2011 Chrysler 300 Limited Sedan 4-door 3.6l on 2040-cars

Burleson, Texas, United States

|

This is a cream puff of a car.

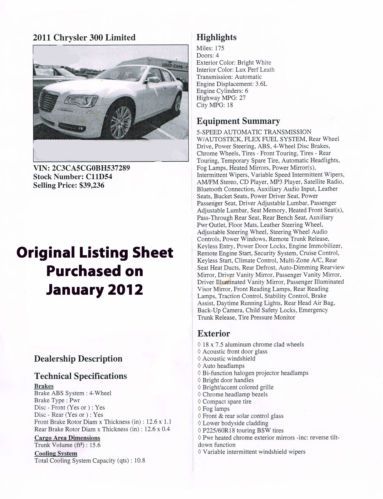

I have owned BMW's, Mercedes and Cadillac's, but this car has more bells and whistles than I've seen in any of them. Of all the cars I've owned, this is by far my favorite. It gets great mileage (27mpg Highway) and is big and luxurious with super lines. I am 6'5" and I fit in this vehicle with room on all sides comfortably. (another reason I love it) I won't take the time to list all the add on's....see the pics for many of the items. It is Bright White in color. Has a 3.6L V6. The only added feature this rear wheel drive vehicle does not have is the sun roof, as I did not want one. Otherwise see the pics of lists as I ordered it with all the upgrades. The sound system is top notch as well with upgraded Alpine System. Three pages of descriptions in the pics. Vented and heated seats and cup holders.......the list goes on and on! I maintained this impeccably with regular tire rotations and oil changes every 3-4k. I replaced two tires last year as ran over some screws in my garage. I am selling this because I am in need of a 4x4 Truck or Suburban/Excursion etc.... I have a clean and clear title for this vehicle as I paid cash for it new. I am the only owner. It has never been in an accident of any kind and garage kept. Many of the miles were trips back and forth from Wisconsin as I reside in both places. I am an honest guy and expect the same from you. Send me a message and I'll respond in a timely manner. Only the overhead interior picture and the rear view camera picture are stock photos. The rest were taken at one point or another and some when I bought it. There are no flaws. I would consider a partial trade on a decent Expedition/Suburban/Ford Truck. Needs to be 4x4 open to Diesel. |

Chrysler 300 Series for Sale

Free shipping warranty clean carfax cheap 300 luxury(US $7,250.00)

Free shipping warranty clean carfax cheap 300 luxury(US $7,250.00) 4dr sdn v6 limited awd low miles sedan automatic 3.6l v6 sfi dohc 24v bright sil

4dr sdn v6 limited awd low miles sedan automatic 3.6l v6 sfi dohc 24v bright sil 4dr sdn limited rwd chrysler 300 limited low miles sedan automatic 3.6l v6 sfi d

4dr sdn limited rwd chrysler 300 limited low miles sedan automatic 3.6l v6 sfi d 2005 touring used 3.5l v6 24v original owners. clean title! no reserve!!!(US $12,999.00)

2005 touring used 3.5l v6 24v original owners. clean title! no reserve!!!(US $12,999.00) All wheel drive navigation rare find beautiful car hemi navigation

All wheel drive navigation rare find beautiful car hemi navigation No reserve no reserve no reserve!!!!!! chrysler 300 on 20" rim's

