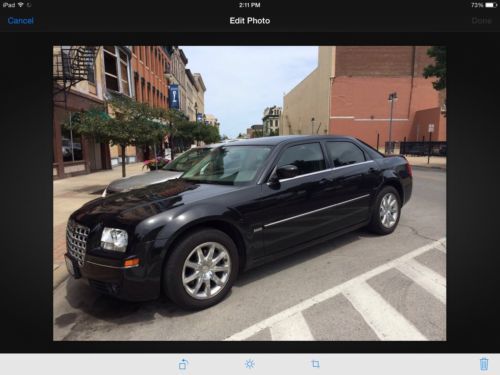

2006 Chrysler 300 Limited Sedan 4-door 3.5l on 2040-cars

Mount Dora, Florida, United States

|

SUPER CLEAN! FRONT LINE READY! CLEAN IN AND OUT! FL CAR THE WHOLE TIME. NEW TIRES. PERFECT!

|

Chrysler 300 Series for Sale

5.7l v8 hemi leather sunroof bluetooth heated seats siriusxm boston acoustics cd

5.7l v8 hemi leather sunroof bluetooth heated seats siriusxm boston acoustics cd 2008 chrysler 300 c hemi htd leather sunroof nav 41k mi texas direct auto(US $17,980.00)

2008 chrysler 300 c hemi htd leather sunroof nav 41k mi texas direct auto(US $17,980.00) Chrysler 300c touring signature series / priced to move!!!(US $13,950.00)

Chrysler 300c touring signature series / priced to move!!!(US $13,950.00) Brand new srt8 6.4l v8(US $57,425.00)

Brand new srt8 6.4l v8(US $57,425.00) New-3ooc, john varvatos , 5.7l, awd, with local rebate.(US $50,900.00)

New-3ooc, john varvatos , 5.7l, awd, with local rebate.(US $50,900.00) 1964 chrysler 300 4 door hard top

1964 chrysler 300 4 door hard top

Auto Services in Florida

Y & F Auto Repair Specialists ★★★★★

X-quisite Auto Refinishing ★★★★★

Wilt Engine Services ★★★★★

White Ford Company Inc ★★★★★

Wheels R US ★★★★★

Volkswagen Service By Full Throttle ★★★★★

Auto blog

CEO Sergio Marchionne curses FCA spokesman for emissions cheating denial

Tue, May 15 2018WASHINGTON — Fiat Chrysler Chief Executive Officer Sergio Marchionne reprimanded the company's top U.S. spokesman for issuing press releases about Fiat's vehicle emissions practices days after Volkswagen's disclosure in September 2015 that the German automaker had used illegal software to evade emissions tests, documents released Monday show. Lawyers suing Fiat Chrysler Automobiles in a securities case filed excerpts of an email from Marchionne to Gualberto Ranieri, then the company's U.S. spokesman, in a filing in federal court in New York criticizing him for saying that the company does not use defeat devices. "Are you out of your goddam mind?" Marchionne wrote in an email on Sept. 22, 2015, adding that Ranieri should be fired and calling his actions "utterly stupid and unconscionable." The company said in a statement on Monday it was "understandable that our CEO would have a forceful response to any employee who would opine on such a significant and complex matter, without the matter having been fully reviewed through its appropriate channels." The statement added that Ranieri's comments came just days after VW's emissions issue became public "and before a comprehensive internal review and discussions with component suppliers was possible." Fiat Chrysler was sued in 2015 along with Marchionne and other executives over claims it defrauded shareholders by overstating its ability to comply with vehicle safety laws. An amended version of the complaint filed in 2017 added claims about its compliance with emissions laws. The shareholders accused the defendants of inflating Fiat Chrysler's share price by hundreds of millions of dollars from October 2014 to October 2015 by downplaying safety concerns. They said the shortcomings materialized in 2015 when the automaker was fined $175 million by the National Highway Traffic Safety Administration, and took a roughly $670 million charge for recalls. Plaintiffs filed the excerpts seeking approval to take up to 40 additional depositions, including Marchionne's. The U.S. Justice Department sued Fiat Chrysler in May 2017, accusing it of illegally using software to bypass emission controls in 104,000 diesel vehicles sold since 2014. Fiat Chrysler has held numerous rounds of settlement talks with the Justice Department and California Air Resources Board to settle the civil suit, including talks as recently as earlier this month. It faces a separate criminal probe into the matter.

