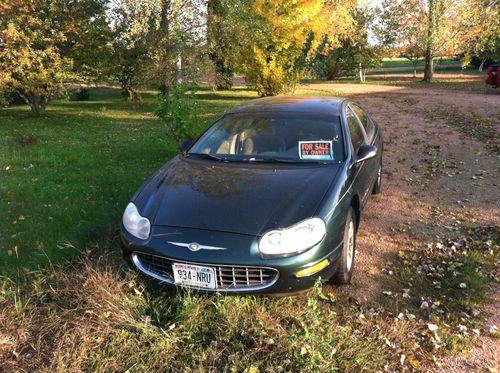

1996 Chrysler Concorde Lx Sedan 4-door 3.3l on 2040-cars

Wayne, New Jersey, United States

Body Type:Sedan

Vehicle Title:Clear

Engine:3.3 Liter

Fuel Type:GAS

For Sale By:Private Seller

Year: 1996

Make: Chrysler

Model: Concorde

Warranty: Vehicle does NOT have an existing warranty

Trim: LX

Options: Cassette Player

Drive Type: FWD

Safety Features: Driver Airbag

Mileage: 119,247

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Sub Model: LX

Exterior Color: Green

Interior Color: Tan

Disability Equipped: No

Number of Cylinders: 6

|

Here we have a 1996 Chrysler Concorde LX --- This car has approximately 119,247 miles on it currently. This car has only had 1 owner since it was bought new back in 1996. There are many scratches on the front and back bumper as well as on the trunk and other parts of the car. There is 1 ding in one of the doors and there's a dent in the trunk. The tires are 50,000 mile tires and there are only 15,000 miles on those tires currently. This car is Spruce Green in color though many times in the sunlight it appears to have a blue shade to it as well. Although the car has scratches, it still gives off a very nice shine as it has been well maintained over the years. The car rides very nicely and the interior of the car is in excellent condition. There is 1 thing wrong w/ the car. It has rusty brake lines which will need to be replaced. The car was just serviced at the mechanics about a week ago and everything else is up to date w/ it. Negotiations are welcome. Please message me with any questions. Local Pickup Only! |

Chrysler Concorde for Sale

2002 chrysler concorde lxi leather moonroof alpine ipod cd 3.2l v6(US $3,250.00)

2002 chrysler concorde lxi leather moonroof alpine ipod cd 3.2l v6(US $3,250.00) 1996 chrysler concorde lx sedan 4-door 3.3l(US $2,200.00)

1996 chrysler concorde lx sedan 4-door 3.3l(US $2,200.00) Concorde with only 75k miles - with free 15k 1 year warranty - videos descriptio(US $2,495.00)

Concorde with only 75k miles - with free 15k 1 year warranty - videos descriptio(US $2,495.00) 1998 chrysler concorde lx sedan 4-door 2.7l(US $1,500.00)

1998 chrysler concorde lx sedan 4-door 2.7l(US $1,500.00)

