2014 Chrysler 300 Base on 2040-cars

500 Admiral Weinel Blvd, Columbia, Illinois, United States

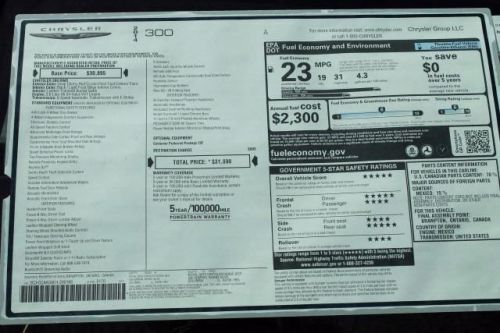

Engine:3.6L V6 24V MPFI DOHC

Transmission:8-Speed Automatic

VIN (Vehicle Identification Number): 2C3CCAAG9EH260166

Stock Num: C94015

Make: Chrysler

Model: 300 Base

Year: 2014

Exterior Color: Deep Cherry Red Crystal Pearlcoat

Interior Color: Light Frost

Options: Drive Type: RWD

Number of Doors: 4 Doors

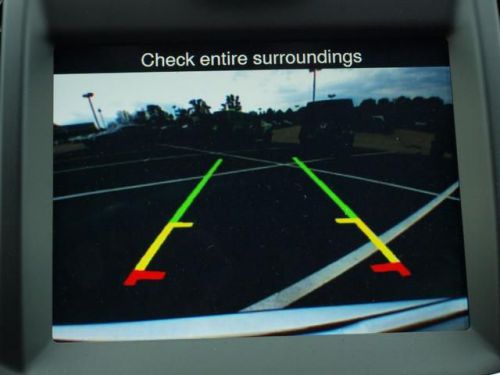

Discerning drivers will appreciate the 2014 Chrysler 300! Offering an alluring bundle of luxury while maintaining efficiency, safety and style! It includes leather upholstery, 1-touch window functionality, heated seats, and power windows. It features an automatic transmission, rear-wheel drive, and a refined 6 cylinder engine. We know that you have high expectations, and we enjoy the challenge of meeting and exceeding them! Stop by our dealership or give us a call for more information. "1ST FOR A REASON" On Price and Selection-No other dealer will beat Royal gate of Columbia on price. Give us a chance to save you some money on the car you want!

Chrysler 300 Series for Sale

2013 chrysler 300c varvatos collection(US $30,640.00)

2013 chrysler 300c varvatos collection(US $30,640.00) 2013 chrysler 300c varvatos collection(US $30,640.00)

2013 chrysler 300c varvatos collection(US $30,640.00) 2014 chrysler 300 base(US $28,652.00)

2014 chrysler 300 base(US $28,652.00) 2013 chrysler 300c varvatos collection(US $30,640.00)

2013 chrysler 300c varvatos collection(US $30,640.00) 2014 chrysler 300 base(US $28,309.00)

2014 chrysler 300 base(US $28,309.00) 2014 chrysler 300 base(US $33,943.00)

2014 chrysler 300 base(US $33,943.00)

Auto Services in Illinois

Vega Auto Repair ★★★★★

Ultimate Deals Vehicle Sales ★★★★★

Tredup`s Inc ★★★★★

Terry`s Service ★★★★★

Stan`s Repair Service ★★★★★

St Louis Dent Company ★★★★★

Auto blog

Chrysler defies NHTSA, says it won't recall 2.7M Jeep Grand Cherokee, Liberty models

Wed, 05 Jun 2013Facing a possible recall totaling around 2.7 million of its most popular SUVs, Chrysler remains insistent that the 1993-2004 Jeep Grand Cherokee and 2002-2007 Jeep Liberty are safe vehicles. This comes on the heels of a recall request from the National Highway Traffic Safety Administration for these two models due to fuel tanks mounted behind the rear axle, which could possibly be ruptured during severe rear-end collisions, leading to an increased risk of fire. In response to the allegations, Chrysler says that it does not agree with NHTSA nor does it plan on recalling either vehicle.

Chrysler said both SUVs "met and exceeded" the requirements for fuel-system integrity, and cooperated fully with NHTSA since the investigation was opened in 2010. While 15 deaths and 46 injuries have been reported from fires caused by rear-end collisions on these models, Chrysler is claiming that the vast majority of incidents cited by NHTSA were "high-energy crashes," including one where a stopped Grand Cherokee was rear-ended by a tractor trailer going 65 miles per hour.

The automaker wraps up by saying "NHTSA seems to be holding Chrysler Group to a new standard for fuel tank integrity that does not exist now and did not exist when the Jeep vehicles were manufactured." Scroll down for Chrysler's official response to NHTSA, but we're pretty sure this isn't the last we've heard on this issue.

Fiat Chrysler recalls 1.33 million vehicles over fire, air bag risks

Fri, Jul 14 2017WASHINGTON - Fiat Chrysler Automobiles NV said on Friday it is recalling 1.33 million vehicles worldwide in two separate campaigns for potential fire risks and inadvertent airbag deployments. The Italian-American automaker said it is recalling about 770,000 sport utility vehicles because of a wiring issue that may lead to inadvertent deployment of the driver-side air bag and is linked to reports of five related minor injuries, but no crashes. The company said wiring could chafe against pieces of steering-wheel trim, potentially causing a short-circuit and ultimately leading to an inadvertent air bag deployment. The issue could also cause unintended windshield wiper operation or inoperable switches. The recall covers 538,000 2011-2015 Dodge Journey vehicles in North America and 233,000 2011-2015 Fiat Freemont crossovers sold elsewhere. Dealers will inspect and replace the wiring, as needed and equip it with additional protective covering. The automaker is also recalling 565,000 vehicles to replace their alternators because of fire risks. The company said hot ambient temperatures could lead to premature diode wear, may result in a burning odor or smoke, could impact the anti-lock braking system or lead to engine stalls. The company said it is aware of two potentially related accidents but no injuries. The recall covers 2011-2014 model year Chrysler 300, Dodge Charger and Dodge Challenger cars and Dodge Durango SUVs and 2012-2014 Jeep Grand Cherokee SUVs. In October, Fiat Chrysler recalled about 86,000 Ram 2500 and 3500 pickup trucks, 3500, 4500 and 5500 chassis cabs from the 2007-2013 model years and 2011-2014 Dodge Charger Pursuit sedans for the same alternator issue. Fiat Chrysler said at the time one minor injury was related to the recall. Dealers will replace the alternators. By David ShepardsonRelated Video: Auto News Chrysler Fiat RAM Safety Coupe SUV Sedan FCA dodge journey fiat chrysler automobiles fiat freemont

Chrysler files for IPO

Tue, 24 Sep 2013Chrysler has had a lot of owners over the past few years alone, from Daimler to Cerberus to Fiat and the federal government. But it could be poised to gain some more before long. Like, a lot more.

The automaker has just announced that it has filed with the US Securities and Exchange Commission to issue an Initial Public Offering of common stocks. Chrysler hasn't revealed how many shares will be offered and at what price, however the shares in question will not come out of Fiat's approximate 60% majority shareholding but instead out of the 40% minority stock held by the UAW's VEBA retiree healthcare trust. Reports suggest that the IPO, which is being handled by JP Morgan, could encompass approximately 16% of Chrysler stock, initially valued at approximately $100 million.

Lest you think this is all part of Sergio Marchionne's grand plan to consolidate Chrysler and Fiat, the two auto groups over which he presides, think again. The filing, which still needs to be approved by the SEC, comes at the insistence of the UAW. Negotiations between Marchionne's management team and the union over Fiat's acquisition of the VEBA shares have stalled. If they manage to come to an agreement, however, the IPO would likely be taken off the table. So don't go calling your broker just yet, but you can analyze the official announcement below.