4dr Sedan Limited Fwd New Automatic Gasoline 2.4l 4 Cyl Engine Billet Silver on 2040-cars

Hendrick Chrysler Dodge Jeep RAM, 1624 Montgomery Hwy, Hoover, AL 35216

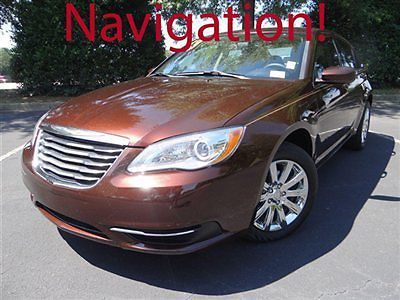

Chrysler 200 Series for Sale

Chrysler 200 touring low miles 4 dr sedan automatic gasoline 2.4l l4 sfi dohc 16

Chrysler 200 touring low miles 4 dr sedan automatic gasoline 2.4l l4 sfi dohc 16 Touring 2.4l 4 cylinder automatic remote start 4 door cruise tilt certified

Touring 2.4l 4 cylinder automatic remote start 4 door cruise tilt certified All-new 200c awd loaded with everything!(US $35,705.00)

All-new 200c awd loaded with everything!(US $35,705.00) *super savings* 2013 chrysler 200 touring edition v6 - accident free 1 owner(US $11,900.00)

*super savings* 2013 chrysler 200 touring edition v6 - accident free 1 owner(US $11,900.00) *mega deal* 2013 chrysler 200 touring series - accident free 1 owner sedan(US $9,900.00)

*mega deal* 2013 chrysler 200 touring series - accident free 1 owner sedan(US $9,900.00) 2012 chrysler 200 limited sedan htd leather alloys 15k texas direct auto(US $16,480.00)

2012 chrysler 200 limited sedan htd leather alloys 15k texas direct auto(US $16,480.00)

Auto blog

Autoblog sell-it-yourself highlight: 2004 Chrysler Crossfire

Wed, Apr 19 2017Chrysler's Crossfire was the most fortuitous product of the Chrysler and Daimler-Benz merger when it launched, but also the most tormented. Clothed in Chrysler sheetmetal, the Crossfire sat atop a Mercedes platform and was propelled by an M-B drivetrain. The upscale vibe was obvious, while its outlier status on a Chrysler showroom dominated by minivans, was preordained. As Autoblog reported in May 2006, "production of the Crossfire [fell] from a peak of 35,700 in 2003 to just 12,500 last year. Introduced in 2003, the Crossfire managed about 28,000 sales in 2004, but less than 10,000 in 2005. Chrysler was so desperate to move Crossfires in late 2005 that it even engaged in a marketing stunt when it attempted to sell units on Overstock.com." Most specialized two-seaters (or 2+2 coupes) invariably run into marketing reality; once the novelty wears off, there is little sustained support for a small, impractical vehicle in modern America. Conversely, if looking for a recreational vehicle with a possible upside as an investment, you'll be hard pressed to find a more accessible example than the Crossfire. Our for-sale example, located in Randleman, NC, looks to be well maintained and has the preferred manual transmission. There are few credible guides for evaluating the price, but the $3,750 ask falls in line with a decent Miata of the same vintage and mileage. A buyer should remember that the Mercedes-sourced drivetrain of this era can be a financial swamp, but with a clean Carfax and pre-purchase inspection, Chrysler's Crossfire can provide real driving enjoyment. Related Video: Chrysler Car Buying Used Car Buying Ownership Coupe Luxury Performance chrysler crossfire

Italy reportedly guarantees $7.1 billion loan to Fiat Chrysler

Wed, Jun 24 2020ROME — Italy has approved a decree offering state guarantees for a 6.3-billion euro ($7.1 billion) loan to Fiat Chrysler's (FCA)Â Italian unit, a source said, paving the way for the largest crisis loan to a European carmaker. The source said Italy's audit court had signed off on the decree, in a final step of what had been a lengthy and contested process to get the loan approved. The court's approval follows an earlier endorsement by the economy ministry. "The audit court authorized the decree," said a source close to the matter, asking not to be named because of its sensitivity. FCA's Italian division has tapped Rome's COVID-19 emergency financing schemes to secure a state-backed, three-year facility to help the group's operations in the country, as well as Italy's car sector in which about 10,000 businesses operate, weather the crisis triggered by the coronavirus emergency. The loan will be disbursed by Italy's biggest retail bank Intesa Sanpaolo, which has already authorized it pending the approval of guarantees the government will provide on 80% of the sum through export credit agency SACE. The request for state support has sparked controversy because FCA is working to merge with French rival PSA and the holding for the Italian-American carmaker is registered in the Netherlands. FCA's global brands include Fiat, Jeep, Dodge and Maserati. It was not immediately clear what conditions, if any, Italy has set as part of the guarantees and whether they would affect FCA's planned 5.5 billion euro ($6.2 billion) extraordinary dividend, which is a key element in the merger with PSA. FCA, whose shares were down 0.5% by 0908 GMT, had no immediate comment. Â Earnings/Financials Chrysler Fiat Peugeot Italy

Stocks down as automakers, Boeing lead China's hit list in trade spat

Wed, Apr 4 2018Shares in U.S. exporters of everything from planes to tractors fell on Wednesday after China retaliated against the Trump administration's tariff plans by proposing duties on key U.S. imports including soybeans, beef and chemicals. U.S. automakers' products are prominent on China's list of tariff targets, yet shares of automakers ended higher on Wednesday as Wall Street stocks changed course in the afternoon when investors' trade fears subsided. Tesla shares closed 7.3 percent higher at $286.94, Ford shares gained 1.6 percent to close at $11.33, and GM shares were up 3 percent at $38.03. Aircraft maker Boeing closed down 1 percent, weighing the most on the Dow Jones Industrial Average as documents from China's Ministry of Commerce and the U.S. manufacturer showed the move would affect some older Boeing narrowbody models. It was not immediately clear how much the tariffs would impact its newer aircraft. Boeing said it was assessing the situation while analysts from JP Morgan said the proposals from China looked to have been calibrated carefully to avoid a major impact on the planemaker. Fellow Dow component 3M lost as much as 2.4 percent. And farming equipment maker Deere lost nearly $10 per share at its lowest. The company urged the two countries to work toward a resolution to "limit uncertainty for farmers and avoid meaningful disruptions to agricultural trade." The speed with which the trade spat between Washington and Beijing is ratcheting up — the Chinese government took less than 11 hours to respond with its own measures — led to a sharp selloff in global stock markets and commodities. China was hitting back against U.S. President Donald Trump's plans to impose tariffs on $50 billion in Chinese goods with similar tariffs on U.S. goods even as Trump said the country is "not in a trade war with China." "Everybody knew they were going to retaliate. The question was how strong of a retaliation. Today's move clearly shows that they mean business," said Adam Sarhan, chief executive of 50 Park Investments in New York. China levied 25 percent additional tariffs on U.S. goods, but unlike Washington's list that covers many obscure industrial items, Beijing's covers 106 key U.S. imports including soybeans, planes, cars, whiskey and chemicals. Trump denied that the tit-for-tat moves amounted to a trade war between the world's two economic superpowers.