3.2l v6 lxi leather sunroof cd alloy wheels power seat dual air bags cruise

3.2l v6 lxi leather sunroof cd alloy wheels power seat dual air bags cruise

Auto Services in New Jersey

West Automotive & Tire ★★★★★

Tire World ★★★★★

Tech Automotive ★★★★★

Surf Auto Brokers ★★★★★

Star Loan Auto Center ★★★★★

Somers Point Body Shop ★★★★★

Auto blog

Mopar highlights wild SEMA creations, AWD Challenger Concept

Tue, Nov 3 2015Thanks to 15,345 square feet of display area, FCA US' Mopar division certainly has ample space to display its parts and accessories at the SEMA Show. To lure attendees to check out all of those cars and components, the company is now revealing ten tuned vehicles for this year's aftermarket event. This isn't even the brand's whole fleet for the show, but it includes some major highlights for Dodge and Ram fans. A lack of traction traditionally makes rear-wheel-drive muscle cars dismal to drive when the weather gets slippery, but the Dodge Challenger GT AWD Concept (above) solves that age-old problem at SEMA. In addition to powering all four wheels through an eight-speed automatic, it boasts an angry-looking, wide-body kit with aggressively flared wheel arches. The asymmetrical stripe with Header Orange accents also adds some extra panache to the Destroyer Grey and Matte Black color scheme. The coupe can back up the macho look thanks to the Scat Pack 3 Performance Kit that adds 75 horsepower and 44 pound-feet of torque to the 5.7-liter V8. However, before you get too excited about driving one this winter, FCA US spokesperson Ariel Gavilan tells Autoblog: "It is only a concept." Mopar isn't done tuning Dodges for SEMA. The Charger Deep Stage 3 shows what's possible with the company's catalog by packing the Scat Pack 3, strut tower braces, coilover suspension kit, and bigger brakes. Meanwhile, the blacked-out Dart GLH Concept tries to harken back to the style of the famous Omni GLH by fitting a red-accented body kit, including a Mopar Performance aluminum hood. If the standard Ram 1500 Rebel is somehow too subdued, check out the Rebel X (right) in a vibrant shade called Copper. To be ready for anything offroad, it wears some muscular flares to fit 17-inch beadlock wheels and 35-inch Toyo tires. A concept, two-piece front skid plate protects the front. Drivers should also be comfortable no matter where they drive thanks to prototype Katzkin leather seats and a concept air-ride suspension. Chrysler enjoys some mods, as well. The 300 Super S has suave style with Matte Cerulean paint, concept 22-inch wheels, and a grille with little Mopar Ms dotted around it. Performance also sees a boost with a tuned engine, bigger brakes, and coilover kit. The gray 200 S Mopar is similarly stylish with a complete body kit, including a conceptual, dual-vented hood. Fiat and Ram's commercial models aren't left out of the SEMA fun, either.

Chrysler 100 hatchback caught cruising around Santa Monica

Thu, 21 Feb 2013A coming hatchback said to be called the Chrysler 100 has been caught on video traipsing around Santa Monica by Autoblog reader Zach Dillman. Still wearing the scrapyard assemblage of Alfa Romeo Giulietta body panels as it was when spy photographers began capturing it last summer, its arrival date is still a question mark: some outlets have reported that it will go on sale this year, others have said it won't be in showrooms until 2016.

In fact, quite a few questions remain. Based on Fiat's Compact US Wide (CUSW) platform that supports the Dodge Dart and expected to be about the same size, the 100 is thought to be a small premium hatchback that will be priced above the Dart and below the Chrysler 200, with the idea that it can challenge the Ford Focus and Hyunda Elantra at the value end and the Buick Verano and Acura ILX at the premium end. Word is that there will be no sedan version.

It looks like there'll be plenty of gewgaws inside, with buttons for Adaptive Cruise Control, Lane Departure Warning, Forward Collision Warning and a button to toggle the traction control.

Feds fretting over remote hack of Jeep Cherokee

Fri, Jul 24 2015A cyber-security gap that allowed for the remote hacking of a Jeep Cherokee has federal officials concerned. An associate administrator with the National Highway Traffic Safety Administration said Thursday that news of the breach conducted by researchers Chris Valasek and Charlie Miller had "floated around the entire federal government." "The Homeland Security folks sent out broadcasts that, 'Here's an issue that needs to be addressed,'" said Nathaniel Beuse, an associate administrator with the National Highway Traffic Safety Administration. Valasek and Miller commandeered remote control of the Cherokee through a security flaw in the cellular connection to the car's Uconnect infotainment system. From his Pittsburgh home, Valasek manipulated critical safety inputs, such as transmission function, on Miller's Jeep as he drove along a highway near St. Louis, MO. The scope of the remote breach is believed to be the first of its kind. The prominent cyber-security researchers needed no prior access to the vehicle to perform the hack, and the scope of the remote breach is believed to be the first of its kind. A NHTSA spokesperson said the agency's cyber-security staff members are "putting their expertise to work assessing this threat and the response, and we will take action if we determine it's necessary to protect safety." A Homeland Security spokesperson referred questions about the hack to Chrysler. Fiat Chrysler Automobiles has already been the subject of a federal hearing this month, in which officials scrutinized whether the company had adequately fixed recalled vehicles and repeatedly failed to notify the government about defects. But cyber-security concerns are a new and different species for the regulatory agency. Only hours before the Jeep hack was announced by Wired magazine earlier this week, NHTSA administrator Dr. Mark Rosekind said hacking vulnerabilities were a threat to privacy, safety, and the public's trust with new connected and autonomous technologies that allow vehicles to communicate. NHTSA outlined its response to the cyber-security challenges facing the industry in a report issued Tuesday. In it, the agency summarized its best practices for thwarting attacks and said it will analyze possible real-time infiltration responses. But the agency's ability to handle hackers may only go so far.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.064 s, 7891 u