2023 Chrysler 300 Series Touring on 2040-cars

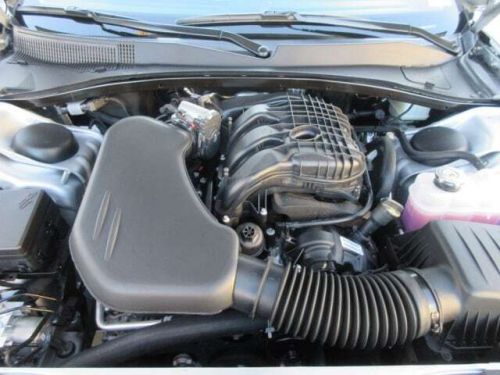

Engine:3.6L V6 24V VVT Engine

Fuel Type:Gasoline

Body Type:4dr Car

Transmission:8-Spd Auto 8HP50 Trans (Buy)

For Sale By:Dealer

VIN (Vehicle Identification Number): 2C3CCAAG6PH707555

Mileage: 14

Make: Chrysler

Trim: TOURING

Drive Type: Touring RWD

Features: BLACK, CLOTH BUCKET SEATS, ENGINE: 3.6L V6 24V VVT, QUICK ORDER PACKAGE 2EE, SAFETYTEC PLUS GROUP, SPORT APPEARANCE PACKAGE, TIRES: 245/45R20 BSW AS PERFORMANCE, TRANSMISSION: 8-SPEED AUTOMATIC 8HP50, WHEELS: 20" X 8.0" BLACK NOISE ALUMINUM

Power Options: --

Exterior Color: Silver

Interior Color: Black

Warranty: Unspecified

Model: 300 Series

Chrysler 300 Series for Sale

2023 chrysler 300 series touring(US $34,150.00)

2023 chrysler 300 series touring(US $34,150.00) 2019 chrysler 300 series 300 touring sedan 4d(US $15,498.00)

2019 chrysler 300 series 300 touring sedan 4d(US $15,498.00) 2023 chrysler 300 series touring(US $40,270.00)

2023 chrysler 300 series touring(US $40,270.00) 2020 chrysler 300 series s(US $25,775.00)

2020 chrysler 300 series s(US $25,775.00) 2006 300 series touring 4dr sedan(US $6,995.00)

2006 300 series touring 4dr sedan(US $6,995.00) 2022 chrysler 300 series touring(US $25,465.00)

2022 chrysler 300 series touring(US $25,465.00)

Auto blog

Fiat Chrysler and Peugeot boards meet to finalize merger

Tue, Dec 17 2019MILAN/PARIS — The boards of Fiat Chrysler Automobiles and Peugeot will meet separately on Tuesday to discuss finalizing an initial agreement for a $50 billion merger to create the world's number four carmaker, sources said. A source close to FCA said the two companies could announce the signing of a binding memorandum early on Wednesday, followed by a conference call to explain further details later in the day. The two mid-sized carmakers announced plans six weeks ago for a tie-up to help them deal with big challenges in the industry, including a global demand downturn and the need to develop costly cleaner cars to meet looming anti-pollution rules. Ahead of the meetings, entities representing the Peugeot family, Etablissements Peugeot Freres (EPF) and FFP, unanimously approved a proposed memorandum of understanding for the planned merger, a source familiar with the situation said. FCA and PSA have said they would seek to finalize a deal by year-end to create a group with 8.7 million in annual vehicle sales. That would put it fourth globally behind Volkswagen, Toyota and the Renault-Nissan alliance. PSA's Carlos Tavares will be chief executive and FCA's John Elkann — the scion of Italy's Agnelli family, which controls FCA through their holding company Exor — chairman of the combined company. The group will include the Fiat, Jeep, Dodge, Ram, Chrysler, Alfa Romeo, Maserati, Peugeot, DS, Opel and Vauxhall brands, allowing it to serve mass and premium passenger car markets as well as those for trucks and light commercial vehicles. Related Video:    Chrysler Dodge Fiat Jeep RAM Citroen Peugeot

Toledo continues fight for Jeep Wrangler production, despite mayor's death

Thu, Feb 19 2015Where will the next-generation Jeep Wrangler be built? That's an open question, but it's one that the city of Toledo, OH desperately wants to be the answer to. The city suffered a major blow, though, with the death of Mayor Michael Collins earlier this month. Collins had been the city's biggest champion during talks with Fiat Chrysler Automobiles, before suffering a fatal heart attack on Feb. 6. But Collins' tragic death isn't dampening the city's desire to carry on as the home of the Wrangler. "The mayor's passing is tragic. But on Monday, when I came to work, I knew exactly what I needed to do and exactly what needed to be done," the city's director of development, Matt Sapara, told the Detroit Free Press. According to the Freep, Sapara said Toledo and the state of Ohio have delivered an outline of a development plan that would give FCA the ability to buy an extra 100 acres to expand the factory. This is to help accommodate FCA's targeted output of 300,000 to 350,000 next-generation Wranglers, up from the 240,000 the factory can make now. "Our target in the proposal is to provide a way to increase the production capacity to a number that allows Fiat Chrysler to meet its business model," Sapara told the Freep, adding that the land could be available later this summer. FCA, meanwhile, has shown a somewhat ambivalent attitude towards Toledo production, with CEO Sergio Marchionne openly discussing the pros and cons of continuing to build the Wrangler south of the Michigan border. "We are going to take a very hard look at this without ignoring what these guys have done," Marchionne told the Free Press at last month's Detroit Auto Show, adding that he'd like to keep production there, provided the cost of retooling is comparable to relocating to another facility. Related Video:

Chrysler nets $1.6B income in Q4, Fiat profit up 5%

Wed, 29 Jan 2014Chrysler announced its 2013 financial results today and unveiled its new name and decidedly bank-like logo. Amid the announcement, Chrysler posted big gains in income, while Fiat didn't perform to analysts' expectations.

For 2013, Chrysler had revenue of $72.1 billion, up 10 percent from 2012. Net income reached $2.8 billion, a 65-percent increase. It was the company's third straight year of annual profits.

In terms of unit sales, Chrysler sold 2.4 million cars worldwide in 2013, up 9 percent. According to Automotive News, 1.8 million of those vehicles were sold in the US, a 14-percent increase. The sales growth boosted Chrysler's US market share to 11.4 percent, up 0.2 percent.