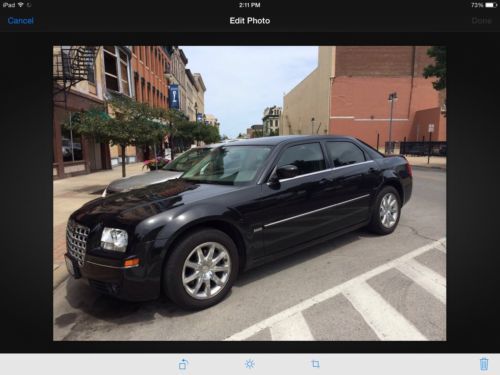

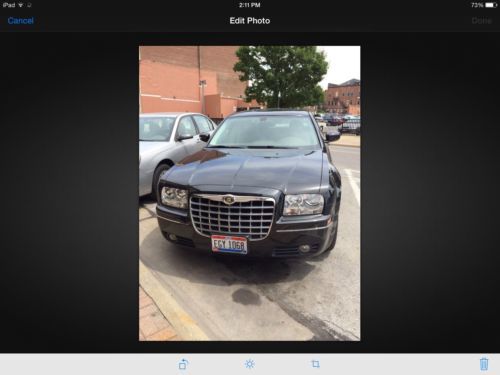

Chrysler 300c Touring Signature Series / Priced To Move!!! on 2040-cars

Sandusky, Ohio, United States

|

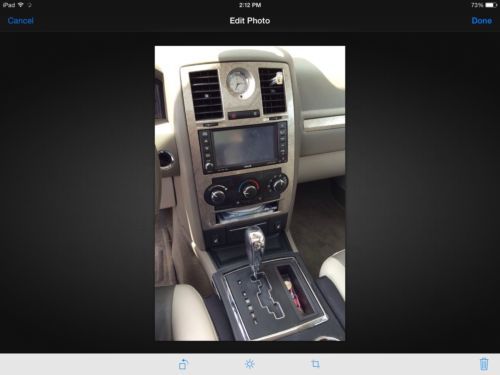

Great condition. Always garage kept. Touring signature series with all the options: leather, navigation, sun roof, alloy wheels, power everything, heated seats, and LOW MILES! Very sharp looking car, everything works, brakes and rubber are good, NON-SMOKER vehicle, and runs GREAT!

NEED TO MOVE / PRICED TO SELL!!! PLEASE CALL MARK @ 419-656-2482 OR EMAIL ME WITH QUESTIONS. MORE PICTURES AVAILABLE UPON REQUEST OR PLEASE COME SEE IN PERSON, NOTHING TO HIDE!! |

Chrysler 300 Series for Sale

Brand new srt8 6.4l v8(US $57,425.00)

Brand new srt8 6.4l v8(US $57,425.00) New-3ooc, john varvatos , 5.7l, awd, with local rebate.(US $50,900.00)

New-3ooc, john varvatos , 5.7l, awd, with local rebate.(US $50,900.00) 1964 chrysler 300 4 door hard top

1964 chrysler 300 4 door hard top Leather,woodgrain,blk,alloys,clean,mp3,aux,usb,factory warranty,low miles,ac(US $24,900.00)

Leather,woodgrain,blk,alloys,clean,mp3,aux,usb,factory warranty,low miles,ac(US $24,900.00) 300c 5.7l nav cd rear wheel drive power steering abs 4-wheel disc brakes(US $23,981.00)

300c 5.7l nav cd rear wheel drive power steering abs 4-wheel disc brakes(US $23,981.00) Mopar limited eddition 465 navigation heated cooled leather blind spot panoramic(US $32,887.00)

Mopar limited eddition 465 navigation heated cooled leather blind spot panoramic(US $32,887.00)