Chrysler 300C gets Sport Appearance Package option

Fri, Jun 14 2019In 2017, Chrysler added the option of a Sport Appearance Package to the sporty trim level of the 300 sedan, the 300S. The package added trim pieces from the hot-blooded 300 SRT sedan that we don't get in the U.S., namely the front fascia with LED foglights and SRT-style side skirts. Mopar Insiders reports that as of this month, the same upgrade is available on the top-level 300C trim as the Performance Appearance Package. Whereas the Sport Appearance Package on the V6-powered S model costs $1,795; the 300C's Performance Appearance Package is said to cost $695. We're sure Chrysler knows this isn't the performance upgrade that U.S. 300 buyers want. For reasons best known inside Chrysler, only Australia, New Zealand, and the Middle East get the 300 SRT and its 6.4-liter V8 with 469 horsepower and 469 pound-feet of torque, limited-slip differential, Bilstein dampers, and Brembo brakes. It's possible the absence of the 300 SRT here is because Chrysler wants North American audiences to see Dodge as the performance brand. At this point, however, anyone intending to buy a 300 should be happy the four-door is still on sale. The model is eight years old and hasn't been the subject of anything close to hard news since last September. That's when Automotive News Canada said the car would die in 2020 to make room for the six-passenger Portal concept. The last hard nugget before that was in 2016, when the late Sergio Marchionne told Reuters the 300 could go front-wheel drive on the Pacifica platform — a fate arguably worse than killing the car. Now all we have is rumor and speculation, such as when Road & Track writes a "major refresh [is] ... supposedly being planned already," and sees a possibility that the 300/Charger/Challenger trio live into the next decade. The moral of the story is: The 300's irons could be as hot as they're ever going to get right now. FCA hasn't announced the upgrade package, but Mopar Insider says dealers can get it right now, order code AJU.

FCA to make 1 million face masks a month for North America coronavirus fight

Tue, Mar 24 2020MILAN, Italy — Italian-U.S. car giant Fiat Chrysler has confirmed plans to produce a million face masks a month and said it will distribute them to emergency services in North America to help the fight against coronavirus. FCA, which is also trying to help produce badly needed respirators for patients in intensive care in Italy, is one of a number of large manufacturers adapting production lines to make products in desperately short supply. "Production capacity is being installed this week and the company will start manufacturing face masks in the coming weeks with initial distribution across the United States, Canada and Mexico," it said in a statement released late on Monday. The monthly output of 1 million masks will be donated to police, emergency medical staff, firefighters and to workers in hospitals and health care clinics, it said. The decision to begin distribution of masks in North America rather than Italy, the company's other home country, underlines the difficult balance global companies are having to maintain as they weigh where to offer help in the emergency. Face masks and other protective equipment for medical staff have been running out across the world as thousands of new cases of the highly contagious virus have arrived in hospitals daily. Fiat's position as a historic pillar of Italian industry makes the issue of where to provide help sensitive, especially as Italy is the country worst hit by the virus so far. Both FCA and its controlling shareholder Exor, the investment firm of Italy's Agnelli family, have offered significant assistance to efforts to handle the crisis in Italy, where almost 6,000 people have died. FCA and luxury automaker Ferrari, also controlled by Exor, are in talks with Siare, Italy's biggest respirator manufacturer, to help it double production of the life-saving machines. In addition, the Agnelli family said last week it was donating 10 million euros to fight the virus emergency in Italy. It said companies controlled by Exor bought 150 ventilators and other medical equipment abroad, provided vehicles for support of people in need and were in touch with Italian authorities to help them buy medical equipment and healthcare products abroad. As part of the process, an Exor spokesman said on Tuesday the group had made an initial purchase of 250,000 face masks in China which would be distributed in Italy and were expected to arrive by the end of this week. Related Video: Â Â