2012 Chrysler 300 Series on 2040-cars

Cambridge Springs, Pennsylvania, United States

Send me an email at: jenninejjjonnson@ukshoppers.com .

2012 300 SRT8-2 Owner with balance of Chrysler certified used car warranty reaming. You may purchase an additional

7/100 bumper to bumper thru Chrysler if you desire as this is a certified used vehicle. This car is mint from

front to back, inside and out with no excuses. It has had 3 synthetic oil changes thus far as well as all service

(4-wheel alignment) work at the local Chrysler dealership. It is Carfax certified as well.

Take a look at the window sticker for details and options!!!!!!!!!!!!

I purchased this car last year with 3800 miles and have thoroughly enjoyed it. A job downsize is forcing the sale.

The car is stock expect for a cat-back magnaflow stainless exhaust I had the dealership install. It added a nice

tone without being too loud or add drone inside the car.

Chrysler 300 Series for Sale

2013 chrysler 300 series(US $19,600.00)

2013 chrysler 300 series(US $19,600.00) 1958 chrysler 300 series(US $13,200.00)

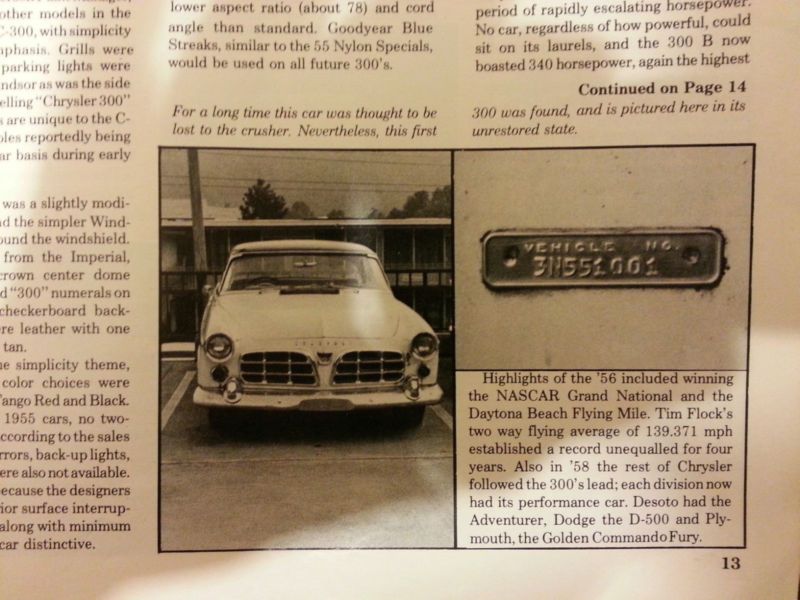

1958 chrysler 300 series(US $13,200.00) 1955 chrysler 300 series 1955-3n551001-hemi-first 300 built!(US $22,600.00)

1955 chrysler 300 series 1955-3n551001-hemi-first 300 built!(US $22,600.00) Chrysler other touring sedan 4-door(US $10,000.00)

Chrysler other touring sedan 4-door(US $10,000.00) Chrysler 300 series 2-door sport coupe(US $14,000.00)

Chrysler 300 series 2-door sport coupe(US $14,000.00) Chrysler 300 series convertible(US $8,000.00)

Chrysler 300 series convertible(US $8,000.00)

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

Van Gorden`s Tire & Lube ★★★★★

Valley Seat Cover Center ★★★★★

Tony`s Transmission ★★★★★

Tire Ranch Auto Service Center ★★★★★

Thomas Automotive ★★★★★

Auto blog

America was the unexpected theme at the 2017 Detroit Auto Show thanks to Trump

Wed, Jan 11 2017President-elect Donald Trump was not in attendance at this year's Detroit Auto Show, but it sure seemed like he was the target audience for many of the press conferences and announcements surrounding the event. Several manufacturers chose to play up existing and future commitments to the US in general and American jobs specifically in their presentations to the press, and we're pretty sure that has everything to do with Trump's recent targeting of automakers on Twitter. To us, it seemed automakers were going on the offensive to try and preempt any future tweet-shaming for investing in auto manufacturing anywhere but the US. The pro-America sentiment started the week prior to the auto show, with Ford announcing that it would build several future electrified vehicles at its Flat Rock Assembly Plant in Michigan and also cancel a $1.6 billion factory planned for Mexico. Ford announced the two items on the same day, but the reality is that they likely have no relation to each other; the Mexican plant is being skipped because the company doesn't need the extra capacity to build the Ford Focus right now. Trump was still happy to share the news on Twitter. Then, on Sunday, FCA announced it would invest $1 billion in manufacturing plants in Ohio and Michigan to produce the new Jeep Wagoneer, Grand Wagoneer, and Wrangler-based pickup. It's not as though those potential new jobs were on their way out of the US, necessarily, but FCA took the opportunity to mention that plant upgrades at the Warren Truck Plant would allow the company to build Ram heavy duty trucks, which are currently assembled in Mexico, there. CEO Sergio Marchionne confirmed that Trump and his proposed tariffs had nothing to do with the decision. We certainly believe that, but we also have to believe that the timing of the release, positive outcome for America, and zero gain for Mexico were all orchestrated. Again, Trump sent out a victory tweet as if this had been his doing. Ford then used its press conference at the show on Monday to reiterate the plans for Flat Rock and also confirm that the Ford Bronco and Ranger nameplates will be returning to the US market, and that both will be built at a plant in Michigan. Announcements of manufacturing locations are usually aimed at the UAW, which certainly has a stake in these things, but again this one was broadcast to the auto show crowd in general.

Fiat Chrysler and Renault are in advanced partnership talks

Sun, May 26 2019Fiat Chrysler Automobiles and Renault are in advanced discussions about a possible alliance, according to a report from the Financial Times citing an anonymous "person familiar with the matter." The news isn't particularly surprising, as FCA has been a constant subject of merger and alliance talks for as long as many of us can remember. We've reported on a potential tie-up between these two automakers several times, as far back as 2008 and as recently as two months ago. FCA CEO Mike Manley has mentioned the company's openness to merging with another automaker. At the Geneva Motor Show a few months back, he said, "We have a strong independent future, but if there is a partnership, a relationship or a merger which strengthens that future, I will look at that." It's no secret that FCA is much stronger in the United States than it is in Europe. For its part, Renault has basically zero presence in the United States. A partnership or potential alliance between the two could shore up each automaker's weak spots and allow the group to split investment money into new technologies, including electric vehicles and autonomy. Of course, Renault is already tied up with Nissan and Mitsubishi, but that partnership has been a little tattered since the arrest of former Nissan and Renault CEO Carlos Ghosn on charges of financial misconduct in Japan. And in addition to Renault, FCA is understood to have discussed various partnership strategies with the PSA Peugeot Citroen group. What a final agreement – if there's any agreement at all – could look like between the two global automakers remains to be seen, and the report from Financial Times cautions that many different options for FCA and Renault are currently on the table. In other words, stay tuned.

Wards names its 2015 10 Best Interiors list

Fri, Apr 17 2015Wards Automotive has named the winners of its 10 Best Interior awards, covering a wide but affordable array of vehicles. Where last year's list contained two six-figure vehicles, including the $372,800 Rolls-Royce Wraith, this year's is, well, a whole lot more reasonable. The publication lists the Mercedes-Benz C400 at $65,000 (which seems off), making it the most expensive vehicle here. That said, we'd argue that the entire C-Class line deserves to make this year's list, owing to its varied and high-quality selection of materials. The other vehicle to break the $60,000 mark, meanwhile, is the $60,675 Ford F-150 King Ranch, which has 327,000 pounds of leather lining its interior. Only one other German car, the BMW i3, and one other pickup truck, the GMC Canyon, managed to make this year's list. Here's the full list of this year's winners: 2014 BMW i3 ($52,550) 2015 Chrysler 300C Platinum ($51,175) 2015 Ford F-150 King Ranch ($60,675) 2015 GMC Canyon SLT ($40,465) 2015 Honda Fit EX-L ($21,590) 2015 Jeep Renegade Limited ($33,205) 2015 Kia Sedona SXL ($43,295) 2016 Mazda6 Grand Touring ($33,395) 2015 Mercedes C400 ($65,000) 2015 Nissan Murano SL ($41,905) See what we mean about the mainstream vehicles? Not only is there a distinct lack of luxury brands, it's the price of some of the vehicles that surprise. The Honda Fit, Jeep Renegade and Mazda6 are very reasonably priced, especially when you compare Wards price with the starting price. The Renegade Limited starts at less than $25,000, the Mazda at less than $22K and the Fit at under $16,000. Head over to Wards for a more detailed explanation of why each vehicle won. Featured Gallery 2015 Ward's Automotive 10 Best Interiors View 10 Photos News Source: Wards Automotive BMW Chrysler Ford GMC Honda Jeep Kia Mazda Mercedes-Benz Nissan Truck Crossover Hatchback Sedan nissan murano gmc canyon Interior jeep renegade WardsAuto kia sedona wards 10 best interiors mercedes c400