the nine-speed tranny, and it is spending some $374 million in addition to the investment in Toledo to upgrade production capacity for it.

The work attached to this new investment won't begin until Q3 of 2014, and it will be finished by the end of that year. There's a press release below with all the details.

2014 Chrysler 300S gets all black and blue

Fri, 15 Nov 2013Outside of the SRT variant, if you want the sharpest-looking Chrysler 300, you'll probably want the 300S trim. This showy variant has traditionally sported larger wheels and some subtle body changes to set it apart from the herd, along with its own unique take on the big sedan's interior.

For 2014, the S will be set apart even further. A number of exterior items will be blacked-out, including black chrome around the grille and Chrysler badges finished in a liquid-chrome finish with a black center. Black moldings are standard, while owners can get an extra dose of style by opting to have the roof painted Gloss Black. Hyper Black 20-inch wheels are standard on the rear-drive model, while 19s are fitted to the all-wheel-drive variant. Smoked tail and headlights round out the package.

The cabin, meanwhile, gets a new trim option - Ambassador Blue. The pale, blue Nappa leather features contrasting, silver French stitching found on the seats and the door armrests.

Fiat Chrysler posts $690M Q1 loss

Mon, 12 May 2014If there is one thing that should be remembered when looking at quarterly and annual earnings, it's that the headline numbers rarely tell the whole story when it comes to an automaker's health. Chrysler's first-quarter earnings are just such an example.

Yes, the Auburn Hills-based manufacturer lost $690 million, which is quite a large sum of money. The reasons for the loss, according to Chrysler, were "Unfavorable infrequent items," which includes a $504 million payment to rid itself of the debts it took on for prepaying the UAW's VEBA healthcare trust. Chrysler was also hit with a $672 million charge to the UAW, which was part of a deal that allowed Fiat to purchase the remaining shares of Chrysler owned by the VEBA.

Ignoring those one-time deals, the first quarter was quite a successful one for Chrysler. It would have made $486 million if you erased the merger costs, which would have been a year-over-year increase of $320 million. Even more promising is the fact that Chrysler snagged the largest increase in market share of any automaker during Q1 at 1.1 percent, bringing its overall share to 12.7 percent of the US market. Chrysler saw a 30-percent improvement in sales of trucks and SUVs, along with an 11-percent increase in year-over-year sales and a 23-percent increase in revenue, to $19 billion.