Auto Services in Ohio

Yonkers Auto Body ★★★★★

Western Reserve Battery Corp ★★★★★

Walt`s Auto Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

Valvoline Instant Oil Change ★★★★★

Tritex Corporation ★★★★★

Auto blog

May 2016: FCA wins, Ford and GM stumble on weak car volumes

Wed, Jun 1 2016The May 2016 sales numbers are in, and it looks as though FCA is getting some vindication for boldly cancelling two slow-selling car models. Meanwhile, Ford saw overall sales dip and GM's May volume took a big dive versus the same month in 2015. While Marchionne's decision to axe the Chrysler 200 and Dodge Dart has drawn criticism as being short-sighted, it's working for FCA so far. Although the Dart and 200 aren't out of production yet and no capacity has been shifted to crossover or trucks, May's numbers show that the emphasis on Jeep and Ram models makes sense right now. FCA's US sales rose 1 percent last month compared to May 2015, putting the year-to-date total at 955,186 vehicles, an increase of 6 percent compared to the same period last year. Standouts included the Jeep Renegade, Compass, and Patriot, and the Fiat 500X. Ram pickup sales were down 3 percent. And your fun fact is that Alfa Romeo sales were up precisely 10 percent, for a total of 44 4Cs sold versus 40 in the same month last year. At FoMoCo, the Ford brand took a hit to the tune of 6.4 percent from May 2015 to 2016, registering 226,190 sales last month. Lincoln showed improvement on its modest numbers, going from 9,174 to 9,807, a 6.9 percent increase. Overall, Ford was down 5.9 percent for the month to 235,997; despite the slump, year-to-date total Ford sales are up 4.2 percent to 1,112,939. Strong sellers included Escape, Expedition, F-Series, and Transit - big stuff. Most small and/or efficient models (Fiesta, Focus, Fusion, C-Max) saw sales slides. Fusion sales were also down, likely due to effects of model changeover to the freshened 2017 model. Ford has promised four new crossovers and SUVs by 2020 and if things keep trending this way the company will be able to sell them, but things could change in the next four years. GM saw the worst of it for domestic brands. Retail and fleet sales were down for each of the four divisions, with the May 2016 total dropping 18 percent to 240,450 vehicles. GM's year-to-date sales are down 5.0 percent in 2016 to 1,183,705. Both the Sierra and Silverado were down significantly, and the majority of Chevy, Buick, GMC, and Cadillac nameplates saw sales decreases, with both small cars and larger utilities included. Not even big stuff could help GM this month, it seems. We'll have more on the rest of the industry's May sales as those figures trickle in.

2015 Chrysler 300 swaggers into LA Auto Show [w/video]

Thu, Nov 20 2014The Chrysler 300 has always exuded a certain brashness, but the chip-on-its-shoulder styling seemed to mellow a bit after its 2011 redesign. Now, the bad boy of the premium sedan segment is getting some of its angry attitude back for 2015, and the refreshed model debuted here at the Los Angeles Auto Show. The grille is larger, the fascia is updated and the lights are redesigned. That doesn't seem like much, but when taken collectively, they give the car a more menacing glare. The inside is freshened with a new seven-inch in-cluster display, better-quality materials and an updated suite of available Uconnect features, and there's a bevy of new active safety features available, too. The engine line continues with the 3.6-liter V6 and the 5.7-liter V8, though they are now both paired with Chrysler's eight-speed automatic. The sedan also received a Sport mode button, which changes the tuning for the steering, engine and transmission, while providing a rear bias for all-wheel drive models. Pricing starts at $31,395, just as it did for the 2014 model. The lineup also gets a new Platinum model with special wood, chrome and leather finishings, though the company also has said it will discontinue the 300's high-performance SRT variant for in the United States. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. New 2015 Chrysler 300: Return of the Big, Bold American Sedan with World-class Levels of Sophistication, Craftsmanship and Technology, Once Again Putting Boulevards and Interstates On Notice The new 2015 Chrysler 300 highlights six decades of ambitious American ingenuity through iconic design proportions inspired by historic 1955 and 2005 models – world-class quality, materials and refinement, best-in-class V-6 highway fuel economy, plus segment-exclusive innovations – all at the same $31,395 starting price as its predecessor.

Maserati's new North American CEO is Chrysler's dealer guru

Wed, 13 Nov 2013There's been a bit of a shakeup among the executive ranks at Chrysler and Maserati, as the Italian sports car manufacturer has appointed Peter Grady as its new North American CEO. Grady, who we imagine is about to get a very nice upgrade to his company car, will retain his role as vice president of dealer network development for Chrysler and Chrysler Capital, and is replacing Bob Graczyk at Maserati.

"It is with pleasure and anticipation that I welcome Peter to Maserati. He brings to our company nearly 30 years of leadership and experience. His background and industry expertise will be a great basis for the continued expansion of Maserati in North America," said Maserati CEO Harald Wester in a statement.

Also joining the team at Maserati is Saad Chehab, who previously worked for the Chrysler and Lancia brands and will be the new head of marketing for the Italian brand. He'll be replaced by Al Gardner, the former boss of Chrysler's southeast business center, as the head of Chrysler brand, according to Automotive News.