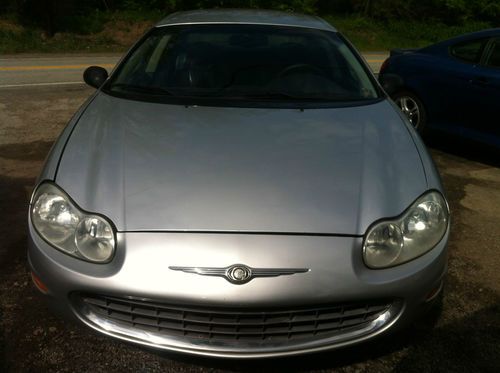

Lxi 3.5l Auto Headlight On/off Intermittent Wipers Leather Upholstery Fog Lamps on 2040-cars

Manchester, New Hampshire, United States

Vehicle Title:Clear

Engine:3.5L 3497CC 215Cu. In. V6 GAS SOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sedan

Fuel Type:GAS

Make: Chrysler

Warranty: Vehicle does NOT have an existing warranty

Model: Concorde

Trim: LXi Sedan 4-Door

Power Options: Air Conditioning

Drive Type: FWD

Number of Doors: 4

Mileage: 99,876

Sub Model: LXI

Number of Cylinders: 6

Exterior Color: Green

Interior Color: Gray

Chrysler Concorde for Sale

2004 silver chrysler concorde lxi sedan 4-door 3.5l great condition sc or va

2004 silver chrysler concorde lxi sedan 4-door 3.5l great condition sc or va 2001 chrysler concorde with no reserve

2001 chrysler concorde with no reserve 2004 chrysler concorde lx sedan 4-door 2.7l(US $3,995.00)

2004 chrysler concorde lx sedan 4-door 2.7l(US $3,995.00) 2001 chrysler concorde lxi sedan 4-door 3.2l **no reserve**

2001 chrysler concorde lxi sedan 4-door 3.2l **no reserve** 2002 chrysler concorde ! no reserve ! no resevre !

2002 chrysler concorde ! no reserve ! no resevre ! 2000 chrysler concorde lxi sedan 4-door 3.2l(US $1,600.00)

2000 chrysler concorde lxi sedan 4-door 3.2l(US $1,600.00)

Auto Services in New Hampshire

Tom`s Automotive ★★★★★

Superior Window Tint ★★★★★

O`Reilly Auto Parts ★★★★★

Northeast Detailing ★★★★★

Leblanc Auto Body Repair & Sales Corp ★★★★★

Kelley Street Garage ★★★★★

Auto blog

2017 Chrysler Pacifica isn't your parents' Town & Country [w/video]

Mon, Jan 11 2016I'm sick of people hating on minivans. There's something about two incredibly functional sliding doors that give people this idea that they've given up, and given in to family life. But if the van you see here had two fixed rear doors, and maybe an extra inch of ride height, it'd be gobbled up like mad as part of the growing crossover craze. So yes, the 2017 Chrysler Pacifica – that's right, Pacifica – is a minivan. But it's so packed full of features, technology, and functionality, that you really ought to look past those sliding doors. There promises to be an incredibly rewarding vehicle within. The 2017 Pacifica rides on an all-new platform, but dimensionally, it's similar to the outgoing Town & Country. That whole "ugh, minivans" thing is one of the reasons why Chrysler decided to axe the Town & Country name for 2017. Simply put, the target customers for the new minivan (young parents) would have grown up in their parents' Town & Country vans (or Caravans, or Voyagers...) in the 1980s. Three decades later, FCA wants to make it absolutely clear that this isn't just your parents' minivan. Why it chose to bring back the name of a lackluster part of its mid-2000s history, though, is anyone's guess. The 2017 Pacifica rides on an all-new platform, but dimensionally, it's similar to the outgoing Town & Country. It's a tenth of an inch shorter in length, about an inch wider, and roughly half an inch taller. The body itself looks great – influence from the 200 sedan is obvious up front, and around back in the taillights, and top-trim models can be had with 20-inch wheels – a big change from the old van, which topped out with 17-inch rolling stock. There's big weight-savings here, too – the Pacifica tips the scales at 4,330 pounds in base spec, which is over 300 pounds less than the Town & Country. Inside, it's more of the same from Chrysler. The interior design uses language brought up from the 200, and the different color and material choices look really rich, especially in Limited Premium trim. Of course, I'll wait to make final judgments on the cabin until I see it in base cloth spec, rife with kid fingerprints and french fries ground into the carpets. Up front, the Uconnect 8.4-inch touchscreen houses familiar infotainment functionality, and for backseat passengers, there's a new Uconnect Theater system, with a pair of 10-inch touchscreen displays.

2015 Chrysler 200 nets 10,000 orders in first day

Thu, 15 May 2014Chrysler is having a "crazy impressive" launch for its 2015 200, claims company spokesperson Rick Deneau. Within the first two days of opening the order books, the Pentastar took over 17,000 requests for its swoopy new family sedan - 10,000 of them in the first day. The company says that's enough to keep its Sterling Heights, MI, factory running at full capacity through mid-July.

Deneau tells Autoblog that the last time he saw such an immediate popularity for a model was when Ram launched its 1500 EcoDiesel pickup. That truck sold out of its initial order allocation in just three days earlier this year. As you'd expect, "most of these are dealer orders," Deneau admits. In other words, they're not necessarily coming at the behest of individual customer, but that's standard operating procedure as dealers look to fill up their showrooms.

For the moment, it's too early to know which trim or engine will prove most popular in the new 200. At present, most of the ordered models are highly optioned. That's normal for a new vehicle launch, as early adopters tend to want all the bells and whistles and dealers want to show off their new stock by putting their best foot forward.

1990 Chrysler Imperial is a forgettable American luxury sedan

Thu, Mar 17 2016MotorWeek's Retro Review series often lets us be nostalgic about vehicles from the '80s and '90s, but this time the show looks back on the 1990 Chrysler Imperial. With atrocious styling and middling performance, it might be better that we collectively forget about this luxury sedan. When this Imperial hit the scene, the BMW 7 Series and Mercedes-Benz S-Class were entrenched in the luxury sedan segment. Japanese automakers like Lexus and Infiniti were also making waves. The Chrysler just seems old fashioned compared to the rest, and its landau roof didn''t fit the competition's modern styling. MotorWeek also complains of poor craftsmanship and bad visibility out of the back. A 3.3-liter V6 with 147 horsepower doesn't provide much acceleration, either. Chrysler understood the demands of its aging customers for the Imperial. The sedan didn't offer anything class-leading, but there were a comfy seats and a floaty suspension to get drivers around town. In the modern world of luxury vehicles, which bristle with active safety tech and advanced infotainment system, the Imperial seems like a dinosaur. Watch Motorweek's clip to get a better understanding why there's not much nostalgia for this American sedan. Related Video: