*mega Savings* 2013 "motown" Edition - Navigation - 8 Speed Auto -heated Leather on 2040-cars

Hollywood, Florida, United States

Chrysler 300 Series for Sale

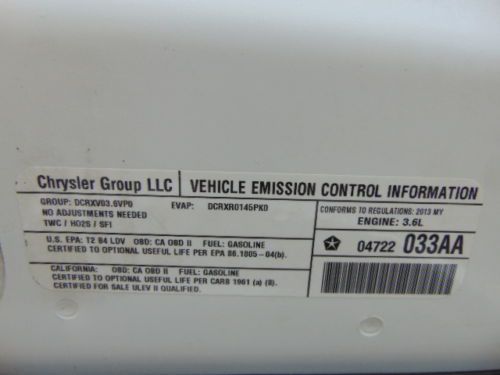

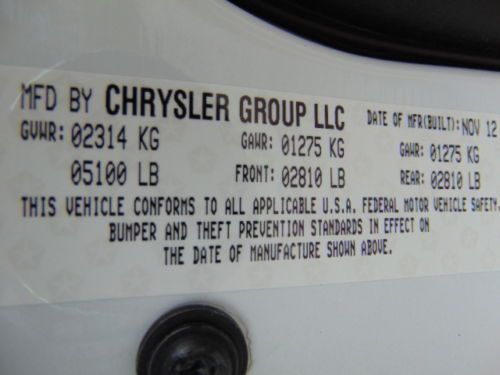

4dr sdn rwd low miles sedan automatic 3.6l v6 sfi dohc 24v bright white

4dr sdn rwd low miles sedan automatic 3.6l v6 sfi dohc 24v bright white Touring 3.5l cd 17" x 7" aluminum wheels leather trimmed bucket seats 4 speakers

Touring 3.5l cd 17" x 7" aluminum wheels leather trimmed bucket seats 4 speakers 1962 chrysler 300 golden lion 383 factory ac fully restored at ps pb

1962 chrysler 300 golden lion 383 factory ac fully restored at ps pb '12 chrysler 300 srt-8,20"black chrome wheels,470hp,safetytec,pano roof,hk radio(US $43,900.00)

'12 chrysler 300 srt-8,20"black chrome wheels,470hp,safetytec,pano roof,hk radio(US $43,900.00) 2008 chrysler 300 touring(US $13,500.00)

2008 chrysler 300 touring(US $13,500.00) 13 chrysler 300c awd leather navigation back up camera uconnect price reduced

13 chrysler 300c awd leather navigation back up camera uconnect price reduced

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

Fiat Chrysler's next-generation Uconnect is faster, built on Android

Mon, Jan 27 2020If you're a regular reader of Autoblog, you know that for a long time we've liked Fiat Chrysler's Uconnect infotainment system for its bright, clear, responsive touchscreen interface. Now, according to the company, it will be better than ever with Uconnect 5, the latest iteration of the system. It has upgraded hardware and a revamped graphic user interface (the stuff on the screen). Looking at sample screens shown above, there are characteristics shared with the old system, such as the time, status and shortcuts at the top and the menu icons at the bottom. In the middle, the major change is the addition of home screens that can be customized with favorite menus and readouts that are always available. Each of these home screens can have up to four functions and you can have five pages to flip through. The graphics themselves feature more legible fonts and updated icons. Each car brand will get its own set of icons, colors and textures to help create unique experiences. And while each Fiat Chrysler product will be able to have Uconnect, including Alfa Romeo that has until now lacked Uconnect, each brand has the ability to make small tweaks including the screen orientation. The system will support displays in landscape, portrait or square, so different brands may choose different shapes. Powering Uconnect 5 is a processor Fiat Chrysler says is six times more powerful than what's in current systems. It features 6 gigabytes of RAM and 64 gigabytes of internal storage. The processor also supports screens as large as 12.3 inches with as many as 15 million pixels, or nearly twice that of a 4K resolution TV. The system can display information on up to four screens, too. Uconnect 5's firmware is built on Google's Android operating system, joining a few other automakers in using Android as a base for their infotainment systems. Uconnect 5 brings with it a number of new features. It brings full Alexa integration, so you can use it just like you do at home, provided you have a data plan for the car. Apple CarPlay and Android Auto continue to be standard, but now they can be used wirelessly. You can also now connect two phones via Bluetooth wirelessly so you can access content from both. Navigation gets real time information and updates from TomTom. Users can create five profiles with unique climate, radio and instrument settings, plus one for a valet.

Fiat Chrysler chief still says EVs can't make money

Sun, Jun 12 2016Add Sergio Marchionne's insistence that it's impossible to make money on electric vehicle production to death and taxes among things we can all count on. The Fiat Chrysler Automobiles CEO, speaking in an interview with UK's Car Magazine, implied that Tesla Motors was "the iPhone of cars." The metaphor may have been mixed, as iPhones make plenty of cash for Apple, whereas Tesla has never made an annual profit from its electric vehicles. But the implication was that automakers should stick to what they know, and they don't know smartphones. Forget any upcoming presidential debates, we're waiting for one between Marchionne and Tesla chief Elon Musk. As for the development of autonomous-driving features? Those are another story, says Marchionne, and an area where he's far more in line with Musk. That's because the technology required to make a car safely accelerate, brake, and steer on its own is far cheaper than making a car with an electric drivetrain that offers similar range and performance to a car with an internal combustion engine, he says. As opposed to electrification, Fiat Chrysler has been going the route of modifying conventional powertrains via wringing out more power out of progressively smaller engines, and mating them with eight- and nine-speed transmissions. As for EVs, credit Marchionne for his consistency. Fiat Chrysler has been selling the Fiat 500e since 2013. That year, Wards Auto named the 500e motor to its 10 Best Engines list, while the 500e won Road & Track's 2013 award for best electric car. Still, Marchionne has long said that Fiat only makes the vehicle for to satisfy zero-emissions vehicle mandates in California, and that the company loses as much as $10,000 for every 500e that it sells. Related Video: Featured Gallery 2014 Fiat 500e News Source: Car Magazine via Hybrid VehiclesImage Credit: Andrew Harrer/Bloomberg via Getty Images Green Chrysler Fiat Electric Sergio Marchionne

2015 Chrysler 200 looks to put Pentastar's cars back on track [w/videos]

Mon, 13 Jan 2014It's fair to say that Chrysler Corporation has been on a major perception upswing with its new products, but that rise has largely been centered around its trucks and utility vehicles - the car side has been somewhat left out. The outgoing 200 (previously skinned as the Sebring) never garnered any laurels, the Dart has suffered a rather cool reception both critically and in terms of sales, the second-gen 300 is a nice car yet it hasn't sold as well as its predecessor, and even the mighty SRT Viper has had its V10 bark muted by the less costly and multi-talented Chevrolet Corvette Stingray. Resurgent Chrysler could use a hit car, and the 2015 200 may just be it.

It looks great here under the lights at the Detroit Auto Show.

For one thing, it looks great here under the lights at the Detroit Auto Show. Eschewing today's oversized headlamp and grille trend, the sleek 200 (with a coefficient of drag of just .27) displays a 'four-door coupe' sensibility with a sense of style that the old 200 with its gawky greenhouse and forced details never did. The new 200's exterior may look a bit like a greatest hits compendium of other high-style cars (see also: Audi A7, Tesla Model S, etc.), but it doesn't come off as a pastiche, it's all well-integrated and organic all the same.