No reserve no reserve no reserve!!!!!! chrysler 300 on 20" rim's

Auto Services in Texas

Woodway Car Center ★★★★★

Woods Paint & Body ★★★★★

Wilson Paint & Body Shop ★★★★★

WHITAKERS Auto Body & Paint ★★★★★

Westerly Tire & Automotive Inc ★★★★★

VIP Engine Installation ★★★★★

Auto blog

Nissan tells Renault it is 'not opposed' to Fiat Chrysler merger plan

Wed, May 29 2019TOKYO – Nissan on Wednesday told Renault it wasn't opposed to its partner's potential $35 billion merger with Fiat Chrysler, the Nikkei newspaper said, as the two met to hash out the future of their alliance amid a deal that could upend the auto industry. The leaders of Nissan Motor Co, France's Renault SA and junior partner Mitsubishi Motors Corp gathered at Nissan's headquarters in Yokohama for a scheduled alliance meeting - one overshadowed by Fiat Chrysler's proposal this week for a merger-of-equals with Renault. The plan, which would create the world's third-largest automaker, raises difficult questions about how Nissan would fit into a radically changed alliance. Renault Chairman Jean-Dominique Senard arrived in Japan on Tuesday to discuss the proposed tie-up with Nissan, 43.4% owned by the French automaker. "We are not opposed," the Nikkei quoted an unnamed Nissan source who had attended the meeting as saying. The person also said "many details need to be worked out" before the Japanese automaker solidifies its position on the issue, the Nikkei reported. In a statement, the alliance members confirmed that they had "an open and transparent discussion" on the proposal. The deal looks designed to tackle the costs of far-reaching technological and regulatory changes, including the drive toward electric vehicles. Nissan, which has rebuffed overtures by Renault for a merger of their own despite their 20-year alliance, was blindsided by the discussions, sources have told Reuters, stoking concerns that a deal with Fiat Chrysler could weaken Nissan's relations with Renault. The tie-up also poses an additional challenge for Nissan CEO Hiroto Saikawa, already grappling with poor financial performance and an uneasy relationship with Renault after Nissan led the ousting last year of long-standing alliance chairman Carlos Ghosn. There have long been tensions between Nissan and Renault over the imbalance of power in their alliance. Nissan, the bigger company, holds a 15% non-voting stake in the French automaker, while Renault owns 43.4% of Nissan. Ahead of Wednesday's meeting, Japanese media quoted Saikawa as telling reporters that he would look at the potential opportunities afforded by a Renault-FCA merger. Credit ratings agency Moody's said it was vital for Nissan to stabilize its partnership with Renault to expand operational synergies and improve margins.

Chrysler recalling nearly half a million Durangos and Grand Cherokees

Fri, Feb 27 2015Rule number one of public relations – save the bad news for Friday. Fiat Chrysler has adhered to that, announcing today that it'd be voluntarily recalling 467,480 SUVs. This latest recall could actually be thought of as a continuation of a September 2014 recall, relating to the fuel-cell relay. In that case, some 188,723 Dodge Durango and Jeep Grand Cherokee CUVs from model year 2011 were recalled. And this time, it's the Durango and GC in trouble again. FCA is adding crossovers from model years 2012 and 2013 to the fuel-pump recall, although only diesel-powered Jeeps with the 3.0-liter V6 that were sold outside of North America are affected this time around. As with the previous recall, deformities in the fuel-pump relay, which could affect its functioning. In most cases, FCA reports that the affected vehicles simply won't start, although they also could be prone to stalling. A new relay circuit will be installed that promises increase durability. Of the 467,480 vehicles being recalled, 338,216 were sold in the US market, 18,991 went to Canada and 10,829 were shipped south of the border, to Mexico. Outside of the NAFTA region, FCA is recalling 99,444 vehicles. No injuries or accidents have been associated with this recall. Statement: Fuel-Pump Relay February 27, 2015 , Auburn Hills, Mich. - FCA US LLC is voluntarily recalling an estimated 467,480 SUVs worldwide to install new a relay circuit that improves fuel-pump relay durability. FCA US engineers have determined a condition identified in a previous investigation may extend to additional vehicles. The previous investigation, which led to a recall, traced a pattern of repairs to fuel-pump relays that are susceptible to deformation. This may affect fuel-pump function, preventing a vehicle from starting, or leading to engine stall. Of the two scenarios, the no-start condition is the more common. FCA US is unaware of any related injuries or accidents. The fuel-pump relay is located inside the Totally Integrated Power Module (TIPM), which also helps manage other vehicle functions. None of these other functions, including air-bag deployment, is affected by the fuel-pump relay. The new campaign affects an estimated 338,216 vehicles in the U.S.; 18,991 in Canada; 10,829 in Mexico and 99,444 outside the NAFTA region. Covered are model-year 2012 and 2013 Dodge Durango full-size SUVs and non-NAFTA 2011 Jeep Grand Cherokee mid-size SUVs equipped with 3.0-liter diesel engines.

FCA recalling 33k vans and SUVs for TPMS problems in two campaigns

Thu, 30 Oct 2014Fiat Chrysler Automobiles is issuing two, separate recalls covering a total of 33,443 examples in the US of the 2014 Ram ProMaster, 2014 Jeep Wrangler, 2014 Dodge Grand Caravan and 2014 Chrysler Town & Country because of potential problems with the tire pressure monitoring system in the vehicles.

The first campaign is for 23,053 units of the 2014 Ram ProMaster. It's possible for the TPMS to not recognize the location of the data coming from the sensors in the wheels. If this happens, then the low tire pressure warning light comes on and potentially gives the driver a false positive. If the warning isn't cleared, and drivers keep going, they might not be aware of another tire that actually has low pressure. This fix for this is a software update.

The second recall covers 10,390 examples of the 2014 Wrangler, Grand Caravan and Town & Country. According to FCA, it's possible that a test mode for the TPMS is still on since being shipped from the supplier. On affected vehicles, it could cause inaccurate pressure readings. The repair involves disabling that mode on the TPMS module.