3.5l V6 Limited Leather Heated Seats Dual Zone Ac Premium Sound 6 Cd Mp3 Chrome on 2040-cars

New Braunfels, Texas, United States

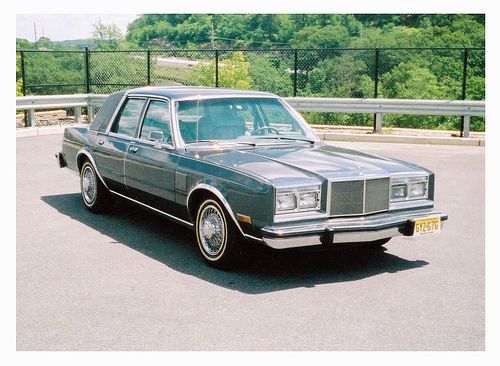

Body Type:Sedan

Vehicle Title:Clear

Fuel Type:Gasoline

For Sale By:Dealer

Year: 2005

Make: Chrysler

Model: 300 Series

Warranty: Vehicle does NOT have an existing warranty

Mileage: 95,810

Sub Model: 4dr Touring

Options: CD Player

Exterior Color: Silver

Power Options: Power Locks

Interior Color: Gray

Number of Cylinders: 6

Chrysler 200 Series for Sale

2006 chrysler 300 c

2006 chrysler 300 c 1987 chrysler 5th avenue - 45,000 orig miles

1987 chrysler 5th avenue - 45,000 orig miles 2008 chrysler sebring ltd convertible nav htd seats 60k texas direct auto(US $12,980.00)

2008 chrysler sebring ltd convertible nav htd seats 60k texas direct auto(US $12,980.00) 2010 touring dual dvd rearcam leather htd seats stow n go town and country 52k(US $17,930.00)

2010 touring dual dvd rearcam leather htd seats stow n go town and country 52k(US $17,930.00) 2006 chrysler 300c hemi engin 5.7l

2006 chrysler 300c hemi engin 5.7l 2003 chrysler town and country lx! 1-owner! no reserve! free carfax! clean! nice

2003 chrysler town and country lx! 1-owner! no reserve! free carfax! clean! nice

Auto Services in Texas

XL Parts ★★★★★

XL Parts ★★★★★

Wyatt`s Towing ★★★★★

vehiclebrakework ★★★★★

V G Motors ★★★★★

Twin City Honda-Nissan ★★★★★

Auto blog

Chrysler purchases remaining shares from VEBA Trust, announces funding plan

Thu, 23 Jan 2014It's official: The Detroit Three is now The Detroit Two and The Fiat Subsidiary, Chrysler. Both the Italian carmaker and The Pentastar announced the completion of cash payments and a Memorandum of Understanding (MOU) on future payments necessary to make the Chrysler Group a wholly-owned subsidiary of Fiat. As previously detailed, Chrysler made a cash payment of $1.9 billion and Fiat North America made a cash payment of $1.75 billion to the Voluntary Employment Benefit Association (VEBA) run by the United Auto Workers union.

On top of that, Chrysler Group signed an MOU that agrees to payments of $700 million to the VEBA in four installments, the first of which was made concurrently with the other cash payments. And for you trivia mavens, the full name of the UAW is the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America. So go impress your loved ones with that nugget after you check out the press release below.

Chrysler will debut a fully electric Pacifica at CES

Sun, Dec 11 2016Fiat Chrysler Automotive will debut a fully electric version of its Pacifica minivan at CES, according to a report from Bloomberg citing "people familiar with the plans." There's already a plug-in hybrid Pacifica model with a battery large enough to allow for an all-electric range of 30 miles. It's unclear if it's this electric version of FCA's minivan that will be the basis of the self-driving vehicle the automaker will provide to Google. Bloomberg's report also suggests that FCA has an electric vehicle in the works for the Maserati brand. This Tesla-fighting vehicle has been rumored for some time, with previous reports pointing for a debut in 2020. In other words, we don't expect to see an electric Maserati at CES, but we'd love to be surprised. And we'll know soon enough – CES starts in less than month. Stay tuned. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Peugeot's American future looks dead, but Stellantis intends to keep all brands alive

Fri, Feb 12 2021The years-old promise of a Peugeot return in the U.S. is looking bleaker by the second. Peugeot said the French brand would come back to sell cars in the U.S. five years ago, but now that FCA and PSA have transitioned to one Stellantis, that promise is looking a lot shakier. This news comes via a report from Car and Driver. When queried about Peugeot, Carlos Tavares, Stellantic CEO, offered this in response: “For the time being, I don't think that is part of the things that we want to prioritize for the next time window," Tavares said. "I think it's better that we funnel the talent, the capital, and the engineering capability of our Stellantis company to the existing brands to improve what needs to be improved and to accelerate where we need to accelerate, because we already have a very strong presence in this market." Tavares hasnÂ’t ruled it out entirely, but any kind of a Peugeot American renaissance is being pushed onto the backburner. In good news for American brands, though, Tavares expressed great interest in keeping them all. Chrysler was the most worrisome of the bunch, as it only sells the aging 300 sedan and Pacifica minivan variants. Nevertheless, Tavares sees Chrysler as one of the “three historical pillars of Stellantis” and is eager “to give this brand a future.” Specifically, Tavares sees a high-tech future for the once-great American car company. Motor Trend reported on what Tavares spoke about in a call with the media. "It needs to rebound,” Tavares said. “We could think about what could be the next technologies in the automotive industry.” The obvious hint here is electrification and greater autonomy. Chrysler could theoretically become StellantisÂ’ electric showcase brand. ItÂ’s partway there with the Pacifica Hybrid PHEV minivan, but thereÂ’s still a long way to go for it to become the conglomerate's tech pillar. And then thereÂ’s Dodge and its powerful but emissions-heavy lineup. "We have the technology to deliver the torque, dynamics, and acceleration feeling, while also dramatically reducing the emissions," Tavares said. The Hellcat canÂ’t have a window-shattering 6.2-liter supercharged V8 forever, but it looks like Stellantis is at least committed to keeping the performance of DodgeÂ’s current lineup. Related video:

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.614 s, 7902 u