Custom 2009 Chrysler 300c Hemi 4-dr Convertible Low Mileage, Red/grey Nice on 2040-cars

Burlington, North Carolina, United States

|

This vehicle is in pristine condition. Recently appraised for $44,700. Reserve price is a fraction of that. It was recently donated to charity, and I am representing the charity to help dispose of the vehicle. The car was appraised on 7/30/13, and since then the car has been sitting garaged.

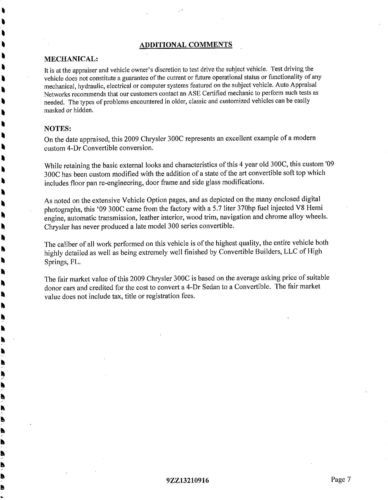

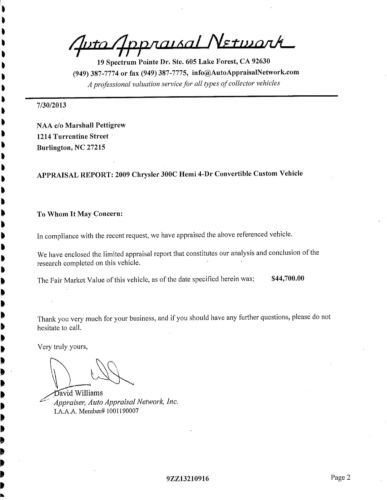

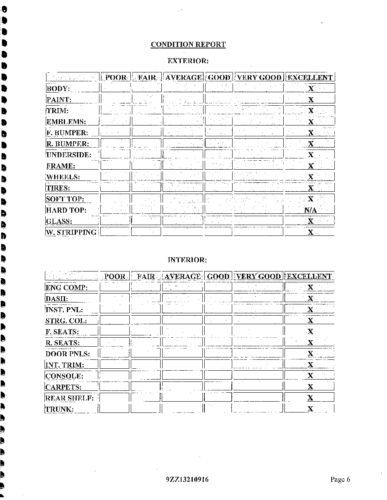

Here is more information from the appraisal: 7/30/2013 Auto Appraisal Network Lake Forest, CA David Williams Appraiser, Member #1001190007 To whom it may concern: In compliance with the recent request, we have appraised the above referenced vehicle. We have enclosed the limited appraisal report that constitutes our analysis and conclusion of the research completed on this vehicle. The fair market value of this vehicle, as of the date specified herein was; $44,700.00. Vehicle Location: Burlington, NC Vehicle Make: Chrysler Model Year: 2009 Model: 300C Hemi Body Style: 4-Dr Convertible Other ID: Paint Code: PRH, Trim Code: TLDV Exterior Color: Inferno Red Crystal Pearl Interior Color: Dark Slate Grey Leather Vehicle Options: 5.7 liter 370hp fuel injected V8 Hemi engine 5-speed automatic transmission Power 4-wheel anti-lock brakes Power Steering Power Door Locks Power Windows Power antenna Power seats Power convertible soft top Air Conditioning Cruise Control Steering Wheel Controls AM/FM/CD/MP3 audio system Navigation Wood trimmed interior Dual zone air conditioning Dark Slate Grey Leather Seats Alarm System 18" chrome allow wheels Continental 225/60-R18 tires Inferno Red Crystal Pearl exterior paint Condition Report: 100% Excellent Body, Paint, Trim, Emblems, F. Bumper, R. Bumper, Underside, Frame, Wheels, Tires, Soft Top, Glass, W. Stripping Eng Comp, Dash, Inst. Panel, Strg. Col, F Seats, R Seats, Door Panels, Int. Trim, Console, Carpets, Rear Shelf, Trunk Additional Comments: On the date appraised, this 2009 Chrysler 300C represents an excellent example of a modern custom 4-Dr Convertible conversion. While retaining the basic external looks and characteristics of this 4-year-old 300C, this custom '09 300C has been custom modified with the addition of a state-of-the-art convertible soft top which includes floor pan re-engineering, door frame and side glass modifications. As noted on the extensive Vehicle Option pages, and as depicted on the many enclosed digital photographs, this '09 300C came from the factory with a 5.7 liter 370hp fuel injected V8 Hemi engine, automatic transmission, leather interior, wood trim, navigation and chrome alloy wheels. Chrysler has never produced a late model 300 series convertible. The caliber of all work performed on this vehicle is of the highest quality, the entire vehicle both highly detailed as well as being extremely well finished by Convertible Builders, LLC of High Springs, FL. The fair market value of this 2009 Chrysler 300C is based on the average asking price of suitable donor cars and credited for the cost to convert a 4-Dr Sedan to a Convertible. The fair market value does not include tax, title or registration fees. Interesting side note: This car is SUPER unique. In fact, the Pope himself ordered one. The company that customizes these only does about 8 per year, and this was one of them. Here's an interesting pic of the current Pope next to his convertible Chrysler 300. Here is a link to Drop Top Customs, which is the company that customized this vehicle. To get a Chrysler 300 customized like this would cost you $20,000 for the customization alone, not to mention the cost of the car itself. |

