2005 Chrysler Crossfire Limited on 2040-cars

Arnold, Missouri, United States

Transmission:Manual

Fuel Type:Gasoline

For Sale By:Private Seller

Vehicle Title:Clean

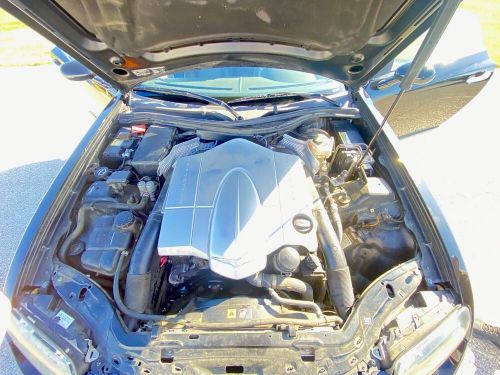

Engine:3.2L Gas V6

VIN (Vehicle Identification Number): 1C3AN65L95X040026

Mileage: 50000

Trim: LIMITED

Number of Cylinders: 6

Make: Chrysler

Drive Type: RWD

Model: Crossfire

Exterior Color: Black

Chrysler Crossfire for Sale

2005 chrysler crossfire limited 2dr roadster(US $19,500.00)

2005 chrysler crossfire limited 2dr roadster(US $19,500.00) 2005 chrysler crossfire leather two tone(US $12,000.00)

2005 chrysler crossfire leather two tone(US $12,000.00) 2004 chrysler crossfire(US $8,900.00)

2004 chrysler crossfire(US $8,900.00) 2007 chrysler crossfire roadster 6spd manual(US $19,995.00)

2007 chrysler crossfire roadster 6spd manual(US $19,995.00) 2005 chrysler crossfire limited(US $8,900.00)

2005 chrysler crossfire limited(US $8,900.00) 2005 chrysler crossfire(US $9,000.00)

2005 chrysler crossfire(US $9,000.00)

Auto Services in Missouri

Wright Automotive ★★★★★

Wilson auto repair & 24-HR towing ★★★★★

Waggoner Motor Co ★★★★★

Vanzandt?ˆ™s Auto Repair ★★★★★

Valvoline Instant Oil Change ★★★★★

Todd`s & Mark`s Auto Repair ★★★★★

Auto blog

Stellantis says its 2021 performance has been better than expected

Thu, Jul 8 2021MILAN — Stellantis softened up investors ahead of its electrification strategy event on Thursday by flagging that 2021 got off to a better-than-expected start despite a chip shortage that has hit automakers worldwide. Stellantis, which was formed in January from the merger of Italian-American automaker Fiat Chrysler and France's PSA, faces an investor community keen to hear how it plans to come up with a range of electrified vehicles (EVs) to rival Tesla. At its "EV Day 2021" kicking off at 1230 GMT, Stellantis will disclose significant investments in electrification technology and connected software as it aims to be an industry frontrunner, it said in a statement. In April, Chief Executive Carlos Tavares said it would offer low-emission versions — either battery or hybrid electric — of almost all of its European models by 2025, and they should make up 70% of European sales and 35% of U.S. sales by 2030. Stellantis, the world's fourth-biggest automaker, has 14 brands in its stable, including Jeep, Ram, Opel, Fiat, Peugeot and Maserati.  Stellantis EV Day coverage: Dodge will launch the 'world's first electric muscle car' in 2024 Fully electric Ram 1500 will begin production in 2024 Jeep will have 4xe plug-in hybrid models across the lineup by 2025 Stellantis teases mystery electric Chrysler concept Stellantis previews 4 electric platforms: Here's how they'll be used Fiat says all Abarth models to be electric from 2024 Opel Manta E will be the electric revival of the classic German coupe Stellantis says its 2021 performance has been better than expected  At a similar EV strategy event last week, French rival Renault announced that 90% of its main brand models would be all-electric by 2030, whereas previously it had included hybrids in its target. Germany's Volkswagen, the world's second-biggest automaker after Toyota, expects all-electric vehicles to make up 55% of its total sales in Europe by 2030, and more than 70% of sales at its Volkswagen brand. Stellantis said its margins on adjusted operating profits in the first half of 2021 were expected to exceed an annual target of between 5.5% and 7.5%, despite production losses due to a global shortage of semiconductor supplies. Stellantis shares listed in Milan were down 2.6% at 0920 GMT, underperforming the broader European car index. Bestinver analyst Marco Opipari said Thursday's news was positive but that the stock was suffering from profit taking as it had moved up about 20% since the end of April.

Chrysler purchases remaining shares from VEBA Trust, announces funding plan

Thu, 23 Jan 2014It's official: The Detroit Three is now The Detroit Two and The Fiat Subsidiary, Chrysler. Both the Italian carmaker and The Pentastar announced the completion of cash payments and a Memorandum of Understanding (MOU) on future payments necessary to make the Chrysler Group a wholly-owned subsidiary of Fiat. As previously detailed, Chrysler made a cash payment of $1.9 billion and Fiat North America made a cash payment of $1.75 billion to the Voluntary Employment Benefit Association (VEBA) run by the United Auto Workers union.

On top of that, Chrysler Group signed an MOU that agrees to payments of $700 million to the VEBA in four installments, the first of which was made concurrently with the other cash payments. And for you trivia mavens, the full name of the UAW is the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America. So go impress your loved ones with that nugget after you check out the press release below.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.