Chrysler 200 Series for Sale

2011 chrysler 300c hemi pano sunroof leather nav 29k mi texas direct auto(US $26,980.00)

2011 chrysler 300c hemi pano sunroof leather nav 29k mi texas direct auto(US $26,980.00) 2006 chrysler 300 hemi c 5.7l v8 rwd leather moonroof one owner clean carfax a+

2006 chrysler 300 hemi c 5.7l v8 rwd leather moonroof one owner clean carfax a+ 1997 chrysler sebring, no reserve

1997 chrysler sebring, no reserve 2006 chrysler pt cruiser ltd ed automatic sunroof 41k texas direct auto(US $9,980.00)

2006 chrysler pt cruiser ltd ed automatic sunroof 41k texas direct auto(US $9,980.00) 13 touring used 2.4l i4 clean autocheck one owner satellite radio cruise(US $17,911.00)

13 touring used 2.4l i4 clean autocheck one owner satellite radio cruise(US $17,911.00) 5.7l power door locks power windows power driver's seat power passenger seat

5.7l power door locks power windows power driver's seat power passenger seat

Auto Services in North Carolina

Wood Tire & Alignment ★★★★★

Wilhelm`s ★★★★★

Wilcox Auto Sales ★★★★★

Town & Country Radiator ★★★★★

The Transmission Shop ★★★★★

The Auto Finders ★★★★★

Auto blog

Fiat Chrysler posts record Q3 profit thanks to U.S. trucks and Jeep

Wed, Oct 28 2020MILAN — A rebound in car production in Fiat Chrysler on Wednesday reported record third-quarter earnings as production returned to nearly pre-pandemic levels. The Italian-American automaker, which is finalizing its full merger with French rival PSA Peugeot, reported a net profit in the three months ending Sept. 30 of $1.4 billion (1.2 billion euros). That compares with a loss of 179 million euros a year earlier. The carmaker reported adjusted earnings before tax and interest in North America of 2.5 billion euros. That offset deepening losses in Europe, Asia and at its Maserati luxury marquee. Latin America, the only other region to post a profit, saw it narrow by two-thirds to 46 million euros. “Our record results were driven by our teamÂ’s tremendous performance in North America,” CEO Mike Manley said in a statement. Overall, the carmaker said global earnings before tax and interest were a record 2.3 billion euros despite a 6% fall in revenues to 26 billion euros. Global shipments were down 3%, due largely to plant retooling in North American to produce the new Jeep Grand Wagoneer in the luxury SUV segment and the discontinuation of the Dodge Grand Caravan classic minivan. Fiat Chrysler announced earlier Wednesday that its merger with PSA Peugeot is on track to be finalized by the end of the first quarter of 2021, as planned. To meet regulatory concerns, the French carmaker is selling a small stake in a components maker to get below 40% ownership. The new automaker, to be called Stellantis, will be the fourth biggest producer in the world. Earnings/Financials Chrysler Dodge Fiat Jeep RAM Citroen Peugeot

Jeep and Ram could be spun off from FCA, says Marchionne

Thu, Apr 27 2017Jeep is surely the biggest single feather left in the cap of the Fiat Chrysler Automobiles portfolio. Under Sergio Marchionne's leadership, Jeep went from fewer than 500,000 annual sales in 2008 to 1.4 million in 2016, and is on track for 2 million by 2018. Add in the brand's legacy, status as one of the most recognizable nameplates in the world, and rabid fan base, and Jeep has extraordinary monetary value to its parent company. Investors and analysts have certainly noticed Jeep's inherent value. According to The Detroit Free Press, Morgan Stanley's Adam Jonas asked FCA chief Sergio Marchionne if he would ever consider spinning Jeep and Ram, FCA's dedicated truck brand, into a separate corporate entity, and he responded with a simple "Yes." Jonas estimated Jeep's worth in January of this year at $22 billion. Ram was valued at $11.2 billion. Marchionne has a history of spinning off brands while keeping them part of FCA's corporate umbrella. The most noteworthy example of this value maximization was with Ferrari, which now trades on the New York Stock Exchange and rakes in $3.4 billion in annual revenue and close to $435 million in net income, reports the Free Press. Marchionne still serves as chairman and CEO of Ferrari, and Fiat heir John Elkann owns 22 percent of the Italian marque's shares. Even if the offloading of Jeep and Ram into a separate entity would amount to little more than a profit-driven ownership change on paper, it would be huge news to the brands' loyal fanbases. In any case, such a move would likely take years to actually happen and probably wouldn't mean much at all to the products that Jeep and Ram produce. In other words, Jeep fans can keep the pitchforks in the shed ... for now. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.